With a Renovation Mortgage from M&T Bank, you can finance both the purchase of your new home and the cost of renovation in one loan and begin your project within a few weeks of closing. This can also allow you to build equity and re-build savings immediately. Is a Renovation Mortgage from M&T right for you?

Why buy a renovation mortgage with M&T Bank?

With a renovation mortgage from M&T Bank, you can finance the purchase of your home and the cost of renovation in one loan and begin your project within a few . ... The Rehabilitation Escrow Account is not, nor will it be treated as, an escrow for the paying of real estate taxes, insurance premiums, delinquent notes, ground rents or assessments

Can I add fees and reserves to my 203K rehab loan?

With a Renovation Mortgage from M&T Bank, you can finance both the purchase of your new home and the cost of renovation in one loan and begin your project within a few weeks of closing. This can also allow you to build equity and re-build savings immediately. Is a Renovation Mortgage from M&T right for you?

Why choose M&T Bank for a personal loan?

Mortgages & Loans. M&T has a variety of lending options to help fund your ambitions. Whether you're looking to pay for a home improvement project, consolidate your high interest balances, or maybe you just need extra cash, we're here and ready to help. Unless otherwise specified, all advertised offers and terms and conditions of accounts and ...

What is a Fannie Mae homestyle renovation loan?

With our cash-secured loans, you benefit by borrowing against your existing deposit account balance. Learn more and apply today. All loans and lines of credit are subject to credit approval. Additional terms and conditions may apply, depending on the type of collateral and other terms offered or chosen. Disclosure: All loans and lines of credit ...

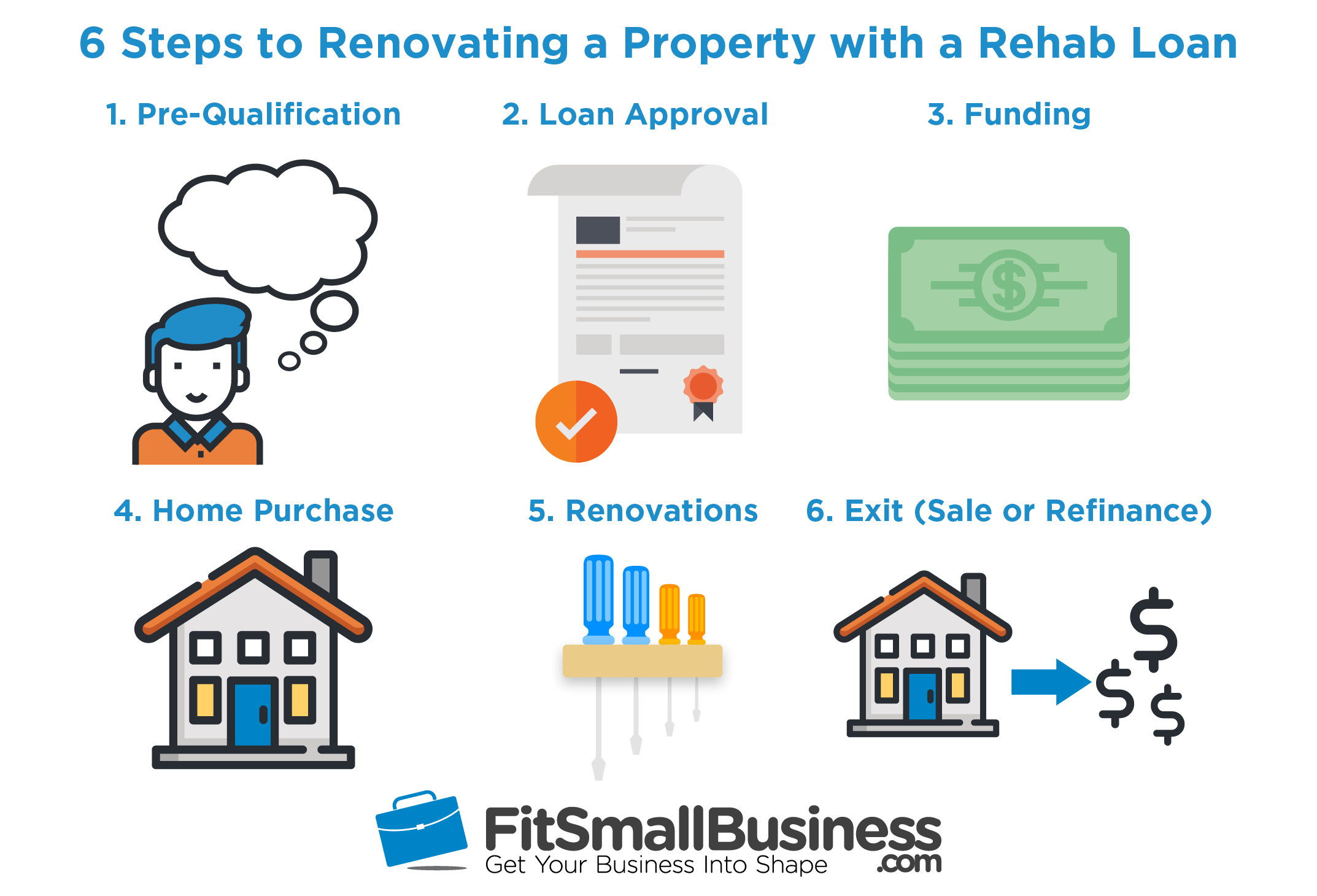

What is a rehab loan and how does it work?

To put it simply, a rehab loan lets you purchase or refinance a home and put the costs of your renovation into the form of a loan. You then combine those costs with your mortgage to pay both off in the form of 1 monthly payment.

What does a rehab loan mean?

Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203(k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date.

What is Freddie Mac's rehab loan product called?

Freddie Mac's Choice Renovation loan is available to home buyers and owners to repair or renovate their house.Nov 8, 2021

What is a FHA rehab loan?

Share: A boon to DIYers and home project enthusiasts, an FHA 203(k) loan – also known as a mortgage rehabilitation loan, renovation loan or Section 203(k) loan – is a type of government loan that can be used to fund both a home's purchase and renovations under a single mortgage.

How long does 203k loan take to close?

How long does it take for a 203k loan to close? It will likely take 60 days or more to close a 203k loan, whereas a typical FHA loan might take 30-45 days. There is more paperwork involved with a 203k, plus a lot of back and forth with your contractor to get the final bids.

Is it hard to get a 203k loan?

Credit score: You'll need a credit score of at least 500 to qualify for an FHA 203(k) loan, though some lenders may have a higher minimum. Down payment: The minimum down payment for a 203(k) loan is 3.5% if your credit score is 580 or higher. You'll have to put down 10% if your credit score is between 500 and 579.

Is HomeStyle Fannie or Freddie?

Fannie Mae's HomeStyle Renovation loan and Freddie Mac's CHOICERenovation program are pretty much alike. Borrowers can finance a one-unit primary residence with as little as 3% down (when combined with Home Possible), the same as with Fannie Mae's HomeStyle financing.Oct 29, 2021

What is a streamline 203k loan?

For them, another option called the FHA Streamlined 203(k) could be the way to go The Streamlined 203(k) is described on the FHA official site as a program that, “permits homebuyers and homeowners to finance up to $35,000 into their mortgage to repair, improve, or upgrade their home.

Does Freddie Mac allow manufactured homes?

Yes, a mortgage secured by a single-wide manufactured home is eligible for sale to Freddie Mac when located on an individual lot or in a subdivision. In addition, to be eligible for sale, the Seller must obtain the negotiated term of business from Freddie Mac, and all other Guide requirements must be met.

What are the cons of a 203k loan?

ConsOnly eligible for primary residences.Mortgage Insurance Premium (MIP) required (can be rolled into loan)Do it yourself work not allowed*More paperwork involved as compared to other loan options.

Is 203k a conventional loan?

FHA 203(k) Loan Offered by the U.S. Department of Housing and Urban Development (HUD), this loan is backed and insured by the FHA. While only approved lenders, such as Contour Mortgage, can offer these, they also have slightly more lenient terms than conventional mortgages.Aug 23, 2021

Can I get a 203k loan if I already have an FHA loan?

You could potentially use the 203k loan to refinance your current home, make renovations, then move after one year and rent the house out as an investment property. FHA allows you to rent out a home you still own with an FHA loan, as long as: You fulfilled the one-year occupancy requirement.Feb 23, 2021

What is a detailed estimate?

Detailed estimates describing the work to be done and specifying labor and material costs are required. This provides an objective point of reference and reduces misunderstandings between all parties.

Can you finance a renovation loan with M&T?

With a Renovation Mortgage from M&T Bank, you can finance both the purchase of your new home and the cost of renovation in one loan and begin your project within a few weeks of closing.

Mortgages & Loans

M&T has a variety of lending options to help fund your ambitions. Whether you're looking to pay for a home improvement project, consolidate your high interest balances, or maybe you just need extra cash, we're here and ready to help.

Mortgages

Mortgages > Every borrower has different needs. That's why M&T offers such a wide range of home mortgage options – and experienced representatives – to help find the right solution for you.

Lending Options

M&T Visa Credit Cards > Apply for an M&T Visa® Credit Card today to take advantage of valuable benefits like competitive rates, our rewards program and introductory offers.

What is LTV ratio?

A loan-to-value (LTV) ratiomeasures how much you’re borrowing compared to your home’s value by dividing your loan amount by the home’s appraisal value. Typically, lenders use the “as-is” or the current value of your home for a mortgage.

What is the minimum down payment for a home?

The minimum down payment depends on the type of property you’re buying, and whether you’re living in it or not. You’ll typically make a down payment of: 1 3% for one-unit homes 2 5% for manufactured homes 3 10% for one-unit second homes 4 15% for two-unit homes 5 25% for three- to four-unit homes

What are contingency reserves?

Contingency reservesinvolve labor, material or cost overrides and may be required, depending on the scope of the project. If you’re renovating a two- to four-unit property, you’ll need to have 10% of the total project costs in reserves, otherwise contingency reserves are optional.

Does Fannie Mae offer down payment assistance?

Depending on where you live, you may be able to apply for down payment assistancethrough Fannie Mae’s Community Second program . Federal, local and nonprofit housing agencies, as well as some employers, may offer cash — up to 5% more than your home’s value — to help cover your down payment, closing and renovation costs.

Make Yourself at home

Whether you’re refinancing or buying your#N#first home, M&T has you covered.

Current mortgage rates

Rates differ by location and details of the loan desired. We’re happy to help you get a rate customized to your situation.

Working Hard for Homebuyers

We know the homebuying process may seem overwhelming. Whether you’re just getting started or working towards an upgrade, we’re here to help make your dream come true.