How to save money on student loan repayment?

Jun 19, 2020 · A student loan rehabilitation is a program that can help you get your federal student loan out of default. A student loan default can show up on your credit for seven years and could continue to affect your credit score.

Should you do student loan rehabilitation?

Jun 04, 2019 · Student loan rehabilitation is a method to get your federal student loans out of default by making nine on-time payments in 10 months.

How to apply for student loan rehabilitation?

You can renew eligibility for new loans and grants and eliminate the loan default by “rehabilitating” a defaulted loan. To qualify for FFEL or Direct Loan rehabilitation, you have to make 9 monthly payments within 20 days of the due date during a period of 10 consecutive months. The 9 out of 10 rule basically allows you to miss your

What are the best student loan forgiveness programs?

Jun 16, 2020 · What is student loan rehabilitation? Loan rehabilitation is a program that gives federal student loan borrowers one opportunity to dig out of default by making nine on-time payments in a 10-month period. It restores eligibility for federal student aid, stops wage garnishments after your fifth payment, and may waive collection costs. Private student loans …

What is a student loan rehabilitation program?

The student loan rehabilitation program gives borrowers an opportunity to dig their federal student loans out of default by making nine monthly payments over 10 consecutive months. It also removes the default status (but not the late payment history) from their credit reports and stops collection activities.Mar 1, 2022

Is loan Rehabilitation a good idea?

Rehabilitation takes longer than student loan consolidation, the other primary option for default recovery. But rehabilitation is generally the better choice because it: Removes the default from your credit report. This will improve your credit score, though the late payments leading to the default will remain.Mar 17, 2022

How do you qualify for student loan rehabilitation?

To qualify for FFEL or Direct Loan rehabilitation, you have to make 9 monthly payments within 20 days of the due date during a period of 10 consecutive months. The 9 out of 10 rule basically allows you to miss your payment one month, but still be eligible to rehabilitate.

What happens after loan rehabilitation?

When you achieve loan rehabilitation status on your student loan debt, your loan is taken out of default and the default is removed from your credit record. Your pre-default payment activity remains in your credit history.Feb 2, 2021

What is better rehabilitation or consolidation?

While rehabilitation could help you start rebuilding your credit, consolidation is a faster option for getting out of student loan default. Our goal is to give you the tools and confidence you need to improve your finances.Jan 3, 2022

How long is student loan rehab?

The traditional rehabilitation process is based on a 10-month plan; but can last as little as 4 months or as long as 12 months, depending on the lender. Rehabilitation of a federal Perkins Loan is accomplished in nine consecutive months with payments determined by the loan holder. Other programs, such as the William D.May 20, 2020

Does loan Rehabilitation affect credit?

If you successfully rehabilitate a loan, the record of default is removed from your credit history. However, your credit history will still reflect late payments that were reported by your loan holder before your loan went into default.Sep 15, 2021

Can student loans in collections be forgiven?

Depending on the type of loan you have, the remaining balance will be forgiven after either 20 or 25 years' worth of payments. Borrowers will have to pay taxes on the amount forgiven. You also can use an extended or graduated repayment plan if you want a lower monthly payment.Jan 6, 2021

Can you rehabilitate student loans in collections?

You can get federal student loans out of collections by negotiating a lump sum payoff, applying for loan consolidation, or entering into the loan rehabilitation program. There's only one option to remove private student loans from a collection agency: settlement.Mar 8, 2022

Can you do student loan rehabilitation twice?

Following the rehabilitation of your loan, send all future payments on time. You will not be allowed to rehabilitate the same loan twice.

Can my student loans be forgiven after 10 years?

Public Service Loan Forgiveness Requirements Make 10 years' worth of payments, totaling 120 payments (although you are still eligible if you have to pause payments through forbearance), for the full amount within 15 days of your monthly payment due date.

Do student loans go away after 7 years?

Do student loans go away after 7 years? Student loans don't go away after seven years. There is no program for loan forgiveness or cancellation after seven years. But if you recently checked your credit report and are wondering, "why did my student loans disappear?" The answer is that you have defaulted student loans.Jan 13, 2022

What happens if a rehabilitated loan defaults?

If your rehabilitated loan defaults again, you’d have to consolidate it out of default. But if you already consolidated that loan, you wouldn’t be able to do this unless you have another loan to add to the consolidation. Your only choice would be to pay your full balance.

How long does it take to pay off student loans?

Pay as required. Student loan rehabilitation requires you to make nine on-time payments — within 20 days of the due date — over a 10-month period. Payments must also be voluntary. For example, money seized from your tax refund wouldn’t count as a payment.

What to do if you fell behind on your mortgage payments?

If you originally fell behind because payments were too expensive, selecting an income-driven repayment plan will likely be your best choice. Your new servicer will give you this option when you restart repayment. If your rehabilitated loan defaults again, you’d have to consolidate it out of default.

How to consolidate out of default?

You can consolidate out of default simply by agreeing to repay your new loan under an income-driven plan. This makes consolidation a good option to resolve default quickly — for example, if you’re heading back to school and need access to federal student aid.

Does a rehabilitated loan increase your credit score?

Removes the default from your credit report. This will improve your credit score, though the late payments leading to the default will remain. Eliminates additional collection costs. Rehabilitated federal direct loans are subject to collection costs, but those fees are not capitalized, or added to your loan balance.

Does consolidating out of default remove default?

But unlike rehabilitation, consolidation will not remove the default from your credit report. Also, consolidating out of default can add collection costs of up to 18.5% of your balance to your new loan’s balance, increasing the amount you owe and repay. » MORE: Student loan default: What it is and how to recover.

Who is Ryan Lane?

But neither of those options is guaranteed to save you money or get rid of your loans. About the author: Ryan Lane is an assistant assigning editor for NerdWallet whose work has been featured by The Associated Press, U.S. News & World Report and USA Today. Read more.

How long do you have to pay a servicer after rehabilitation?

The Department says that your payments for 90 days after rehabilitation will be the same as the payments you were making before the rehabilitation ended.

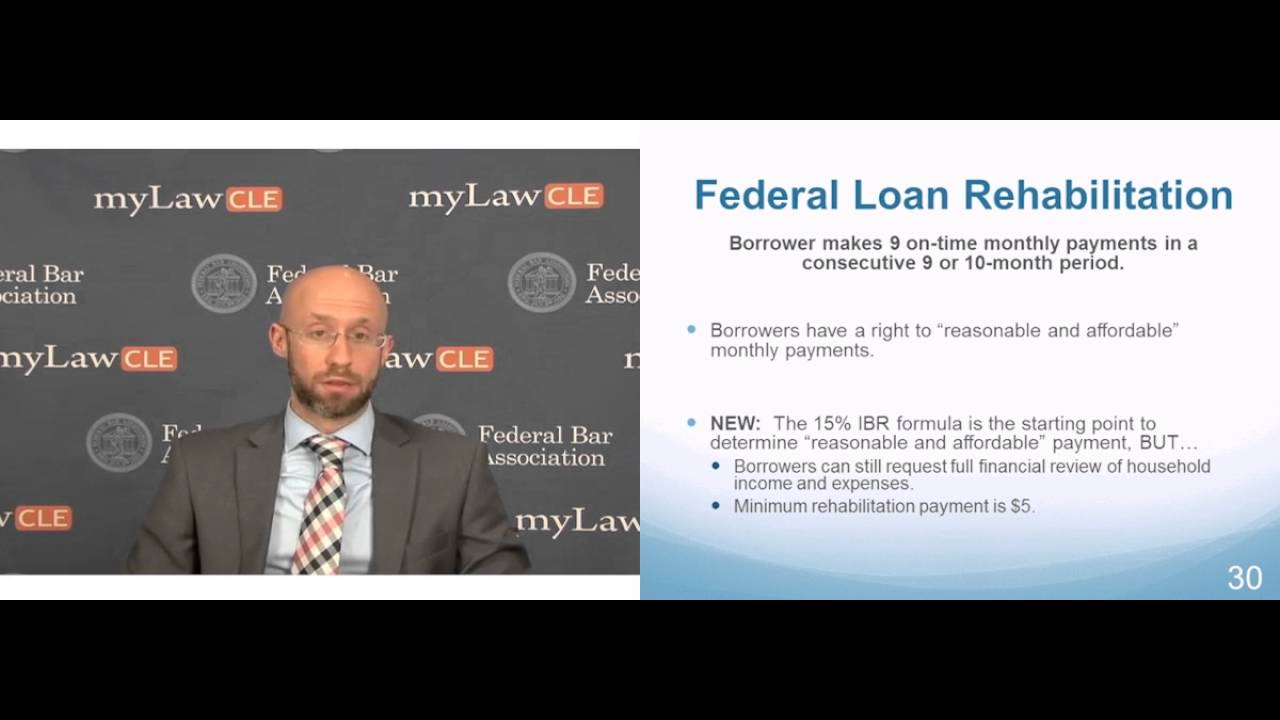

What is the IBR formula for student loans?

If you decide on rehabilitation, the loan holder should start out with the amount you would pay under the IBR formula. This is the IBR formula for older loans, based on the borrower making student loan payments of 15% of disposable income. This does not mean that you are eligible for IBR while you are still in default.

How many months do you have to make to qualify for FFEL?

To qualify for FFEL or Direct Loan rehabilitation, you have to make 9 monthly payments within 20 days of the due date during a period of 10 consecutive months. The 9 out of 10 rule basically allows you to miss your payment one month, but still be eligible to rehabilitate.

What is collection during rehabilitation?

Collection during the rehabilitation period is limited to collection activities that are required by law and to any communications that support the rehabilitation (for example, monthly statements with the amount your rehabilitation payment listed).

What is the Department of Revenue's expense standards?

A: The Department uses the Internal Revenue Service (IRS) expense standards as guidelines for acceptable expenses. For expenses that are not limited in the IRS standards, such as medical costs, the Department also does not set limits.

Can you have your wages garnished if you make five required rehabilitation payments?

If you are having your wages garnished, you have a one time right to have the garnishment suspended if you make five required rehabilitation payments. The rehabilitation payments are in addition to the amounts being garnished.

Do you have to make a good faith payment on a mortgage?

The loan holder may tell you that you have to make a “good faith” payment while they are waiting for you to submit documentation of your income. This is your choice. You do not have to make this payment. However, you may want to do this so that you can get started with the nine month rehabilitation period.

What happens when you complete the loan rehabilitation program?

When you complete the loan rehabilitation program, you’ll no longer have the burden of collection agencies. Collection activities like wage garnishment, tax refund offsets, and Social Security Income garnishment will stop.

How many times can you go through student loan rehabilitation?

Remember, you can only go through loan rehabilitation once . If you decide to go this route, make sure you plan on keeping your federal student loan current after rehabilitation. If you default a second time, loan rehabilitation is no longer an option.

How to eliminate anything that would prevent you from completing the rehabilitation program?

To eliminate anything that would prevent you from completing the rehabilitation program, you should: Enroll in autopay for your monthly rehabilitation payments. Submit your loan rehabilitation agreement letter and financial documents (tax return, pay stub, etc.) as soon as possible.

What is a consolidation loan?

A consolidation loan is the process of obtaining a new loan to pay off your existing loans. A Direct Consolidation Loan will pay off your defaulted student loan. In return, you’ll have a single, larger loan with one monthly payment. However, a Direct Consolidation Loan may extend your repayment length.

What happens if my student loan is in default?

If your federal student loan is in default, you may be eligible for student loan rehabilitation. Student loan rehabilitation allows you the opportunity to turn your federal student loan around and start fresh.

How many months of payments do you need for a Perkins loan?

For a Federal Perkins Loan, you’ll need 9 consecutive months of payments. For either option, you’ll first need to be in default before qualifying for student loan rehabilitation. If the payments are made as agreed upon, your loan will be brought back in good standing.

Is student loan rehabilitation good?

Loan rehabilitation can be a good idea if you’re eligible, as it removes the default from your credit report. The late payments that landed you in default will stay, unfortunately. But your credit may get a small boost by the student loan reporting as current.

How long does it take to rehabilitate a student loan?

A student loan rehabilitation is typically a 9-10 month payment program where the borrower will make agreed upon payments to rehabilitate the student loans to remove the default status.

Why are there negatives in rehab?

The negatives only exist because of the option to consolidate rather than entering into a rehabilitation. If consolidation is not an option for you, then the rehabilitation should always be considered as the best option for getting out of default.

How long does it take to consolidate a loan?

The consolidation process takes 30-60 days from when your new lender receives your file. There would be no payments due to consolidate your loans if doing it on your own.

What happens if you are in a wage garnishment?

If you are in an active wage garnishment, the amount taken from the wage garnishment will not be applied to any rehabilitation payments. You must make all the rehabilitation payments while also having your wages garnished concurrently.

Can you consolidate student loans?

You may be eligible for a student loan consolidation to remove the default status on your loans. When your loans are consolidated into the William D Ford Direct Loan program, all your loans would be combined into one new loan, and you would no longer be in default.

What is the repayment plan for a rehabilitation loan?

The most common plan used for rehabilitation loans, and the one required for consolidation loans, is income-based repayment. As the name suggests, repayment installments are computed using your income, and are adjusted over time as your income changes. Payments are capped at 15% of annual discretionary income.

What are the advantages of seeking loan rehabilitation?

Advantages to seeking loan rehabilitation: It puts your loan back in good standing. It makes you eligible for deferment, forbearance, consolidation, forgiveness and alternative repayment plans. You are eligible for additional loans and financial aid. You are no longer subject to collections activity or legal issues over your loan.

What happens if you default on a loan?

Defaulting on a loan can add years to a repayment schedule and result in collection fees that are added to the loan balance. Fortunately, options are available. They include forbearance and deferment, which allow borrowers to temporarily stop or reduce payments.

How long do you have to pay off a loan if you have a 10 year repayment plan?

No matter how much your income increases, you won’t be obligated to pay more each month than the amount you would have paid under a 10-year standard repayment plan. In addition, you are eligible for loan forgiveness after 20 or 25 years, depending on when you borrowed the money.

What is income based repayment?

The loan holder will use a system called income-based repayment to compute the installments you’ll pay unless you object. The lender will discuss the advantages and disadvantages of loan rehabilitation and loan consolidation with you.

How long can you defer student loans?

Federal student loans allow borrowers to defer payments for a long as three years if they have financial hardships or are enrolled in post-secondary school. Student loan rehabilitation programs are another alternative.

How long does a Perkins loan last?

The traditional rehabilitation process is based on a 10-month plan; but can last as little as 4 months or as long as 12 months, depending on the lender. Rehabilitation of a federal Perkins Loan is accomplished in nine consecutive months with payments determined by the loan holder.