Four things happen after you've completed the loan rehabilitation program:

- The default status will be removed from your credit history for the rehabilitated loans.

- Wage garnishments, Treasury offsets, and other collection activities stop.

- You'll regain eligibility for new financial aid, loan forgiveness programs, deferment, forbearance, and other income-based repayment options.

What happens when you get out of student loan rehabilitation?

Jun 04, 2019 · Follow these steps to rehabilitate student loans: Contact your federal student loan holder. This could be a servicer, collection agency or different company, depending on your loans and how long ... Agree to a payment amount. Rehabilitation payments must be “reasonable,” which usually means 15% of ...

What is the student loan rehabilitation program?

You should carefully track when the rehabilitation period is over. Once you have rehabilitated, your loan is out of default and you are eligible for any of the pre-default flexible repayment plans. Particularly if you applied for an income-driven repayment plan, the servicer may also place you temporarily in an alternative repayment plan. The Department says that your payments for 90 …

How do I rehabilitate my loan?

Jun 16, 2020 · What happens after student loan rehabilitation? Once your loans are rehabilitated, the default status is removed from the credit bureaus, and your loans will be moved from collections to a new loan servicer. Your eligibility for loan forgiveness programs, income-driven repayment plans, and deferments will also be restored.

How many student loan rehabilitation payments do I have to make?

Aug 14, 2020 · What Happens After Student Loan Rehabilitation? Once your loans are rehabilitated and you’re out of default, your loans are typically transferred to a new loan servicer. You won’t have the same...

Is loan Rehabilitation a good idea?

Rehabilitation takes longer than student loan consolidation, the other primary option for default recovery. But rehabilitation is generally the better choice because it: Removes the default from your credit report. This will improve your credit score, though the late payments leading to the default will remain.Mar 17, 2022

How many times can you rehab a student loan?

Learn about the payment suspension and its impact on loans in default. After the payment suspension ends, rehabilitation payments must be received within 20 days of the due date to be considered on time. As a reminder, you can rehabilitate a defaulted loan only once.

How long is rehabilitation loan?

The traditional rehabilitation process is based on a 10-month plan; but can last as little as 4 months or as long as 12 months, depending on the lender. Rehabilitation of a federal Perkins Loan is accomplished in nine consecutive months with payments determined by the loan holder. Other programs, such as the William D.May 20, 2020

Does student loan Rehabilitation remove late payments?

If you successfully rehabilitate a loan, the record of default is removed from your credit history. However, your credit history will still reflect late payments that were reported by your loan holder before your loan went into default.Sep 15, 2021

How can I get rid of student loans without paying?

There's no simple way to get rid of student loans without paying. ... If you're having difficulty making payments, your best option is to contact your private loan holder about renegotiating your payment or taking a short-term payment pause.More items...

Can student loans in collections be forgiven?

Depending on the type of loan you have, the remaining balance will be forgiven after either 20 or 25 years' worth of payments. Borrowers will have to pay taxes on the amount forgiven. You also can use an extended or graduated repayment plan if you want a lower monthly payment.Jan 6, 2021

Can you do student loan rehabilitation twice?

Following the rehabilitation of your loan, send all future payments on time. You will not be allowed to rehabilitate the same loan twice.

How much will credit score increase after student loan default removed?

by 75 pointsHow much will my credit score increase after the student loan default is removed? Borrowers have shared that their credit scores increased by 75 points after the student loan default status was removed from their credit reports. FICO score increased 57-74 points. FICO score increased by 75 points.Mar 1, 2022

How long does it take to clear Caivrs after a student loan is paid in full?

How long does it take to clear CAIVRS after a student loan is paid in full? It can take up to 10 business days to clear CAIVRS after a student loan is paid in full, either through settlement or consolidation.Dec 3, 2021

Will IRS take refund for student loans 2021?

The bottom line. The student loan tax offset has been suspended through Nov. 1, 2022. If you have federal student loans in default, your 2021 tax return won't be taken to offset your defaulted loan balance if you file your 2021 tax return by the filing deadline.Feb 24, 2022

How do I get old student loans off my credit report?

All you need to do is file an account dispute with each of the three credit bureaus, and they'll be required by law to follow up with the loan servicer within 30 days. If the servicer confirms the corrected information to the bureaus, the negative information will be removed.Aug 6, 2021

What is the difference between loan rehabilitation and consolidation?

The only difference to your credit score between consolidation and rehabilitation is that completing the loan rehabilitation program removes the default status from your credit report. Loan consolidation pays off the defaulted loans with a new Direct Consolidation Loan.Jun 29, 2021

How long do you have to pay a servicer after rehabilitation?

The Department says that your payments for 90 days after rehabilitation will be the same as the payments you were making before the rehabilitation ended.

What is collection during rehabilitation?

Collection during the rehabilitation period is limited to collection activities that are required by law and to any communications that support the rehabilitation (for example, monthly statements with the amount your rehabilitation payment listed).

What is the IBR formula for student loans?

If you decide on rehabilitation, the loan holder should start out with the amount you would pay under the IBR formula. This is the IBR formula for older loans, based on the borrower making student loan payments of 15% of disposable income. This does not mean that you are eligible for IBR while you are still in default.

Can you have your wages garnished if you make five required rehabilitation payments?

If you are having your wages garnished, you have a one time right to have the garnishment suspended if you make five required rehabilitation payments. The rehabilitation payments are in addition to the amounts being garnished.

Can you rehabilitate a loan that was rehabilitated before 2008?

If you rehabilitated before August 14, 2008 and go back into default on that loan, you can still rehabilitate again. However, this new rehabilitation will be subject to the one-time limit.

Can you request rehabilitation from a loan holder?

You will need to request rehabilitation from your loan holder. You will most likely be dealing with a collection agency. In the past, it was very common for collectors to tell you that you had to pay an unaffordable amount. This was wrong then and is still wrong.

Do you have to resell a direct loan?

There is no resale requirement for Direct Loans. Once rehabilitation is complete, the loan is removed from default status and you are eligible for new loans and grants. The default notation should be removed from your credit record. In most cases, however, the other negative history will remain until it gets too old to report.

What happens when you complete the loan rehabilitation program?

When you complete the loan rehabilitation program, you’ll no longer have the burden of collection agencies. Collection activities like wage garnishment, tax refund offsets, and Social Security Income garnishment will stop.

How many times can you go through student loan rehabilitation?

Remember, you can only go through loan rehabilitation once . If you decide to go this route, make sure you plan on keeping your federal student loan current after rehabilitation. If you default a second time, loan rehabilitation is no longer an option.

How to eliminate anything that would prevent you from completing the rehabilitation program?

To eliminate anything that would prevent you from completing the rehabilitation program, you should: Enroll in autopay for your monthly rehabilitation payments. Submit your loan rehabilitation agreement letter and financial documents (tax return, pay stub, etc.) as soon as possible.

What is a consolidation loan?

A consolidation loan is the process of obtaining a new loan to pay off your existing loans. A Direct Consolidation Loan will pay off your defaulted student loan. In return, you’ll have a single, larger loan with one monthly payment. However, a Direct Consolidation Loan may extend your repayment length.

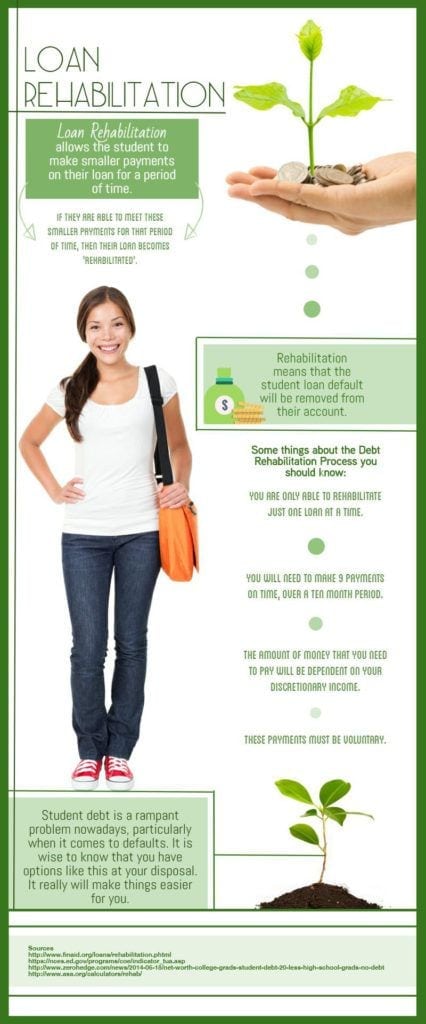

What happens if my student loan is in default?

If your federal student loan is in default, you may be eligible for student loan rehabilitation. Student loan rehabilitation allows you the opportunity to turn your federal student loan around and start fresh.

How many months of payments do you need for a Perkins loan?

For a Federal Perkins Loan, you’ll need 9 consecutive months of payments. For either option, you’ll first need to be in default before qualifying for student loan rehabilitation. If the payments are made as agreed upon, your loan will be brought back in good standing.

Is student loan rehabilitation good?

Loan rehabilitation can be a good idea if you’re eligible, as it removes the default from your credit report. The late payments that landed you in default will stay, unfortunately. But your credit may get a small boost by the student loan reporting as current.

What are the benefits of rehabilitating student loans?

There are some advantages to rehabilitating your student loans if they’re in default: Your payments may be reduced. Because your rehabilitation payments are based on your discretionary and family size, your payments can be quite low. Some borrowers qualify for payments as low as $5.

How many times can you go through student loan rehabilitation?

It’s a one-time opportunity. You can only go through student loan rehabilitation once. If you default on your loans again, student loan rehabilitation isn’t an option. It takes longer to get out of default. Student loan rehabilitation requires nine monthly payments within 10 consecutive months before the default ends.

How long do you have to pay off a federal student loan?

Direct loans and Federal Family Education Loan (FFEL) Program loans are considered to be in default if you don’t make your scheduled payments for 270 days or more. The consequences can be severe, including the following repercussions: 1 Your loans will be accelerated. Your entire unpaid loan balance and any interest that accrued will have to be immediately paid in full. 2 You lose eligibility for federal loan benefits. You will no longer qualify for income-driven repayment plans, and you can’t postpone your payments with forbearance or deferment. 3 You’re no longer eligible for additional aid. As long as your loans are in default, you won’t qualify for federal loans or grants. 4 The servicer will report the default to the credit bureaus. Reporting your default will damage your credit and make it difficult to qualify for other loans, such as auto financing or credit cards. 5 Your loan servicer can seize your tax refund and federal benefit payments. If you’re eligible for a refund or benefits, your loan servicer can seize that money through a Treasury offset to repay a portion of the loan. 6 Your servicer can garnish your wages. Your loan servicer can contact your employer to garnish your wages, meaning some of your paycheck will be withheld to repay your loans. 7 Your loan servicer can take you to court. If that happens, you’ll have to pay court costs, collection fees and attorney fees.

What is the default rate for student loans?

Department of Education, the national federal student loan cohort default rate—the percentage of federal loan borrowers who enter repayment in a specific year and default within three years—is 10.1% as of September 2019.

What happens if you make all of the required payments within the 10-month period?

If you make all of the required payments within the 10-month period, your loans will no longer be in default. All collections activity will end, and wage garnishments and Treasury offsets will stop, too.

How to contact a student loan servicer?

To start the process, you must contact your loan servicer. If you’re not sure who your loan servicer is, you can contact the Federal Student Aid Information Center at (800) 433-3243, or you can use the online National Student Loan Data System to find your loan servicer.

What happens if you miss a student loan payment?

When you miss a federal student loan payment by as little as one day, your loan becomes past due, and your loan servicer considers you delinquent. If your account is delinquent for 90 days or more, the loan servicer will report the late payment to the three major credit bureaus—Equifax, Experian and TransUnion—and you risk entering default.

What is the benefit of rehabilitating a student loan?

There are huge benefits to rehabilitating your Federal student loan, the biggest of which is that it removes your loan from default status, and places you have into repayment.

How to get help with student loans?

For help with Federal Student Loans call the Student Loan Relief Helpline at 1-888-906-3065. They will review your case, evaluate your options for switching repayment plans, consolidating your loans, or pursuing forgiveness benefits, then set you up to get rid of the debt as quickly as possible. For help with Private Student Loans call McCarthy Law ...

How many times can you rehabilitate a loan?

Rehabilitation can only be done once per loan. The exception to this rule is if you rehabilitated a loan prior to August 14, 2008. If you did, you can rehabilitate that loan one more time. Lenders typically add collection costs to the new loan balance, but as of a new rule established in July, 2014, they can only add up to 16% ...

What happens after a FFEL loan is rehabilitated?

After an FFEL loan rehabilitation, the loan guarantor is required to find a buyer for the loan, which means that they need to transfer ownership of your loan from themselves to someone else, typically one of the big Federal Student Loan Servicing Companies.

How long does it take to rehabilitate a Federal Direct loan?

In order to rehabilitate a defaulted Federal Direct or FFEL loan, you must make 9 monthly payments within 20 days of their due date, over a 10 month consecutive period of time.

How much does a collection agency charge for a rehabilitation loan?

After you’ve completed the rehabilitation process, and the collection agency resells your loan to a traditional lender, they’ll be able to charge up to 16% of the principal balance of your loan, plus 16% of any accrued interest, which can end up being a substantial amount of money.

Does the federal student loan program remove default?

The Federal Student Loan Rehabilitation Program offers borrowers who have defaulted on their student loans a way to get out of default, and back into repayment, but it does something even better than that, because it also removes the default status from your credit report as well. In fact, if you’re trying to choose between Federal Student Loan ...

Severely depressed because of my debt. Advice?

Update: I’m okay. Thank you everyone. I just got into a dark place/mindset. I will continue to fight against the debt. Thank you everyone for all of your kindness. I appreciate you al

Covid Forebarance Awareness

Hey everyone, Just got off the phone with my student loan company because it wasn't clear to me when Interest would start accruing again vs when I needed to make payments, and thought many people might also be confused.

Co-Signing a student loan

My friend asked if I would co-sign for his daughter's student loan with Sallie Mae, she defaulted and my credit took a HUGE hit, from mid-800's down to high 600's. She is not paying any longer and will not going forward. Her father (my friend) is ignoring the issue. Is there any way to resolve this fairly quickly? I can pay it.

Can I rehabilitate a federal student loan?

You can’t rehabilitate the federal student loan, but you may be able to consolidate the loan if you agree to repay the loan under either the Income Contingent or Income Based Repayment Plan.

Is a defaulted student loan the end of the world?

As you can see, a defaulted student loan isn’t the end of the world. Whether it’s consolidation or Chapter 13 bankruptcy, there are ways to avoid the government’s collection efforts.