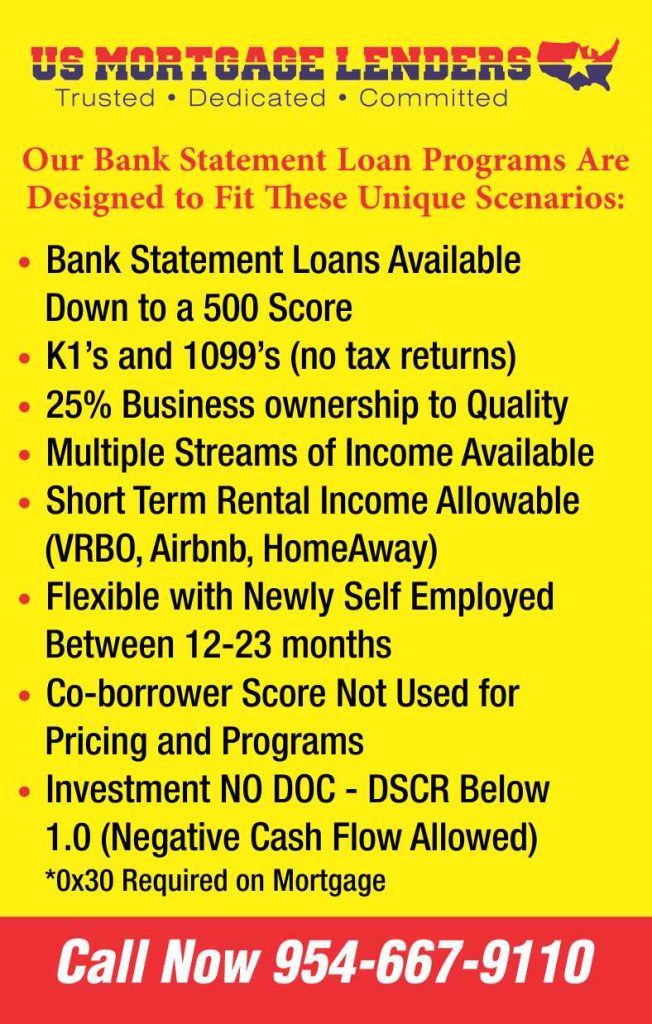

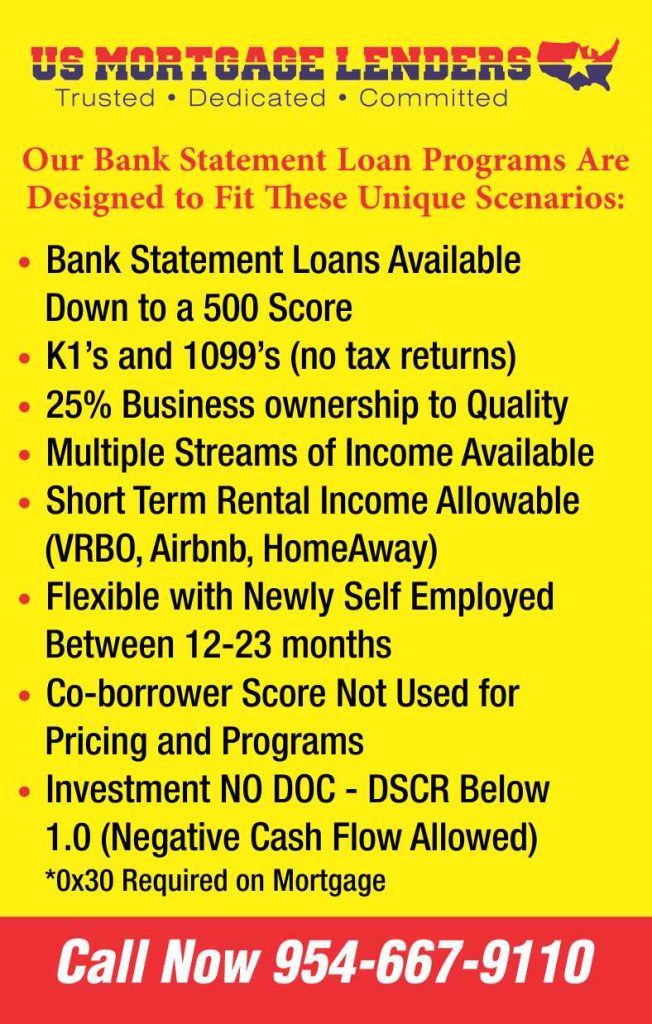

When you’re applying for a rehab loan, lenders will expect you to meet the following requirements:

- Credit score: You’ll need a score of at least 550, or 500 for FHA 203 (k) loans

- Income: Lenders will look for stable income

- Real estate experience: Lenders look for borrowers who have completed a few real estate flips before, and turned a...

What do you need to qualify for a rehab loan?

Nov 07, 2019 · When you’re applying for a rehab loan, lenders will expect you to meet the following requirements: Credit score: You’ll need a score of at least 550, or 500 for FHA 203 (k) loans Income: Lenders will look for stable income Real estate experience: Lenders look for borrowers who have completed a few ...

What credit score do you need to get an FHA loan?

Jul 19, 2017 · Credit Score Requirements as Low as 580. FHA loans are the #1 loan type in America. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. DOWN PAYMENT ASSISTANCE MAY BE AVAILABLE IN YOUR AREA.

What credit score is needed for an FHA 203 (K) loan?

Minimum 640 credit score required. Because rehab loans provide borrowers with additional cash over and beyond the home’s purchase price, it’s considered a risky investment. Because of the increased risk, the minimum credit score for a 203k mortgage is 640. If your FICO score is below 640 and you are having trouble getting approved for a 203k mortgage.

How do I get an FHA rehab loan?

Jan 24, 2022 · A minimum credit score of 580 A debt-to-income (DTI) ratio of 50 percent or less (individual lenders may have higher or lower requirements) The home is your primary residence and passes inspection...

Is it hard to get approved for a rehab loan?

But rehab loans do come with challenges, Supplee said. Because the repair work that fixer-uppers need is often difficult to estimate, there is more that can go wrong with a rehab loan, she said. "It is frustrating and a lot of work at times," Supplee said. "It is imperative to have good contractors who you trust.

How much money can you get with a 203k loan?

What is the maximum 203k loan amount? You can borrow up to 110% of the property's proposed future value, or the home price plus repair costs, whichever is less.

What is a rehab loan and how does it work?

To put it simply, a rehab loan lets you purchase or refinance a home and put the costs of your renovation into the form of a loan. You then combine those costs with your mortgage to pay both off in the form of 1 monthly payment.

What is a FHA 203k rehab loan?

An FHA 203(k) rehab loan, also referred to as a renovation loan, enables homebuyers and homeowners to finance both the purchase or refinance along with the renovation of a home through a single mortgage.

Is it hard to get a FHA 203k loan?

Is an FHA 203k loan hard to get? FHA loans are not hard to get: most lenders work with FHA. However, most lenders do not do 203k Rehab loans. Most lenders do not want to do 203k loans because they take more time, are tougher to get approved, and require more work on the lender's part.Sep 30, 2019

What is the difference between a FHA 203b and 203k loan?

Rather, the FHA insures or backs a couple of different mortgage products made by approved lenders, including the agency's 203(b) and 203(k) loans. The major difference between an FHA 203(b) and a 203(k) mortgage loan is that one is intended for homes in need of extensive repair while the other one isn't.

Can you refinance a 203k loan?

In short, yes you can refinance and remodel with the FHA 203k loan. Rolling the mortgage you have now, plus the renovations and improvements you want to do, is possible with the 203k. The new mortgage will include what you owed on the previous loan PLUS the work you're financing.

What is a 203b loan?

FHA 203(b) loans allow borrowers with modest incomes, credit challenges and down payments as low as 3.5 percent to obtain affordable financing. Eligibility is determined by assessing the borrowers' income, employment history, assets, existing debts, and credit history and score.

What is a 205k loan?

What Is an FHA 203(k) Loan? An FHA 203(k) loan is a type of government-insured mortgage that allows the borrower to take out one loan for two purposes: home purchase and home renovation. An FHA 203(k) loan is wrapped around rehabilitation or repairs to a home that will become the mortgagor's primary residence.

What is a conventional renovation loan?

The Conventional HomeStyle Renovation Loan program allows borrowers to create one loan amount, including a repair and renovation budget to make repairs and home improvements, that are permanently affixed to the property, which when: Purchasing a house can be combined with the purchase price.

What is hard money rehab?

If you’re having trouble finding financing help, consider a hard money rehab loan . Unlike traditional lenders, which look at your credit score and income, hard money lenders base their decision to approve you for a loan based on what collateral you can provide. If you have valuable property to serve as collateral, a hard money lender is more likely to work with you, even if your credit score is less-than-stellar.

Do hard money lenders look at your credit score?

When determining your loan, hard money lenders will look at the property’s after repair value (ARV).

Is a 203k loan FHA?

By contrast, 203 (k) loans are insured by the FHA, and usually offer lower rates and longer repayment terms. The process for leveraging an FHA rehab loan is pretty straightforward: Apply with an approved lender. Meet the credit requirements and get approved. Choose a contractor.

Do you need a rehab loan to flip a house?

If you’re planning on flipping houses for profit, you’ll likely have to make significant repairs and renovations to the home you intend to flip. To do so, you’ll probably need a rehab loan to pay for the property and its repairs so you can sell it. There are three main types of rehab loans for investors you should know about.

What is the minimum credit score for a 203k?

Because of the increased risk, the minimum credit score for a 203k mortgage is 640.

How many units can I buy with a 203k loan?

203k loans allow you to purchase a single-family home or a multi-family home up to 4 units. You must occupy one of the units as your primary residence to be eligible.

What is a 203k loan?

203k loans are a type of renovation loan that includes funds to purchase the property plus additional funds to make home improvements and repairs. A minimum 640 credit score is required with a 3.5% down payment. 203k loans are government home loans guaranteed by the Federal Housing Administration and funded by private FHA-approved lenders.

What is a first time homebuyer?

A first-time homebuyer is defined as a person who has not owned a home within the last three years. 203k loans, like FHA loans, are only for borrowers who intend to occupy the property as their primary residence. First-time homebuyers can qualify, Investors do not.

Best FHA 203 (k) rehab mortgage lenders

LoanDepot offers some of the most competitive rates and a streamlined process, closing on loans as much as 50 percent faster than competitors. That’s in part because the lender uses asset verification technology instead of requiring borrowers to mail or fax documents.

What is an FHA 203 (k) rehab loan?

The FHA 203 (k) loan is a type of mortgage backed by the Federal Housing Administration for homebuyers looking to renovate the home they’re purchasing. 203 (k) loans tend to come with more competitive rates, and require a smaller down payment and lower credit score compared to other kinds of loans.

How does a 203 (k) loan work?

A 203 (k) loan bundles your mortgage and renovation funds into one loan. Once you close on the loan, a portion of the loan proceeds is paid to the seller of the home, and the remaining balance goes toward the renovations.

Who qualifies for a 203 (k) loan?

If you’re interested in a 203 (k) loan, you’ll need to meet the same requirements for a standard FHA loan:

What information is required to apply for an FHA loan?

When you apply for an FHA loan, you’re required to disclose all debts, open lines of credit, and all sources of income. From this information, your Mortgage Loan Originator will evaluate your debt-to-income ratio.

How much down payment do I need for a FHA loan?

FHA loans only require at least a 3.5% down payment.

What are the requirements for a first time home buyer?

FHA loans are open to everyone but they’re often considered a first-time homebuyer program for a variety of reasons: 1 First-time homebuyers don’t typically have much money for a down payment 2 FHA loans only require at least a 3.5% down payment 3 Homebuyers with lower credit scores may find themselves eligible for an FHA 203 (k) loan 4 Gift funds are allowed as a partial or full down payment for an FHA 203 (k) loan but documentation is required including a letter that no repayment of the gift funds is expected.

How much of your income can you use for housing?

According to lenders, the FHA allows you to use 31% of your income towards housing costs, and 43% towards housing expenses and other long-term debt. If these numbers seem unforgiving, the FHA does offer some flexibility under the right circumstances. Get Started.

Can I get a 203k loan with a lower credit score?

Homebuyers with lower credit scores may find themselves eligible for an FHA 203 (k) loan. Gift funds are allowed as a partial or full down payment for an FHA 203 (k) loan but documentation is required including a letter that no repayment of the gift funds is expected.

What are the advantages of rehab loans?

The prime advantage of rehab loans is that they offer investors the option of a short-term loan swiftly approved, and facilitate both the renovation financing and the purchase of a house in a single loan. Forbes Real Estate Council is an invitation-only community for executives in the real estate industry.

What is a 203k loan?

The FHA 203 (k) loan is an ideal financing option if you are looking to renovate and fix up a home for your own personal use or if you are planning on fixing up the real estate property and hanging onto it for a period. Instead of filing applications for several loans like a separate home renovation loan and a mortgage, with an FHA 203 (k) loan, you purchase or refinance a home that requires repair work and roll the expenditures of the renovation work into your mortgage payments.

What is the passion of a real estate investor?

When an investor wants to buy a real estate property in poor condition, renovate it and then sell it for a profit, they require short-term money to purchase the property and renovate it promptly.

Can you borrow a percentage of your home equity?

You can borrow a percentage of your home’s equity and keep on using it repeatedly as required. Investment property lines of credit usually have lower interest rates than the other financing alternatives available. This is because the real estate property secures the former.

Do I Qualify for a Rehab Home Loan?

In order to qualify for an FHA 203 (k) home loan, a homeowner must meet certain requirements outlined by the Department of Housing and Urban Development (HUD).

203 (k) Rehab Loan Advantages

Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203 (k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date.

How to apply for a 203k loan?

To apply for a 203 (k) loan, you’ll need to find an FHA-approved lender and be ready to provide your Social Security number, as well as documents that verify your income, debts and credit score.

What is a 203k loan?

An FHA 203 (k) loan allows you to buy or refinance a home that needs work and roll the renovation costs into the mortgage. You'll get a loan that covers both the purchase or refinance price and the cost of upgrades, letting you pay for the renovations over time as you pay down the mortgage.

Is a 203k loan FHA?

Although it has a very specific purpose, the 203 (k) loan is still an FHA mortgage at its core. This means it has more lenient qualification requirements than a conventional mortgage and is subject to FHA loan limits. Credit score: You’ll need a credit score of at least 500 to qualify for an FHA 203 ...