How do you write a loan agreement for a client?

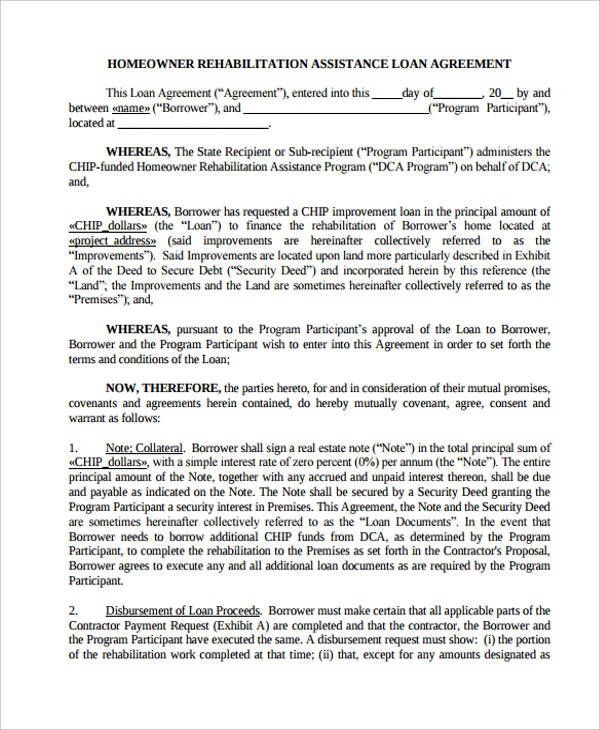

in accordance with the Work Write-Up or Work Plan, as evidenced by a compliance inspection or other authorized method, and when the repairs and improvements meet all federal, state and local laws, codes ... Failure of the Borrower to perform under the terms of this Rehabilitation Loan Agreement will make the loan amount, at the option of the ...

How do I choose the best rehab loan?

Changes in the architectural exhibits must be approved in writing by the Lender, prior to the beginning of the work, by writing a letter describing the changes or using form HUD 92577. ... Failure of the Borrower to perform under the terms of this Rehabilitation Loan Agreement will make the loan amount, at the option of the Lender, due and payable.

Can a builder be a borrower on a rehab loan?

Jul 27, 2008 · 10. No modification of this contract will be effective unless it’s in writing and is signed by both parties hereto. This contract binds and benefits both parties, assigns, personal representatives and any successors. Time is of the essence of this Contract. This document, including any attachments, is the entire agreement between parties.

What are the different types of rehab mortgages?

Jun 28, 2012 · Don’t be intimidated by the process of writing a contract for a Renovation Loan. Also don’t get scared if you see that a buyer is using this type of loan to purchase a new home. Also don’t get scared if you see that a buyer is using this type of loan to purchase a new home.

Can I write my own loan agreement?

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.Oct 28, 2021

How do you write a loan contract?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options.

What is included in a loan contract?

A loan agreement spells out the details of the transaction, including the loan amount, the interest rate, and the terms. Lenders expect business borrowers to meet certain reporting and financial requirements; if you don't, they can recall your loan.

What is a renovation loan agreement?

A renovation loan agreement is a written agreement between the borrower and the lender. This agreement must be fully executed by both the lender and the borrower at closing and dated the same date as the note.Feb 2, 2022

How do I write a contract letter?

Here are the steps to write a letter of agreement:Title the document. Add the title at the top of the document. ... List your personal information. ... Include the date. ... Add the recipient's personal information. ... Address the recipient. ... Write an introduction paragraph. ... Write your body. ... Conclude the letter.More items...•May 27, 2021

How do you write a contract between two parties?

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing. ... Keep it simple. ... Deal with the right person. ... Identify each party correctly. ... Spell out all of the details. ... Specify payment obligations. ... Agree on circumstances that terminate the contract. ... Agree on a way to resolve disputes.More items...

What is a contractor profile?

The Contractor Profile is the internet area for dissemination of the contractual activity of the Consortium for the Construction, Equipment and Explotaition of the Synchotron Light Laboratory (CELLS), in charge of the ALBA Synchrotron management.

How long does it take to close on a HomeStyle renovation loan?

The funds can only be released after a progress inspection from the HUD consultant. Your renovation must begin within 30 days of the loan closing and must be completed within a six month period.Jan 7, 2021

What is an FHA 203k rehab loan?

An FHA 203(k) rehab loan, also referred to as a renovation loan, enables homebuyers and homeowners to finance both the purchase or refinance along with the renovation of a home through a single mortgage.

What is a loan contract?

Most loan contracts define clearly how the proceeds will be used. There is no distinction made in law as to the type of loan made for a new home, a car, how to pay off new or old debt, or how binding the terms are. The signed loan contract is proof that the borrower and the lender have a commitment that funds will be used for a specified purpose, ...

What is the purpose of a loan agreement?

The main purpose of a loan contract is to define what the parties involved are agreeing to, what responsibilities each party has and for how long the agreement will last.

How is the length of a loan determined?

The length of a loan contract is determined by a lender’s reliance upon an amortization schedule. Once the lender and the borrower have determined the amount of money needed, the lender will use the amortization table to calculate what the monthly payment will be by dividing the number of payments to be made and adding the interest onto the monthly payment.

What happens if a loan is paid off late?

The borrower can be liable for a myriad of potential legal damages to compensate the lender for any losses suffered .

Why are loan agreements important?

Loan agreements are especially useful when borrowing or loaning to a family member or friend. They prevent arguments over terms and conditions. A loan agreement protects both sides if the matter goes to a court. It allows the court to determine whether the conditions and terms are being met.

What is amortization table?

If the loan includes interest, one side may want to include an amortization table, which spells out how the loan will be paid off over time and how much interest is involved in each payment. Loan agreements can spell out the exact monthly payment due on a loan.

How is interest rate determined?

The interest rate depends on the type of loan, the borrower’s credit score and if the loan is secured or unsecured.

What to write on a loan?

Follow by entering the name and address of the Borrower and next the Lender. In this example, the Borrower is located in the State of New York and he is asking to borrow $10,000 from the lender.

What happens after a loan agreement is signed?

After the agreement has been authorized the lender should disburse the funds to the borrower. The borrower will be held in accordance with the signed agreement with any penalties or judgments to be ruled against them if the funds are not paid back in full.

What are the terms of a loan agreement?

Depending on the loan that was selected a legal contract will need to be drafted stating the terms of the loan agreement including: 1 Borrowed amount; 2 Interest rate; 3 Repayment period; 4 Late fee (s); 5 Default language; 6 Pre-payment penalty (if any)

What is the greatest aspect of a loan?

The greatest aspect of a loan is that it can be customized as you see fit by being highly detailed or just a simple note. No matter the case, any loan agreement must be signed, in writing, by both parties.

How often do you have to pay off a loan?

Most loans typically use the monthly payment schedule, therefore in this example, the Borrower will be required to pay the Lender on the 1st of every month while the Total Amount shall be paid by January 1st, 2019 giving the borrower 2 years to pay off the loan.

What is a business loan?

Business Loan – For expansion or new equipment. If the business is new or in bad financial shape a personal guarantee by the owner of the entity may be required by the lender.

What is a FHA loan?

FHA Loan – To purchase a home with bad credit (cannot be below 580). Requires the borrower to purchase insurance in the chance of default. Home Equity Loan – Secured by the borrower’s home in case the funds are not paid-back.

What is a loan agreement?

A loan agreement is a legally binding agreement that describes the terms on which a loan will be extended and repaid. You may need to draft a loan agreement if you are loaning money to (or borrowing from) family, friends, or a small business. Each year almost $90 billion is loaned between family and friends.

What is a contract in finance?

A contract is an agreement between two parties. Accordingly, you need to identify both parties to the loan agreement. Be sure to identify each party by whether it is the “Borrower” or the “Lender” and include each party’s address.

Why is it harder to enforce an oral contract?

Although you could make an oral contract, these are harder to enforce because you will not have conclusive proof of the terms of the contract. Always be sure to put your loan agreement in writing.

What is boilerplate provision?

You will want to finish the loan agreement with “boilerplate” provisions. These are provisions that clarify how contract disputes are resolved. An important provision is to state what law governs the loan agreement. Generally, people choose the state where the loan is agreed to.

How much down payment is required for a 203k?

Only a 3.5 percent down-payment is required. In addition to other requirements, 203 (k) loan down payments are also significantly lower than conventional loans. With just 3.5 percent of the selling price down at closing, you can achieve your dream home. You’ll also have more available cash for furniture, moving expenses, and other essentials.

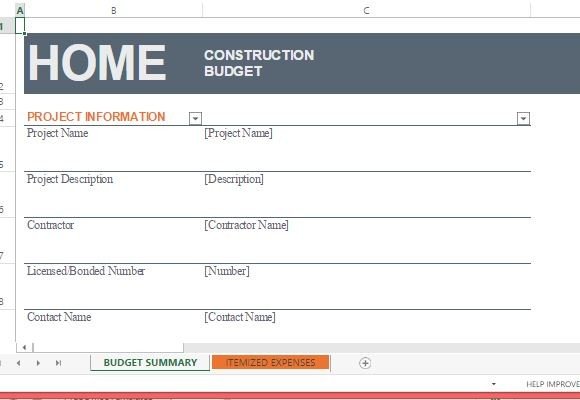

Do you have to itemize repairs before approval?

All repairs and improvements must be outlined and itemized prior to approval. A reputable lender can ensure you have the most accurate and correct information. It’s also prudent to check specific coverage items and dollar amounts.

Does the FHA insure 203k loans?

While the FHA doesn’t actually provide buyers with the funds, it does insure the loan through approved lenders, such as Contour Mortgage.

Purpose of A Loan Agreement

- The main purpose of a loan contract is to define what the parties involved are agreeing to, what responsibilities each party has and for how long the agreement will last. A loan agreement should be in compliance with state and federal regulations, which will protect both lender and borrower should either side fail to honor the agreement. Terms of t...

Other Reasons For Using Loan Agreements

- Borrowing money is a huge financial commitment, which is why a formal process is in place to produce positive results on both sides. Most of the terms and conditions are standard fare – amount of money borrowed, interest charged, repayment plan, collateral, late fees, penalties for default – but there are other reasons that loan agreements are useful. A loan agreement is proo…

on Demand vs. Fixed Repayment Loans

- Loans use two sorts of repayment: on demand and fixed payment. Demand notes are usually used for short-term borrowing and are often used when people borrow from friends or family members. Sometimes banks will offer demand loans to customers with whom they have an established relationship. These loans typically don’t require collateral and are for small amounts…

Legal Terms to Consider

- All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered must be clearly outlined. There are some standard legal terms involved in loan agreements that all sides should be aware of, regardless of whether the c…

Interest Rate Determination

- Many borrowers in their first experience securing a loan for a new home, automobile or credit card are unfamiliar with loan interest rates and how they are determined. The interest rate depends on the type of loan, the borrower’s credit score and if the loan is secured or unsecured. In some cases, a lender will request that the loan interest be tied to material assets like a car title or prop…

Contract Length & Amortization

- The length of a loan contract is determined by a lender’s reliance upon an amortization schedule. Once the lender and the borrower have determined the amount of money needed, the lender will use the amortization table to calculate what the monthly payment will be by dividing the number of payments to be made and adding the interest onto the monthly payment. Unless there are cer…

Pre-Payment Fees and Penalties

- While the goal to pay back a loan quickly is a financially sound practice, there are certain loans that penalize the borrower with pre-paid fees and penalties for doing so. Prepayment penalties are typically found in automobile loansor in mortgage subprime loans. They also can occur when borrowers choose to refinance a home or auto loan. Pre-payment penalties are applied to protec…

Breach Or Default

- If a loan contract is paid off late, the loan is considered in default. The borrower can be liable for a myriad of potential legal damages to compensate the lender for any losses suffered. The breached or defaulted lender can pursue litigation and have a court hold the borrower liable for legal costs, liquidated damages and even have assets and property attached or sold for repaym…

Mandatory Arbitration

- Mandatory arbitration is an increasingly popular provision in loan agreements that requires parties to resolve disputes through an arbitrator, rather than the court system. More than 50% of lending institutions include mandatory arbitration as part of their loan contracts because it is supposed to be faster and cheaper than going to court. Arbitration puts the final decision in the hands of one …

Usury and Predatory Protections

- Several federal and state consumer protection lawsprotect consumers against predatory and usury loan tactics used by lenders. The Truth In Lending Act, Real Estate Settlement Act and the Home Owners Protection Act federally protect borrowers against predatory lenders. Many states enacted companion consumer predatory and usury protection acts to protect borrowers. Both p…