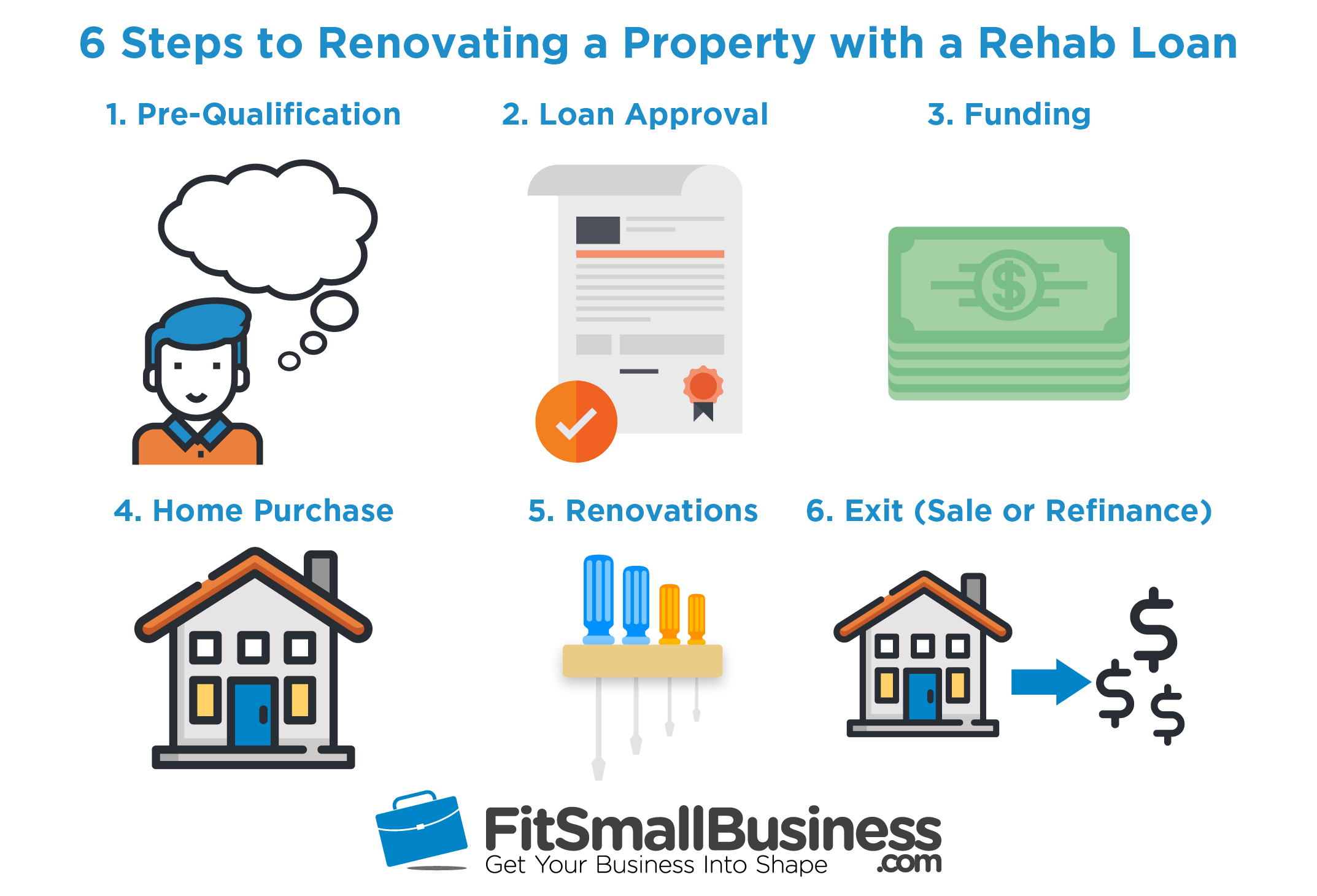

- Apply for a rehab loan with a participating lender.

- Get approved for the loan.

- Request bids from experienced contractors.

- Select your contractor.

- Close on the loan.

- Have the repairs and renovations completed.

- Have the rehabbed home inspected, if required.

How often can you qualify for a FHA loan?

Dec 21, 2021 · According to Solomon, here are the likely steps for getting and using a rehab loan : Apply for a rehab loan with a participating lender. Get approved for the loan. Request bids from experienced contractors. Select your contractor. Close on the loan. Have the repairs and renovations completed. Have the rehabbed home inspected, if required.

How to calculate housing loan eligibility?

Apr 23, 2022 · You must follow specific rules to receive a standard rehab loan. Some of these requirements are as follows: You must work with an approved consultant. A contingency reserve must be added to the loan. These are usually around 10%–20% of the total cost. Your property must be inspected after the project is complete. What does a limited 203 (k) cover?

How you can qualify for a FHA loan?

Do I Qualify for a Rehab Home Loan? In order to qualify for an FHA 203 (k) home loan, a homeowner must meet certain requirements outlined by the Department of Housing and Urban Development (HUD). These 203 (k) loan eligibility requirements include: Finding a property that may need some cosmetic repairs or updating Finding a qualified lender

How much FHA loan can I qualify for?

Oct 22, 2021 · How Do You Apply For a USDA Loan? 1. Pre-qualify with a USDA-approved lender. There are hundreds of lenders who offer USDA loans, so you’ll want to do your research on local ... 2. Apply for pre-approval. 3. Find your USDA-approved home. 4. Sign your purchase agreement. 5. Complete loan underwriting ...

Is it hard to get approved for a rehab loan?

But rehab loans do come with challenges, Supplee said. Because the repair work that fixer-uppers need is often difficult to estimate, there is more that can go wrong with a rehab loan, she said. "It is frustrating and a lot of work at times," Supplee said. "It is imperative to have good contractors who you trust.

What credit score do you need to get a rehab loan?

Credit score: You'll need a credit score of at least 500 to qualify for an FHA 203(k) loan, though some lenders may have a higher minimum. Down payment: The minimum down payment for a 203(k) loan is 3.5% if your credit score is 580 or higher. You'll have to put down 10% if your credit score is between 500 and 579.

What is an FHA rehab loan?

An FHA 203(k) rehab loan, also referred to as a renovation loan, enables homebuyers and homeowners to finance both the purchase or refinance along with the renovation of a home through a single mortgage.

How do you qualify for 203k?

The FHA 203k loan requirements are similar to that of a standard FHA loan. All borrowers must meet the FHA credit score requirements. The minimum FICO score allowed is 500. All borrowers must have the minimum down payment of 3.5%, or 10% if the FICO score is below 580.

What is a conventional rehab loan?

A conventional rehab loan allows you to finance the purchase of a new home and the cost of renovations with a single mortgage product. This means you won't have to take out a second mortgage or pay out of pocket for costly home improvement projects.Jan 19, 2022

Can I get a 203k loan if I already have an FHA loan?

You could potentially use the 203k loan to refinance your current home, make renovations, then move after one year and rent the house out as an investment property. FHA allows you to rent out a home you still own with an FHA loan, as long as: You fulfilled the one-year occupancy requirement.Feb 23, 2021

Is 203k a conventional loan?

FHA 203(k) Loan Offered by the U.S. Department of Housing and Urban Development (HUD), this loan is backed and insured by the FHA. While only approved lenders, such as Contour Mortgage, can offer these, they also have slightly more lenient terms than conventional mortgages.Aug 23, 2021

What are the cons of a 203k loan?

ConsOnly eligible for primary residences.Mortgage Insurance Premium (MIP) required (can be rolled into loan)Do it yourself work not allowed*More paperwork involved as compared to other loan options.

How long does it take to close on a FHA 203k loan?

It will likely take 60 days or more to close a 203k loan, whereas a typical FHA loan might take 30-45 days. There is more paperwork involved with a 203k, plus a lot of back and forth with your contractor to get the final bids.

What is the difference between a FHA 203b and 203k loan?

Rather, the FHA insures or backs a couple of different mortgage products made by approved lenders, including the agency's 203(b) and 203(k) loans. The major difference between an FHA 203(b) and a 203(k) mortgage loan is that one is intended for homes in need of extensive repair while the other one isn't.

What is a 203b loan?

FHA 203(b) loans allow borrowers with modest incomes, credit challenges and down payments as low as 3.5 percent to obtain affordable financing. Eligibility is determined by assessing the borrowers' income, employment history, assets, existing debts, and credit history and score.

How do I know if I qualify for an FHA loan?

How to qualify for an FHA loanHave a FICO score of 500 to 579 with 10 percent down, or a FICO score of 580 or higher with 3.5 percent down.Have verifiable employment history for the last two years.Have verifiable income through pay stubs, federal tax returns and bank statements.More items...•Jan 3, 2022

What is the minimum down payment for rehab?

Great interest rates for your rehab in one loan. Come with a low down payment. A minimum down payment of 3.5% means you won’t deplete your savings trying to come up with a down payment. Qualifications may be more lenient than for a conventional loan because FHA. insures your mortgage.

How long does it take to repair a home loan after closing?

After closing, the following will occur: A Repair Escrow Account is set up and the repairs must start within 30 days of closing and completed within six months.

What are the benefits of a 203k loan?

203 (k) Rehab Loan Advantages 1 A convenient way to finance your home improvements without the need for perfect credit, huge down payments, or high interest rates 2 Upgrade your home with your style and needs 3 Buy a home that’s usually listed at a lower price due to the older existing condition 4 Great interest rates for your rehab in one loan 5 Come with a low down payment 6 A minimum down payment of 3.5% means you won’t deplete your savings trying to come up with a down payment 7 Qualifications may be more lenient than for a conventional loan because FHA#N#insures your mortgage

What are the requirements for a USDA rehab loan?

What are the Requirements to Get a USDA Rehab Loan? USDA rehab loans are for low-income families and individuals. To qualify for a Section 504 loan, the homeowners must be unable to obtain affordable credit elsewhere. Homeowners also must have low income, below 50% of the area’s median income.

What is pre-approval for a loan?

Pre-approval is a more thorough process than prequalification. For this step, your lender will verify information about your income and finances and determine how much you can actually borrow. This is determined by calculating your debt-to-income (DTI) ratio, which shows how much of your monthly income goes towards expenses.

What happens after you find your home?

Once you find your home, you’ll work with your lender and agent to make an offer. This is also time to negotiate on closing costs. Then you sign! After you and the seller sign the purchase agreement, your lender will order a USDA loan appraisal, to ensure the home meets USDA standards . 5.

What do lenders look for in rehab loans?

Income: Lenders will look for stable income. Real estate experience: Lenders look for borrowers who have completed a few real estate flips before, and turned a profit. Many companies and lenders offer rehab loans, including some big name banks and online lenders that specialize in investor loans.

What are some uses for a rehab loan?

Some of the uses for a rehab loan include: Kitchen and bathroom remodels. Septic system improvements. Major appliance replacement. Heating and air conditioning upgrades. Improvements to make the home more energy efficient. Replacing carpet and flooring. Replacing the roof, new gutters and downspouts. Painting.

What is hard money rehab?

If you’re having trouble finding financing help, consider a hard money rehab loan . Unlike traditional lenders, which look at your credit score and income, hard money lenders base their decision to approve you for a loan based on what collateral you can provide. If you have valuable property to serve as collateral, a hard money lender is more likely to work with you, even if your credit score is less-than-stellar.

How long does a FHA renovation loan take?

Although the FHA renovation loan is pretty lenient there are some thing you cannot do with the loan: Any project that will take longer than six months. Minor landscaping projects. Adding luxury amenities like a swimming pool or tennis court. 1. FHA 203 (k) permanent rehab loan.

How long do you have to repay a home investment loan?

And, you can have up to 30 years to repay it. To qualify for an investment property line of credit, you likely need good to excellent credit, a low debt-to-income ratio, and have equity in the property. 2. Hard money rehab loan.

How does investment property line of credit work?

You can borrow a percentage of your property’s equity, and use it again and again as needed. Because investment property lines of credit are secured by the property, they tend to have lower interest rates than other financing options.

What is the minimum credit score required for a 203(k) loan?

There is no income requirement to qualify, but you must have a credit score of at least 500 to be eligible for a 203 (k) loan. Only owner-occupants — not investors — may use the program.

What is a rehab loan?

A Rehab Loan benefits borrowers, as well as lenders, since it insures a single, long term loan--whether its a fixed-rate or ARM-- that covers the purchase/refinance and renovation of a home. The FHA's 203 (k) program is also a good option in cases of federally declared natural disasters that cause property damage or destruction. ...

What are the types of rehabilitation that borrowers may make using Section 203 (k) financing?

According to the US Department of Housing and Urban Development, the types of rehabilitation that borrowers may make using Section 203 (k) financing include: Structural alterations and reconstruction. Modernization and improvements to the home's function. Elimination of health and safety hazards.

Does FHA make home loans?

FHA.com is a privately-owned website that is not affiliated with the U.S. government. Remember, the FHA does not make home loans. They insure the FHA loans that we can assist you in getting. FHA.com is a private corporation and does not make loans. FHA Loan Guidelines.

What is rehab mortgage?

Rehab mortgages are a type of home improvement loans that can be used to purchase a property in need of work -- the most common of which is the FHA 203 (k) loan. These let buyers borrow enough money to not only purchase a home, but to cover the repairs and renovations a fixer-upper property might need. Buyers can use these fixer-upper loans, backed ...

What is a 203k loan?

Standard 203 (k) loans are for homes that do need more intense repairs, including structural repairs and room additions. There is no set limit on the cost of repairs, but the total mortgage must still fall within the FHA's mortgage lending limits for your area. These limits vary, so check the FHA's loan limits for your community.

Is closing a rehab loan a traditional mortgage?

Closing a rehab loan is a more complicated task than is closing a traditional mortgage. Consider the FHA 203 (k) loan: When you close this loan, you are wrapping your estimated renovation costs into your mortgage. The amount of your final loan is the total of the home's sales price and the estimated cost of the repairs you'll be making, ...

Does Fannie Mae offer rehab loans?

Fannie Mae also offers its own rehab loan, the HomeStyle Renovation Mortgage. This type of rehab loan works much like the FHA's. Fannie Mae must approve your contractor before it loans you any money. You'll also have to submit rehab plans created by your contractor, renovation consultant or architect.

Is a FHA loan good for fixer uppers?

An FHA rehab mortgage is perfect for fixer-uppers. As local housing markets get tighter and tighter, buying a fixer-upper with an FHA rehab mortgage loan may be your ticket to to a home in that perfect neighborhood.

How much down payment is required for a 203k?

Only a 3.5 percent down-payment is required. In addition to other requirements, 203 (k) loan down payments are also significantly lower than conventional loans. With just 3.5 percent of the selling price down at closing, you can achieve your dream home. You’ll also have more available cash for furniture, moving expenses, and other essentials.

Can you personalize a 203(k) loan?

You can personalize your new home as your own. A limited 203 (k) loan funds value-added, non-structural changes to customize the home as your own. These include paint colors, flooring, cabinetry, countertops, and other cosmetic improvements.

Does the FHA insure 203k loans?

While the FHA doesn’t actually provide buyers with the funds, it does insure the loan through approved lenders, such as Contour Mortgage.

What You Need To Know

It’s a seller’s market. And that means home buyers are up against stiff competition.

What Is an FHA 203 (k) Rehab Loan?

You get an FHA 203 (k) rehab loan through a conventional lender, but it’s secured through a government loan program. The program lets borrowers renovate fixer-uppers without having to get separate mortgage and home improvement loans.

How FHA 203 (k) Loans Work

Nothing good in life is free … of rules. So it should come as no surprise that there are strict guidelines that govern the FHA’s lending program.

Types of FHA 203 (k) Loans and What They Cover

There are two primary types of FHA 203 (k) loans: limited and standard. The FHA 203 (k) loan you apply for will depend on your own unique needs.

FHA 203 (k) Loan Requirements

Ready to take the plunge into homeownership with an FHA 203 (k) loan? You need to meet these requirements to be eligible:

How To Get FHA 203 (k) Loans, Explained

Applying for an FHA 203 (k) is similar to applying for any other kind of mortgage loan. As a starting point, you’ll need the following:

Use an FHA 203 (k) To Turn a Fixer-Upper Into Your Future Home

Maybe you were under the impression that you needed flawless credit to buy a home. Maybe someone in your life tried to discourage you from falling too hard for fixer-uppers and insisted that you only look at move-in-ready properties.