What does a rehab loan mean?

Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203(k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date.

What is an FHA rehab loan?

Share: A boon to DIYers and home project enthusiasts, an FHA 203(k) loan – also known as a mortgage rehabilitation loan, renovation loan or Section 203(k) loan – is a type of government loan that can be used to fund both a home's purchase and renovations under a single mortgage.Mar 19, 2022

What credit score is needed for a rehab loan?

Credit score: You'll need a credit score of at least 500 to qualify for an FHA 203(k) loan, though some lenders may have a higher minimum. Down payment: The minimum down payment for a 203(k) loan is 3.5% if your credit score is 580 or higher. You'll have to put down 10% if your credit score is between 500 and 579.

What are the cons of a 203k loan?

ConsOnly eligible for primary residences.Mortgage Insurance Premium (MIP) required (can be rolled into loan)Do it yourself work not allowed*More paperwork involved as compared to other loan options.

How long does it take to close on a FHA 203k loan?

It will likely take 60 days or more to close a 203k loan, whereas a typical FHA loan might take 30-45 days. There is more paperwork involved with a 203k, plus a lot of back and forth with your contractor to get the final bids. Don't expect to close a 203k loan in 30 days or less.

Can I use a 203k loan to flip a house?

The most important requirement is that the FHA 203(k) loan is for people who are looking to buy a primary home or if you're refinancing you already live in the home. It's not for investment properties, vacation homes or property flipping.

Is it hard to get approved for a rehab loan?

But rehab loans do come with challenges, Supplee said. Because the repair work that fixer-uppers need is often difficult to estimate, there is more that can go wrong with a rehab loan, she said. "It is frustrating and a lot of work at times," Supplee said. "It is imperative to have good contractors who you trust.

Can you refinance a 203k loan?

In short, yes you can refinance and remodel with the FHA 203k loan. Rolling the mortgage you have now, plus the renovations and improvements you want to do, is possible with the 203k. The new mortgage will include what you owed on the previous loan PLUS the work you're financing.

Can I get a 203k loan if I already have an FHA loan?

You could potentially use the 203k loan to refinance your current home, make renovations, then move after one year and rent the house out as an investment property. FHA allows you to rent out a home you still own with an FHA loan, as long as: You fulfilled the one-year occupancy requirement.Feb 23, 2021

What is the difference between FHA and 203k?

Rather, the FHA insures or backs a couple of different mortgage products made by approved lenders, including the agency's 203(b) and 203(k) loans. The major difference between an FHA 203(b) and a 203(k) mortgage loan is that one is intended for homes in need of extensive repair while the other one isn't.

What is a 201k loan?

Section 203(k) insurance enables homebuyers and homeowners to finance both the purchase (or refinancing) of a house and the cost of its rehabilitation through a single mortgage or to finance the rehabilitation of their existing home. Purpose: Section 203(k) fills a unique and important need for homebuyers.

What is the difference between a HomeStyle loan and a 203k loan?

FHA 203(k) loans are more lenient about the borrower's credit and more strict about the renovation work that can be done. Fannie Mae HomeStyle mortgages are more strict about the borrower's credit and more lenient about the renovation work that can be done.Dec 14, 2018

What is USDA rehab loan?

USDA rehab loans are for low-income families and individuals. To qualify for a Section 504 loan, the homeowners must be unable to obtain affordable credit elsewhere. Homeowners also must have low income, below 50% of the area’s median income. The property must be a home, not a farm or other income-generating property.

What is pre-approval for a loan?

Pre-approval is a more thorough process than prequalification. For this step, your lender will verify information about your income and finances and determine how much you can actually borrow. This is determined by calculating your debt-to-income (DTI) ratio, which shows how much of your monthly income goes towards expenses.

What are the benefits of USDA loans?

Among the many benefits to USDA loans are: 1 102% financing/refinancing for first-time and repeat home buyers 2 Low-interest rates 3 No reserve requirements 4 No maximum loan amount 5 Income from self-employment accepted 6 No mortgage insurance required 7 Fixed-rate mortgage loan 8 Ability to finance repairs 9 Financing for low-income individuals 10 Grants for people age 62 and above

What happens after you find your home?

Once you find your home, you’ll work with your lender and agent to make an offer. This is also time to negotiate on closing costs. Then you sign! After you and the seller sign the purchase agreement, your lender will order a USDA loan appraisal, to ensure the home meets USDA standards . 5.

Best FHA 203 (k) rehab mortgage lenders

LoanDepot offers some of the most competitive rates and a streamlined process, closing on loans as much as 50 percent faster than competitors. That’s in part because the lender uses asset verification technology instead of requiring borrowers to mail or fax documents.

What is an FHA 203 (k) rehab loan?

The FHA 203 (k) loan is a type of mortgage backed by the Federal Housing Administration for homebuyers looking to renovate the home they’re purchasing. 203 (k) loans tend to come with more competitive rates, and require a smaller down payment and lower credit score compared to other kinds of loans.

How does a 203 (k) loan work?

A 203 (k) loan bundles your mortgage and renovation funds into one loan. Once you close on the loan, a portion of the loan proceeds is paid to the seller of the home, and the remaining balance goes toward the renovations.

Who qualifies for a 203 (k) loan?

If you’re interested in a 203 (k) loan, you’ll need to meet the same requirements for a standard FHA loan:

What is hard money rehab?

If you’re having trouble finding financing help, consider a hard money rehab loan . Unlike traditional lenders, which look at your credit score and income, hard money lenders base their decision to approve you for a loan based on what collateral you can provide. If you have valuable property to serve as collateral, a hard money lender is more likely to work with you, even if your credit score is less-than-stellar.

Do hard money lenders look at your credit score?

When determining your loan, hard money lenders will look at the property’s after repair value (ARV).

Is a 203k loan FHA?

By contrast, 203 (k) loans are insured by the FHA, and usually offer lower rates and longer repayment terms. The process for leveraging an FHA rehab loan is pretty straightforward: Apply with an approved lender. Meet the credit requirements and get approved. Choose a contractor.

Do you need a rehab loan to flip a house?

If you’re planning on flipping houses for profit, you’ll likely have to make significant repairs and renovations to the home you intend to flip. To do so, you’ll probably need a rehab loan to pay for the property and its repairs so you can sell it. There are three main types of rehab loans for investors you should know about.

How much down payment is required for a 203k?

Only a 3.5 percent down-payment is required. In addition to other requirements, 203 (k) loan down payments are also significantly lower than conventional loans. With just 3.5 percent of the selling price down at closing, you can achieve your dream home. You’ll also have more available cash for furniture, moving expenses, and other essentials.

Do you have to itemize repairs before approval?

All repairs and improvements must be outlined and itemized prior to approval. A reputable lender can ensure you have the most accurate and correct information. It’s also prudent to check specific coverage items and dollar amounts.

Does the FHA insure 203k loans?

While the FHA doesn’t actually provide buyers with the funds, it does insure the loan through approved lenders, such as Contour Mortgage.

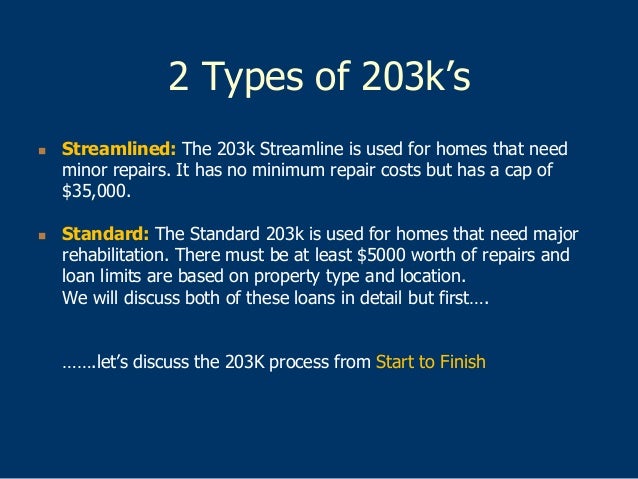

What is a 203k loan?

A streamline 203 (k) loan, or limited loan, is frequently utilized for homes that require fewer repairs. It provides home buyers or homeowners seeking to purchase or refinance a property with a maximum of $35,000 for renovations. No minimum cost requirement is attached, and applications may be simpler to process due to the lower sums borrowed under the terms of these loans. However, bear in mind that you won’t be able to roll major structural repairs into the sums that you wish to borrow.

Who is Scott Steinberg?

Hailed as The Master of Innovation by Fortune magazine, and World’s Leading Business Strategist, award-winning professional speaker Scott Steinberg is among today’s best-known trends experts and futurists. A strategic adviser to four-star generals and a who’s-who of Fortune 500s, he’s the bestselling author of 14 books including Make Change Work for You and FAST >> FORWARD. The CEO of BIZDEV: The Intl. Association for Business Development and Strategic Planning™, his website is www.AKeynoteSpeaker.com.

What is VA rehab loan?

A VA renovation loan, sometimes called a VA rehab loan, is a home loan that allows borrowers to include the cost of certain repairs or improvements in their loan amount. This makes it possible for VA loan borrowers to purchase a home in need of repairs or upgrades without having to get a separate loan; rather, the repair costs ...

What is a home equity loan?

Home Equity Loan Or Home Equity Line Of Credit. These loans, sometimes referred to as second mortgages, allow you to borrow against the equity you have in your home. Home equity loans are installment loans, meaning you’ll receive your funds in one lump sum and pay it back over time.

How long do you have to serve to get a VA loan?

Veterans or active-duty servicemembers are generally eligible for a VA loan if they’ve served a 90 consecutive days of active service during wartime or 181 days during peacetime. The minimum service requirement for National Guard or Reserve members is 6 years. Qualifying surviving spouses may also be eligible for a COE.

Can VA loans be used for renovations?

VA renovation loans can only be used for repairs and upgrades that improve the safety and livability of the home. They can’t be used for luxury improvements. Additionally, these loans can’t be used for major structural changes.

Does the VA have a minimum credit score?

Lender Credit Standards. In addition to meeting basic service requirements, you’ll also need to meet your lender’s credit standards. The VA doesn’t set a minimum credit score for the loans it guarantees. However, lenders can and usually do have their own requirements.

What is a mortgage loan?

Mortgage loans provide potential home buyers the funds to purchase a single- or multi-family home, condominium or townhouse. There are other types of loans, however, which additionally assist qualified applicants with upgrades and repairs.

What is a limited 203k loan?

The first is the Limited 203 (k) loan, for non-structural work. Specifically, home buyers can potentially finance “up to $35,000 into their mortgage to repair, improve, or upgrade their home,” according to the FHA's website.

What is a 203k loan?

Department of Housing and Urban Development (HUD), the FHA states that a 203 (k) loan “helps both borrowers and lenders, insuring a single, long term, fixed or adjustable rate loan that covers both the acquisition and rehabilitation of a property.”.