What should I consider when buying a re-rehab property?

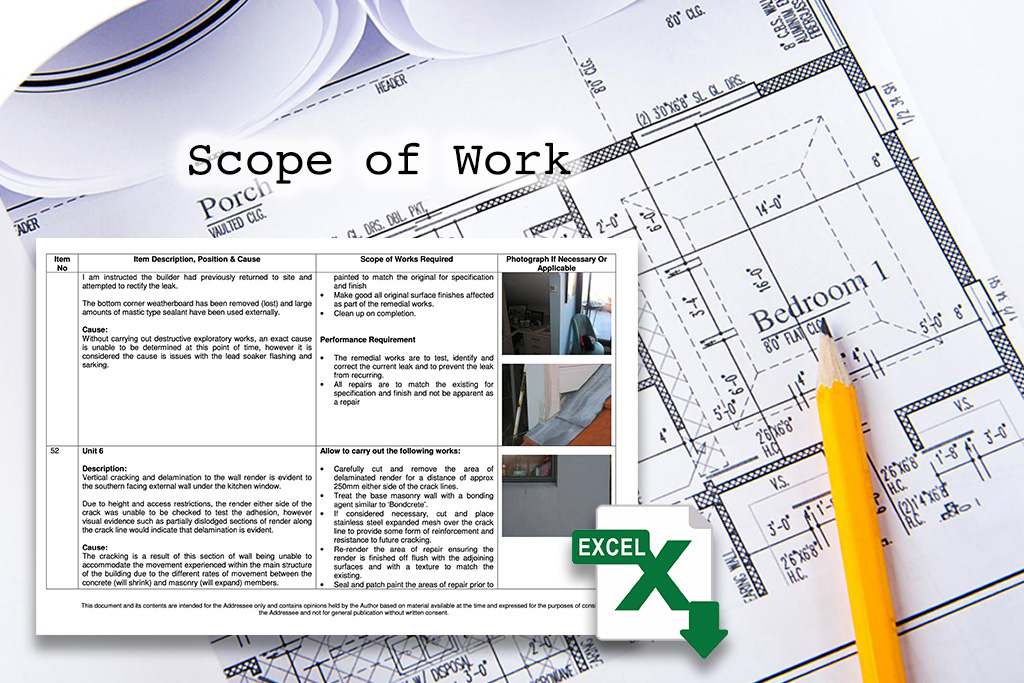

It will require preparation and hard work, but by following these steps you can help ensure your rehab property is a success: Walk through the property to get a better idea of the work that will need to be done. Create a scope of work outlining the specifics of the rehab project. Find the right contractor for the job.

How do you prepare a house for rehab?

Paint: Believe it or not, the appeal of your prehab project could be significantly improved with just the swipe of a... Cleaning: A little elbow grease never hurt anyone and by simply taking the time to remove excess trash and for general... Landscaping: This is one of the more crucial components ...

What is a real estate rehab?

Mar 16, 2021 · Scale of the Rehab. When fixing up a property to sell, whether it’s a new property or an existing rental, the cost is usually more than if you’re fixing it up just to rent it out. With a rental, the focus is more on functionality. If things are just a little outdated, it may only make sense to replace them once they’re completely worn out.

What should be included in a home rehab checklist?

The great part of the 203k Rehab Loan is you still only need a 3.5% down payment or minimum equity. While the rehab loan does allow for a low down payment it does require a slightly higher credit score than a regular FHA loan. A Massachusetts borrower with bad credit may not be eligible for the rehab mortgage.

What are the steps to rehab a house?

Although the exact rehab process will vary based on the property and the exit strategy, there are 10 general steps to follow to rehab a house:Evaluate Current Property Condition. ... Calculate ARV and Offer Price. ... Create a Rehab Checklist. ... Calculate a Budget. ... Hire a General Contractor. ... Pull Permits. ... Begin Demolition.More items...•Aug 20, 2021

What does rehab mean in real estate?

A real estate rehab is when investors purchase a property, complete renovations, and then sell it for a profit. These projects can take anywhere from a few weeks to a few months, depending on the amount of work needed. This is one of the most popular exit strategies in the industry, and rightfully so.

How do I start a rehabbing business?

Starting a house-flipping business in 8 stepsStep 1: Write a business plan. ... Step 2: Grow your network. ... Step 3: Choose a business entity. ... Step 4: Obtain an EIN, insurance, permits, and licenses. ... Step 5: Find suppliers and contractors. ... Step 6: Assemble a team. ... Step 7: Obtain financing. ... Step 8: Source your deal.

What does a full rehab consist of?

Fixing up a rehab often means replacing floors, along with significant systems in the home, such as the electrical, heating and plumbing. Most importantly, you need to assess the property before you even call in the home inspector.Dec 15, 2019

Is it worth rehabbing a home?

A fixer-upper may be a good investment. But it can also be a huge money pit if you estimate renovations incorrectly, contract out for most projects, and skip an inspection. To ensure a fixer-upper house is well worth the money, look at comparable homes (known in real estate as comps) in the neighborhood.Mar 2, 2022

What is the difference between rehab and renovation?

As verbs the difference between rehabilitate and renovate is that rehabilitate is to restore (someone) to their former state, reputation, possessions, status etc while renovate is to renew; to revamp something to make it look new again.

How much cash do you need to start flipping houses?

For our smallest loan, we'd like to see between $12,000 and $15,000, or at least access to it. For larger loans, the amount we're expecting to see increases. For example, if you want to acquire a $250,000 loan, we would need to see at least $25,000 to $30,000 to approve the loan.

How can I start my own fixer upper business with no money?

Here are seven options to help you learn how to flip a house with no money:Private Lenders.Hard Money Lenders.Wholesaling.Partner With House Flipping Investors.Home Equity.Option To Buy.Seller Financing.Crowdfunding.

How much does the average house flipper make a year?

The average salary of a house flipper is $117,372. We calculated this number by looking at the 2020 average reported income of house flippers across the entire United States.

How do you rehab a house on a budget?

How To Rehab A HouseEvaluate the property with the help of a professional inspector.Create a checklist so that rehabbing a house from start to finish becomes a reality.Develop a rehab budget once you understand your scope of work.Find a contractor who is best qualified to execute your property rehab vision.More items...

What is Brrrr method?

Share: The BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method is a real estate investment strategy that involves flipping distressed property, renting it out and then cash-out refinancing it in order to fund further rental property investment.Mar 1, 2022

What does rehab needed mean?

What Does Rehabbing A House Mean? The rehabbing definition is when an investor renovates a property to improve it. Rehabbing can be approached several ways but is most often purchased at a discounted price and renovated intending to resell. This process is also known as house flipping.

What is a good prehab deal?

At the end of the day, a good prehab deal is merely a cosmetic fix up that will make you money, with little to no additional cost. While finding a distressed property with just enough upside in terms of potential and price isn’t easy, done right it can yield a sizeable profit for beginner investors. According to Merrill, the top 10 reasons to get started in prehabbing include:

Is real estate opportunistic?

The opportunistic world of real estate is ideal for beginner investors as it presents copious ways to make money. For those looking to make a quick nickel over a slow dime in real estate, one of the better starting platforms is in prehab.

What should be included in a home inspection?

The home inspection should include the heating system, air-conditioning or HVAC system, interior plumbing, electrical system, the roof, the attic, any visible insulation, walls, ceilings, flooring, windows, doors, foundation, sewer line, and the basement.

What should be included in a checklist?

Include both interior (walls, paint, etc.) and exterior items (e.g. landscaping, gutters, and outside lighting). The checklist should be very detailed and describe everything that needs to be done to the property. The inspection report can be used to generate the checklist.

What is the best way to change the look of a house?

Install light fixtures, flooring, and appliances (stoves, dishwashers, washing machines, dryers, etc.) Lighting is a great way to change the look of a property and is relatively inexpensive compared to other repairs. Flooring may include vinyl or ceramic tile, hardwood, carpet, or laminate.

What is a pre-screen question?

Pre-screen any candidate to determine if he or she is a good fit for your project. Pre-screen questions should cover these considerations: A contractor's experience: you want at least three years. Equipment: a contractor should have his/her own equipment. Employees: you want to see adequate support to complete the job.

What to do when you have a house in a building?

Begin with demolition and trash removal. Remove any trash inside or outside the building. Remove any items that are damaged or that you will be replacing (flooring, cabinets, appliances, light fixtures, toilets, water heaters, etc.) Outside work may include trimming any dead trees or bushes and removing garage doors, fencing, sheds, decks, and siding.

As a Guest you have free article (s) left

Join BiggerPockets (for free!) and get access to real estate investing tips, market updates, and exclusive email content.

In this article

Recently, I had a tenant move out of one of my townhomes, and I decided to fix it up in order to sell it. I had owned the property for a while, and the area was starting to change. With taxes, township rental license fees, and inspections on the rise, the cash flow just wasn’t what it used to be.

Scale of the Rehab

When fixing up a property to sell, whether it’s a new property or an existing rental, the cost is usually more than if you’re fixing it up just to rent it out.

Cons to Selling

Probably the biggest con to fixing up a rehab to sell it is the taxes, more specifically the short-term capital gain tax, which applies if the house sells and settles in less than one year after you bought it.

Rehabbing to Rent

Fixing up a property to rent it out may be a little less expensive, but it comes with its own set of concerns as well.

The Limited 203K Rehab Loan

The Limited 203k was formerly known as the 203k Streamlined loan. It is designed for minor repairs, updates and alteration of no more than $35,000.

The 203K Rehab Loan

The 203k Rehab Loan is for work requiring over $35,000 or any work requiring structural alteration or repair. The full 203k Rehab Loan does have a minimum draw of $5,000.

Role Of The FHA 203K Consultant

Homebuyers using the full 203k loan must work closely with a HUD accepted 203k consultant.

Pros and Cons Of An FHA 203k Rehab Loan

There are a lot of benefits to the FHA 203k Rehab loan, but some downsides as well.

Summary

An FHA 203k may open up possibilities for you when searching for a home. Now you know there can be money available to do those repairs and upgrades on home.

Why is maintaining investment capital important?

Maintaining investment capital is crucial to finding better deals and growing your investments. Investment masters are active in the game. Using the traditional method, you simply run out of money too fast. If you want to make hot deals, you must be ready, willing, and able to close.

What does BRRRR mean?

No, they’re not chilly: BRRRR stands for buy, rehab, rent, refinance, repeat. In other words, the smart investor’s investment cycle. The traditional method of buying rental property involves buying a property with financing, such as a mortgage, then rehabbing, renting, and eventually repeating the process later.

Why is BRRRR better than traditional real estate?

BRRRR beats the traditional method of real estate investing because it allows you to recover the capital you left behind. The traditional method involves putting a percentage of the home’s value down up front, when the home’s value is lowest. Think about it: Investors are always looking for deals.

What happens when you buy a property?

When you buy a property, fix it up, improve its value, and then refinance, you’re borrowing against the value of the property at its highest. Done correctly, this allows you to recover more of—or sometimes all of—the money you invested in the property. Here’s what you need to know. 1. Buy.

How much money does a hard money lender finance?

The right hard money lender will finance up to 90 percent of the purchase price and 100 percent of the construction. And when you're buying, they're treated like cash—which keeps you competitive.

Can banks refinance a property that isn't occupied?

Banks rarely want to refinance a property that isn’t occupied, so renting comes first. It’s critical to screen diligently so you get tenants that will pay each month. But it’s also important on the financing side. While appraisers shouldn’t take too much into account about how clean and pleasant the tenant is, everyone is human. First impressions make a difference.

What to do if you don't have the cash to finance your first deal?

Here's a BRRRR trick, if you lack the cash to finance your first deal: Work with a private or hard money lender for that initial down payment money . After successfully rehabbing, renting, and refinancing the property, you can pay off that initial loan—and then, of course, reinvest the profits.

Who Should Buy a Rehab Home?

First of all, let us establish the definition of a rehab compared to a fixer-upper house. A home that requires a complete rehab project is more than likely a property that has been left standing for a while without any attention whatsoever. A fair amount of time, the owners of these kinds of properties have run into financial difficulties.

What About a Fixer-Upper?

A fixer-upper is a totally different ball game. Most of the time, you will get away with replacing the kitchen, flooring, the bathrooms, and decorating the property. Anything more than that, and you are entering rehab territory.

Learning How to Budget

If you have not done any property refurbishments before, a fixer-upper is the best way to go. Consider it a project and learn from the experience. One of the most important things you need to learn is how to budget. There are certainly pros and cons to buying a fixer-upper.

Final Thoughts on Buying a Fixer-Upper or Rehab Home

Whether you are buying a fixer-upper house or a rehab property, make sure you ask questions. Do a thorough amount of research and due diligence. Make sure you don’t just focus on the house itself, either.

Other Valuable Realty Biz News Features

Frequently asked questions buying a house – do you know some of the essential questions lots of home buyers will ask their real estate agent? See the most common FAQ’s and make sure you understand the answers.

Purchase Price

How much you pay for a property. For single family and multi-family homes, the purchase price includes the property itself and the land the property is on.

Rehab Cost?

Costs associated with renovating the property.#N#Rehab costs should include both cost of materials and labor.

Interest Rate

The interest rate associated with borrowing money to fix and flip a property.

Anticipated Length of Project

The number of months you anticipate your house flip to take until complete.

Loan Amount

The amount of money you need to borrow from a lender to renovate the property.

Monthly Property Taxes

The portion of the annual or semi-annual property taxes that accrue each month.

Monthly Insurance

The amount of property insurance due monthly. Note: House flippers typically need an unoccupied property insurance policy, which is different than a homeowner’s policy.