Workers compensation insurance protects your business from employee lawsuits for the injuries they sustain or diseases they contract that arise out of and in the course of their employment - with rates as low as $37/mo. Get a fast quote and your worker comp insurance now. Below are some answers to commonly asked workers comp insurance questions:

Full Answer

How much does Workers'Comp Insurance Cost?

Nov 08, 2021 · The Hartford estimates that workers comp insurance costs about $1 for every $100 in payroll. But there can be significant variations depending on …

How are workers compensation insurance rates calculated?

If the rate for landscaping is $3.25, and the insured has 10 employees who each earn $500 per week, the basic premium is determined as follows: Weekly payroll $2,500 x 52 weeks = $130,000 total payroll. $130,000 total payroll x 3.25 rate per $100 of payroll = $8,450 annual workers comp insurance premium.

What does workers compensation insurance cover?

Workers’ compensation cost can start as low as $14 a month. Several factors are used to determine the cost of workers’ compensation insurance, including the number of employees at your business, your payroll, the location of your business and other details. If you are exposed to more risks, you typically pay more for insurance, regardless ...

What is in a workers comp cost manual?

Sep 15, 2021 · In Texas, businesses may pay $.57 for every $100 covered in payroll. The average rate of workers compensation in 2016 was $1.30 for every $100. Companies with a history of claims may also pay more in workers compensation insurance, as they’re seen as more likely to file. The four areas of coverage under workers compensation are medical treatment, …

Which of the following is not covered under workers compensation?

Intentional acts: When a worker intentionally causes their workplace injuries or illnesses, they are not covered under a Workers' Comp insurance policy. Illegal activities: Employee injuries due to illegal activities at the worksite are not covered by an organization's Workers' Compensation insurance policy.

Which of the following is included under workers compensation insurance?

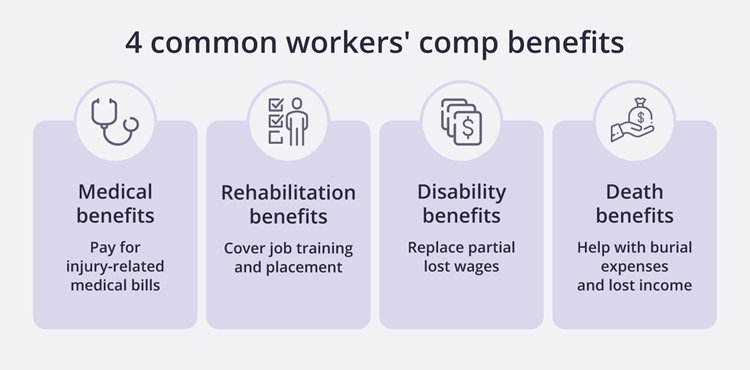

Workers' compensation insurance, also known as workman's comp, provides benefits to employees who get injured or sick from a work-related cause. It also includes disability benefits, missed wage replacement and death benefits. Workers' comp also reduces your liability for work-related injuries and illnesses.

How workmen compensation is calculated?

In the case of total permanent disability of an employee due to an accident in the workplace, the compensation that is offered under workmen compensation policy are: 50% of the monthly salary X relevant factor based on the age of the worker. 1,20,000 is the minimum amount payable in this situation.Aug 3, 2021

What is workman compensation insurance?

To safeguard organizations from the threat of costly lawsuits and other financial liabilities insurers offer the Workmen's Compensation(WC) Policy. It covers the statutory liability of an employer for the death, injury or occupational disease of an employee at the workplace.Apr 8, 2021

How Much Does Workers Compensation Insurance Cost?

The average price of a standard $1,000,000 Workers Comp Insurance policy for small businesses ranges from $29 to $297 per month based on location,...

What Are Workers Comp Payroll Exceptions That Reduce Cost?

How much does workers compensation insurance cost? Workers comp insurance cost & premium calculations are usually based on the entire payroll amou...

What Are Workers Compensation Payroll Limitations That Lower Premiums?

In some states, premium is based on a certain amount of the average weekly wage for the payroll classification for each employee. Payroll of Execut...

How Do I Select The Right Workers Compensation Insurance Classification Codes?

Governing Classification How much does workers compensation insurance cost? The rate that applies to any risk is based on the classification that b...

What Other Factors Can Affect Workers Comp Insurance Cost

Expense Constant The expense constant is a premium charge applied after all other premium calculations are complete. It offsets the higher expense...

How Can I Get A Discount On My Workers Compensation Premium?

How much does workers compensation insurance cost? On larger risks with more payroll, a discount is allowed on the portion of the premium that exce...

What Is Experience Rating In Workers Compensation?

How much does workers compensation insurance cost? In order to encourage employers to reduce the frequency and severity of industrial accidents, mo...

What's A Retrospective Rating Plan In Workers Compensation?

How much does workers compensation insurance cost? Retrospective rating provides a way to adjust the premium for a current policy based on the loss...

What is included in workers compensation?

The dollar value of certain non-monetary items, such as board, rent, housing, merchandise, credits, and any kind of services an employee receives as compensation for services is included in the payroll used to determine workers compensation premiums. The bonuses, commissions, and tips an employee receives are included in ...

What type of insurance pays for bodily injury?

Commercial auto insurance pays bodily injury or property damage costs for which the business is found liable - up the the policy limits for liability and property damage. Workers Compensation Insurance: In almost every state employers must provide workers comp when there are W2 employees.

What is audit premium?

Audit Premiums. The workers compensation and employers liability insurance policy states that the final earned premium is based on the rules, classifications, rates, and rating plans in the rating manual of the rating organization that has jurisdiction.

How long does a premium charge for a payroll of $100,000 last?

For example, the premium charge for a payroll of $100,000 for one month is the same as the premium charge for a $100,000 payroll paid out over a 8-month period.

What is included in payroll basis?

The bonuses, commissions, and tips an employee receives are included in the payroll basis for premium calculations. Vacation pay, sick pay, holiday pay, all piecework earnings, and money received under incentive or profit-sharing plans are also included.

What factors affect workers comp costs?

Several factors affect workers' compensation costs, including: your state, your payroll, your industry and claims history. Speak with an experienced commercial insurance broker to find the best workers comp policy for your business at the lowest cost.

What is the expense constant?

The expense constant is a premium charge applied after all other premium calculations are complete. It offsets the higher expense factor on policies that have smaller premiums. In most states, the expense constant ranges from $100 to $200.

How to improve health and safety?

Dr. Thomas Schenk: Three steps that employers can take to improve workplace safety and health are: 1 Make workplace safety and health a priority in all decision-making and business processes. 2 Establish health and safety committees to foster employee engagement. Listen to employee concerns and act to correct unsafe conditions or practices. 3 Promote a Safety Culture where all employees take workplace safety and health seriously.

How to calculate workers compensation premiums?

The basic formula for calculating workers’ compensation insurance premiums is: The classification rate is a dollar amount (for example, $1.25) that is assigned to a certain type or class of workers. Most commonly, states use classifications from the NCCI to set their classification rates.

What is workers compensation insurance?

Workers’ compensation insurance is an important insurance coverage that applies to many types of businesses and employers. In most states, workers’ compensation insurance is legally required for most employers, with some states offering exceptions for the smallest employers. Carrying workers’ compensation insurance protects a business financially ...

What factors affect the premiums paid by businesses between states?

Additionally, other factors that affect the premiums paid by businesses between states are the types of jobs and businesses within the state, the worker safety regulations required by each state, wage rates in the state, and medical costs in each state.

What is the goal of a work environment that is 100% safe?

Ideally, the hazardous conditions would then be eliminated; the goal would be to create a work environment that is 100% safe. When this isn’t possible, work procedures and policies should be put in place to minimize workers’ exposures to hazards and protect them.

Is workers compensation insurance required in Texas?

Texas is the only state in which workers’ compensation insurance is not legally required. In most states, private insurance companies provide all or some of the workers’ compensation insurance policies available to businesses. Some states have a mixed system in which the state also runs a workers’ compensation insurance program ...

Is workers comp required in Texas?

In many states, all companies with employees are required to carry workers’ compensation insurance, while in other states, only companies that surpass a minimum number of employees are required to have coverage. Texas is the only state in which workers’ compensation insurance is not legally required. In most states, private insurance companies ...

What is workers compensation?

Workers’ compensation provides a safety net for you and your employees after a workplace injury. It can help cover expenses for medical treatment, lost wages, and other costs. It’s an essential component of your small business insurance package that protects you and your employees from financial harm.

What factors determine the cost of workers compensation insurance?

Several factors are used to determine the cost of workers’ compensation insurance, including the number of employees at your business, your payroll, the location of your business and other details.

What happens if a heavy beam lands on a construction worker's foot and causes a compound fracture

For example, if a heavy beam lands on a construction worker’s foot and causes a compound fracture, workers’ compensation can cover medical expenses and lost wages during the recovery. Without insurance, the employer could be responsible for all related costs, which could add up to tens of thousands of dollars.

When do you have to purchase workers compensation insurance?

You’re required to purchase coverage in most states as soon as you hire your first employee. The workers’ compensation system was created to ensure workers are taken care of if they are hurt on the job, while also protecting business owners from significant financial losses after an accident.

Does Workman's comp cover physical therapy?

Workman’s comp insurance can help pay for all those expenses. Otherwise, the business owner would most likely be responsible for covering costs out of pocket.

Is workers compensation required in most states?

Because of the essential nature of workers’ compensation coverage, it is legally required in most states for businesses with employees . There can be significant penalties for non-compliance, ranging from fines to felony criminal charges in the most extreme cases.

What happens if an employee is not compensated under state workers compensation laws?

In addition, if the employee injury is not compensable under applicable state workers compensation laws or occupational disease acts, Employers Liability Insurance responds to the employee's allegation of negligence by you , again subject to certain policy terms, conditions, and exclusions.

How to avoid a coverage gap?

To avoid a coverage gap, any firm with business operations in any of the monopolistic funds or territories should obtain stop gap insurance using an appropriate endorsement to its commercial general liability or workers compensation policy.

What is part one workers compensation?

PART ONE - WORKERS COMPENSATION INSURANCE . Workers compensation insurance applies to bodily injury by accident that occurs during the policy term. It also includes bodily injury by disease caused or aggravated by employment conditions. The insurance company pays benefits you are required to pay when they are due.

What is the purpose of the named insured in workers compensation?

The insurance company obtains the named insured's rights to recover from others who may be liable for an injury as a result of the payments it makes. The named insured must do everything possible to preserve those rights. The insurance company is subject to all statutory provisions of the workers compensation law.

What is a named insured?

The named insured is responsible for payments that exceed the benefits the workers compensation law requires, as well as certain other payments. Examples are those required due to willful misconduct, illegal employment, not complying with health or safety laws, and employment-related practices that violate the law.

What is employer liability?

Employers Liability covers an employer's common law or tort liability for employee injuries that fall outside the scope of the state laws or acts. This liability is separate and distinguished from the liability that workers compensation laws impose.

What is a workers compensation policy?

A workers' compensation insurance policy protects a business and its owner (s) from claims by employees who experience a work-related injury, illness, or disease - either sustained on business premises or due to business operations.

What is the number to call for workers comp insurance in California?

Give one of our CA workers compensation Specialists a call today at 888-611-7467 for a free, no-obligating quote on workers compensation insurance. California Agency License: 0G63217. National Producer Number: 5064979. Contact a Work Comp Specialist.

Which state has the most workers compensation insurance?

California has been the most expensive state for workers' compensation insurance coverage. A 2018 study indicated that the average rates in CA were almost 188% higher than the study medium. California was ranked 13th in 2016, but rates have steadily increased since then.

Who makes the base manual rates?

Insurance companies file their "base manual rates" for approval with each state for all class codes. Rate recommendations are generally made to the state and carriers annually by the National Council on Compensation Insurance.

Is California the most expensive state for workers compensation?

Private insurance companies are likely to follow suit in order to remain competitive. Despite the overall reduction, Employers may still see some rate increases or decreases depending on class codes and experience factors. California has been the most expensive state for workers' compensation ...

How much can you lose in Massachusetts if you turn down vocational rehab?

In Massachusetts, your weekly benefits can be decreased by 15% if you turn down vocational rehabilitation services. Likewise, in Michigan, your benefits can be reduced after a hearing if you fail to follow through with a vocational rehab plan.

How long can you receive vocational rehabilitation?

Most states limit the amount of vocational rehab services you can receive. For example, in Michigan and Oklahoma, workers may receive up to two years of vocational rehabilitation services. In other states, such as Texas, you can continue to receive services for as long as your rehab counselor deems necessary.

What is vocational rehabilitation?

Vocational rehabilitation describes a wide range of services that help impaired workers develop the skills they need to return to their jobs or enter a new line of work. For example, a construction worker who loses a leg in a workplace accident will probably not be able to return to construction work in the future.

What happens if you can't return to work?

If you can't return to your regular job because of a work injury, you may be entitled to job training services. By Carey Worrell, Attorney (J.D., Harvard Law School) Updated: May 27th, 2020. You may be entitled to vocational rehabilitation benefits if a workplace injury prevents you from doing the work you did prior to your injury.

Do disabled people have to be in vocational rehabilitation?

For example, in New York, workers with a permanent disability of more than 50% are required to participate in vocational rehabilitation.

Average Cost of Workers’ Compensation Insurance

States with The Highest and Lowest Workers’ Compensation Premiums

- Each state and the District of Columbia run their own workers’ compensation systems, and rules for which companies are required to have this insurance vary in each state. In many states, all companies with employees are required to carry workers’ compensation insurance, while in other states, only companies that surpass a minimum number of employees are required to have cove…

How Much Are Workers’ Compensation Claims?

- Workers’ compensation claims can be very costly and potentially ruinous for small businesses that don’t carry appropriate insurance. According to data from the National Safety Council and National Council on Compensation Insurance (NCCI), the average cost of a workers’ compensation claim is $41,003. Claims were generally split approximately 45% in indemnity cos…

How Are Workers’ Compensation Premiums calculated?

- The basic formula for calculating workers’ compensation insurance premiums is: Premiums = Classification Rate x ( Payroll / $100 ) x Experience Modifier The classification rate is a dollar amount (for example, $1.25) that is assigned to a certain type or class of workers. Most commonly, states use classifications from the NCCI to set their classification rates. Each group …

Expert Commentary

- Dr. Thomas Schenk is an assistant professor and director of the Environmental Health and Safety Program at Oakland University’s School of Health Sciences. Dr. Laurel Kincl is an associate professor at Oregon State University’s College of Public Health and Human Sciences. Dr. Katie Schofield is an associate professor and director of the Master of Environmental Health & Safety …

Methodology

- To determine the average workers’ compensation insurance cost, AdvisorSmith examined workers’ compensation costs as published by the Bureau of Labor Statistics for private industry workers, which details these costs on a per-hour basis on average nationwide. We then estimated the cost for private employers if they employed a worker full-time throughout a year to find the a…

A Basic Guide to Workers’ Compensation Insurance

- Everyone who wants to be an entrepreneur and intends to hire employees should learn about workers’ compensation insurance. It is a mandatory insurance coverage that benefits both employers and employees. When an employee is injured or becomes ill at work, they can file a workers’ compensation claim to cover medical treatment costs, including multip...

Types of Workers’ Compensation Benefits

- Medical care: Covers employees when they suffer injuries on the job • Vocational rehabilitation: Includes care needed to help the patient smoothly transition back to the workplace • Disabilit...

General Liability vs. Workers’ Compensation Insurance

- Your insurance options for your business will initially be shaped by your state’s laws on private and public workers’ comp markets. Workers’ compensation began in the United States in the Progressive Era of the early 1900s. Since then, states have made their own specific requirements as to who needs the insurance. Insurance companies that serve large corporations tend to stay …

Workers’ Compensation Insurance Requirements

- Since workers’ compensation is regulated at the state level, it’s best to understand your state’s unique requirements before launching an enterprise. Failing to comply can result in a very expensive penalty. Be aware of the fact you will have certain social responsibilities as a business leader in your community. Regulations on workers’ compensation apply to the state where empl…

Do Business Owners Need Workers’ Compensation?

- Not all businesses need to buy workers’ compensation insurance, but in most cases, the answer is yes for companies with one or more employees. In some states, corporate officers are permitted to take exemptions from coverage. However, you can save yourself the worry on which path to take by discussing your business operation with your insurance agent, who can then inform you …