What kind of insurance do you need for a home renovation project?

Feb 03, 2022 · TriWest Healthcare Alliance Insurance Coverage for Drug & Alcohol Rehab Treatment; QualCare Insurance Coverage for Drug & Alcohol Rehab; Cigna Insurance Coverage for Drug and Alcohol Rehab Treatment; Great-West Healthcare Insurance Coverage for Drug & Alcohol Rehab; MagnaCare Insurance Coverage for Drug & Alcohol Rehab

Do I need insurance during rehab?

Medicare Part A (Hospital Insurance) covers . medically necessary care you get in an inpatient rehabilitation facility or unit (sometimes called an inpatient “rehab” facility, IRF, acute care rehabilitation center, or rehabilitation hospital).

What is a house rehab?

NREIG is developed specifically for residential real estate investment properties including rehabs & rental properties. REI Guard provides: Occupied, Vacant & Renovation Policy Coverages with the ability to seamlessly transition between these occupancy statuses throughout your project Basic and Special Form coverage options

What should investors consider when buying a rehabilitation home?

A rehab can cost anywhere from $20,000 to $75,000 and up. To find a rehab project within your budget, it is a good idea to start by assessing how much capital you have access to. This will help you narrow down the size of the property and rehab you can take on.

Why are some homes uninsurable?

In the housing market, an uninsurable property is one that the FHA refuses to insure. Most often, this is due to the home being in unlivable condition and/or needing extensive repairs.

Who would provide coverage through the FAIR Plan?

FAIR plans are state-mandated, shared market insurance plans designed to provide coverage for homeowners who can't obtain insurance through the traditional marketplace.Feb 10, 2021

Can you insure a house that is not occupied?

Generally, your home is considered vacant if it's left empty for 30 to 60 days or more. Most typical homeowner policies won't provide full coverage for the property once it's been vacated. Vacant home insurance can be purchased to help.

Can you insure an empty house in Michigan?

According to the Insurance Information Institute, your home should be insured for up to 30 days of vacancy as a general rule. Some companies will allow you to work for up to 60 days if you are unemployed.Sep 14, 2021

What to do when no one will insure your home?

Being high-risk can make finding a home insurance policy you can afford difficult, but you have some options that can help:Shop around. ... Talk to your neighbors. ... Ask your real estate agent. ... Consult an independent agent. ... Look into surplus line insurance. ... See if your state has a FAIR plan.Jun 30, 2020

How is CA FAIR Plan funded?

Created in 1968, the California Fair Plan is not a state agency and does not have any taxpayer money or public funding involved in financing the California Fair Plan.Jan 6, 2021

Does USAA insure vacant homes?

Foremost specializes in homes that are vacant or occupied by you or a tenant. You can tailor a policy to get the protection you want for your property: Primary residences, seasonal and secondary homes. Vacant homes.

Does it cost more to insure an unoccupied house?

The exact cost for insuring your unoccupied home could be higher or lower because insurers consider things like: Property value: Expensive properties and belongings cost more to repair and replace, so you'll have to pay more to cover them.May 13, 2020

Is house insurance more expensive if the house is empty?

How much does unoccupied house insurance cost? Unoccupied property insurance tends to be more expensive than standard home insurance. This is because vacant properties are considered a higher risk by insurers.Dec 20, 2021

What is the difference between vacant and unoccupied?

Unoccupied: without occupants, but not devoid of furniture or other furnishings. Vacant: having no tenant or contents; empty, void. The difference between the two is a matter of time and intent.

How long can a house be left unoccupied?

Generally, there are no set-rules in place that state how long you can leave your unoccupied property vacant for. However, it is important to note that most standard home insurance providers will only cover an empty property for 30 to 60 days.

How long can I leave my home unoccupied?

Most standard home insurance policies allow your home to be empty for up to 60 days per year. If you leave your property unoccupied for longer than this, you may not be covered.Sep 17, 2021

Do I need insurance for my house flip project?

Yes, insurance protects you and your property from all kinds of perils and liabilities that can happen during your rehab. Your house could burn dow...

What type of insurance coverage should I purchase for my house flip?

Flipping houses requires special insurance coverage that your traditional homeowner's insurance policy will not cover. Your traditional insurance p...

How much should an insurance policy cost for my house flip?

As a general rule of thumb, your Vacant Insurance policy with Builder's Risk rider should be around .5 to 1% of the property value per month. So f...

How much insurance coverage do I need for my house flip?

In general, at the very least you want to obtain enough insurance coverage to cover the amount you paid for the home (less the lot value) and the a...

When should I get insurance for my house flip?

Don't wait until the last second to start contacting insurance providers! As soon as you get the property under contract you should reach out to a...

What is Builder's Risk Insurance?

A Builder's Risk insurance policy may be considered when doing a structural renovation and covers direct, physical damage to a property during the construction process. Coverage may extend to materials, fixtures and equipment used in the renovation of the property, if owned by the insured.

What is general liability umbrella?

A General Liability policy may provide coverage for bodily injury that occurs on the premises such as a slip and fall or wrongful death. This coverage does not extend to your general contractor or workers you hire to be on site.

Does insurance cover rehab?

Yes, insurance protects you and your property from all kinds of perils and liabilities that can happen during your rehab. Your house could burn down, a worker could fall off of a ladder, your property could be vandalized or tools & materials could be stolen.

Does insurance cover flipping a house?

Flipping houses requires special insurance coverage that your traditional homeowner's insurance policy will not cover. Your traditional insurance provider that you use for your personal residence or auto, will likely not provide the type of policy you need for your house flip. House flippers typically buy distressed properties ...

Is all insurance created equal?

All insurance coverage isn't created equal, so it's best to thoughtfully consider how much coverage your need for your house to make sure you aren't under-insured (or over-insured). You generally have two different options for insurance coverage: Basic Form Coverage. Special Form Coverage.

What is a dwelling policy?

Dwelling Policy. A Dwelling policy for a Vacant Building Under Renovation is for direct, physical damage to the property. This may affect you as a flipper when doing a light, cosmetic renovation, when the property is on the market for sale, or when looking for a tenant.

What is replacement cost value?

Replacement cost value coverage settles claims based upon the amount of money it would take to replace your damaged or destroyed home with the exact same or a similar home in today's market. It's important to note that the replacement cost value only includes the value of the home, but not the value of the land.

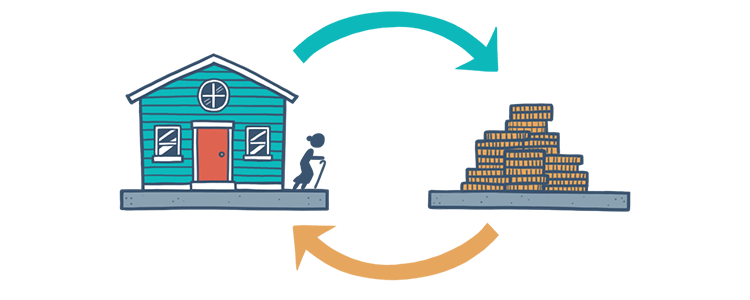

What is rehabbing a house?

One of the more costly projects a real estate investor can undertake is rehabbing houses. This endeavor can be both daunting and challenging, especially for beginner investors, as it consists of purchasing a property, renovating it, and selling it for full market value. Rehabbing requires attention to detail and a lot of time to master, ...

Why is it important to find a good contractor for rehab?

These individuals will play a crucial role in transforming your property into a winning investment. However, not all contractors are created equal. Investors will need to spend a responsible amount of time researching general contractors. This meticulous process will help investors steer clear of bad contractors, ultimately costing time, patience, and money.

What are lender fees?

Lender Fees: Depending on how the property is financed, different lender fees could be required. More often than not, these will cover paperwork, title searches, and other costs associated with property purchase. Ownership Costs: Do not forget to account for holding costs when estimating the overall budget.

What is the last piece of work to do when rehabbing a house?

The last piece to rehabbing a house on a budget is finalizing the improvements. With the contractor by your side, you must examine all of the work done, including double-checking any adjustments made during the renovation. A final inspection by a professional service is also recommended, as they can essentially confirm the work completed by the contractor is up to par with standards.

What is the difference between a fixer upper and a rehab?

The best way to think about a house rehab vs. fixer-upper is overall workload and cost: a house rehab is typically a more comprehensive project than a fixer-upper. House rehabs will involve renovating the property and making bigger changes, like fixing electrical, plumbing, or roofing issues. On the other hand, a fixer-upper typically focuses on cosmetic changes that can be made quickly or at a lower cost than a full rehab. A good rule of thumb is that if someone can live in the property during renovations, it will most likely be a fixer-upper and not a full house rehab.

Is it okay to walk away from a deal?

Not knowing when to walk away: It is okay to walk away from a potential deal if something is not right. For example, don’t be afraid to pass up on a property if you cannot find the right financing or team. These details can greatly impact the success of the project, even if the other details seem perfect.

What is included in a home inspection?

In most cases, a home inspection will include examining the home’s heating and air-conditioning system, electrical system, plumbing, foundation, roof, flooring, walls, ceilings, windows, doors, and insulation. As an investor, it’s important to take a combination of notes and pictures during the initial inspection.