Medicare Part A (Hospital Insurance) covers medically necessary care you get in an inpatient rehabilitation facility or unit (sometimes called an inpatient “rehab” facility, IRF, acute care rehabilitation center, or rehabilitation hospital

Rehabilitation hospital

Rehabilitation hospitals, also referred to as inpatient rehabilitation hospitals, are devoted to the rehabilitation of patients with various neurological, musculo-skeletal, orthopedic and other medical conditions following stabilization of their acute medical issues. The industry is largely made up by independent hospitals that operate these facilities within acute care hospitals.

What does Medicare pay for inpatient rehabilitation?

During the COVID-19 pandemic, inpatient rehabilitation facilities may accept you from an acute-care hospitals experiencing a surge, even if you don’t require rehabilitation care. Medicare Part B (Medical Insurance) covers doctors’ services you get …

What does Medicare Part B cover for inpatient rehab?

Mar 07, 2022 · The costs for rehab in an inpatient rehabilitation facility are as follows: You usually pay nothing for days 1–60 in one benefit period, after the Part A deductible is met. You pay a per-day charge set by Medicare for days 61–90 in a benefit period.

Does Medicare cover cardiac rehabilitation?

Oct 01, 2015 · The following CPT ® codes replaced G0424 for the Pulmonary Rehabilitation Program effective January 1, 2022 and may only be billed when all the above program requirements are met. 94625 - Physician or other qualified health care professional services for outpatient pulmonary rehabilitation; without continuous oximetry monitoring (per session), or

Are pulmonary rehabilitation services covered by Medicare?

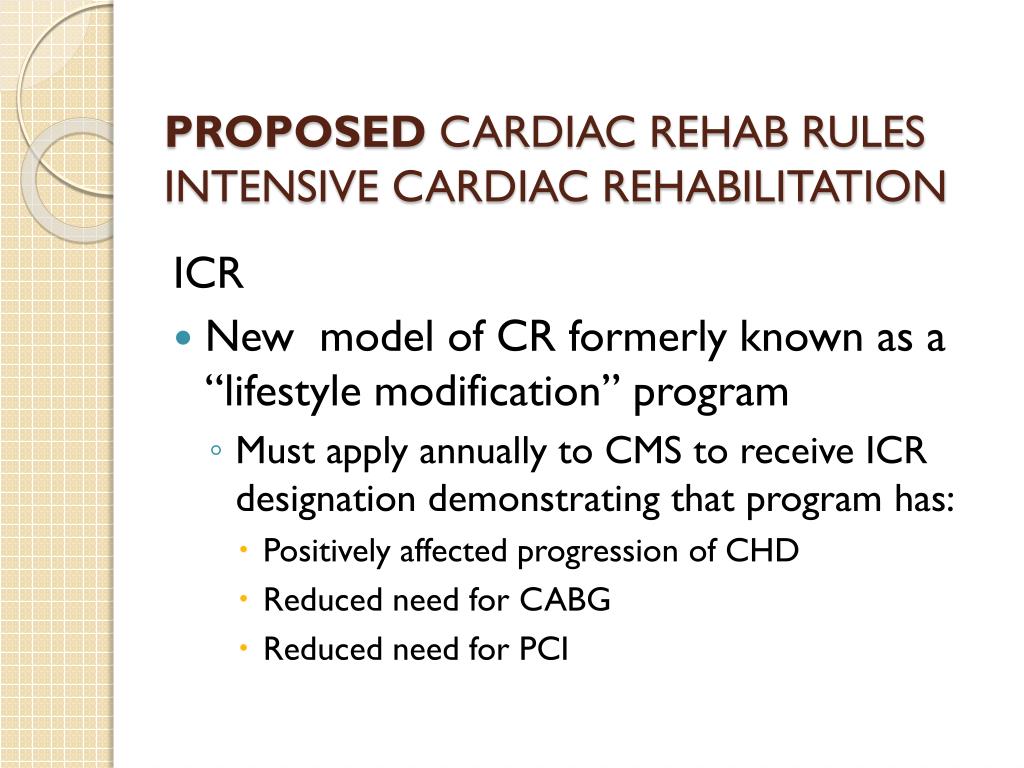

Oct 01, 2015 · Medicare covers cardiac rehabilitation (CR) services to beneficiaries as per Sections 1861 (s) (2) (CC) and 1861 (eee) (1) of the Social Security Act and 42CFR410.49 which defines key terms and the cardiac conditions that would enable a …

How long does Medicare cover inpatient rehab?

Medicare covers inpatient rehab in a skilled nursing facility – also known as an SNF – for up to 100 days. Rehab in an SNF may be needed after an injury or procedure, like a hip or knee replacement.

What is an inpatient rehab facility?

An inpatient rehabilitation facility (inpatient “rehab” facility or IRF) Acute care rehabilitation center. Rehabilitation hospital. For inpatient rehab care to be covered, your doctor needs to affirm the following are true for your medical condition: 1. It requires intensive rehab.

What is Medicare Part A?

Published by: Medicare Made Clear. Medicare Part A covers medically necessary inpatient rehab (rehabilitation) care , which can help when you’re recovering from serious injuries, surgery or an illness. Inpatient rehab care may be provided in of the following facilities: A skilled nursing facility.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How many reserve days can you use for Medicare?

You may use up to 60 lifetime reserve days at a per-day charge set by Medicare for days 91–150 in a benefit period. You pay 100 percent of the cost for day 150 and beyond in a benefit period. Your inpatient rehab coverage and costs may be different with a Medicare Advantage plan, and some costs may be covered if you have a Medicare supplement plan. ...

Does Medicare cover speech therapy?

Medicare will cover your rehab services (physical therapy, occupational therapy and speech-language pathology), a semi-private room, your meals, nursing services, medications and other hospital services and supplies received during your stay.

What is section 3004?

Section 3004 of the Affordable Care Act. CMS has created a website to support Section 3004 of the Affordable Care Act, Quality Reporting for Long Term Care Hospitals, Inpatient Rehabilitation Hospitals and Hospice Programs.

What is IRF PPS?

Historically, each rule or update notice issued under the annual Inpatient Rehabilitation Facility (IRF) prospective payment system (PPS) rulemaking cycle included a detailed reiteration of the various legislative provisions that have affected the IRF PPS over the years. This document (PDF) now serves to provide that discussion and will be updated when we find it necessary.

When is the new U07.1 code?

The new code, U07.1, can be used for assessments with a discharge date of April 1, 2020 and beyond. Section 4421 of the Balanced Budget Act of 1997 (Public Law 105-33), as amended by section 125 of the Medicare, Medicaid, and SCHIP (State Children's Health Insurance Program) Balanced Budget Refinement Act of 1999 (Public Law 106-113), ...

General Information

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

CMS National Coverage Policy

Title XVIII of the Social Security Act, Section 1833 (e) states that no payment shall be made to any provider of services or other person under this part unless there has been furnished such information as may be necessary in order to determine the amounts due such provider or other person under this part for the period with respect to which the amounts are being paid or for any prior period..

Article Guidance

History/Background and/or General Information:#N#It has come to Novitas’ attention that providers who are not physicians (MD or DO) are prescribing (i.e.

Bill Type Codes

Contractors may specify Bill Types to help providers identify those Bill Types typically used to report this service. Absence of a Bill Type does not guarantee that the article does not apply to that Bill Type.

Revenue Codes

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service. In most instances Revenue Codes are purely advisory. Unless specified in the article, services reported under other Revenue Codes are equally subject to this coverage determination.