203 (k) Rehab Loan Advantages

- A convenient way to finance your home improvements without the need for perfect credit, huge down payments, or high interest rates

- Upgrade your home with your style and needs

- Buy a home that’s usually listed at a lower price due to the older existing condition

- Great interest rates for your rehab in one loan

- Come with a low down payment

Full Answer

What are the requirements for a rehab loan?

3 rows · Apr 23, 2022 · Article Summary: A rehab loan allows you to put repair and renovation costs into a loan. ...

Can you get a home loan with a 550 credit score?

Jun 08, 2021 · Government-Backed Rehab Loans. These differ from conventional rehab loans in their backing by the FHA. Whether for improvements by yourself or professionals, 203(k) renovation loans secure funding for home purchase and renovations. It’s important to note this loan has two sub-types designed for renovation type, location, and work scope: Limited 203(k)

What is a rehab loan and how does it work?

Oct 22, 2021 · USDA rehab loans are for low-income families and individuals. To qualify for a Section 504 loan, the homeowners must be unable to obtain affordable credit elsewhere. Homeowners also must have low income, below 50% of the area’s median income. The property must be a home, not a farm or other income-generating property.

How to help get someone into rehab?

Rehab mortgages are a type of home improvement loans that can be used to purchase a property in need of work -- the most common of which is the FHA 203(k) loan. These let buyers borrow enough money to not only purchase a home, but to cover the repairs and renovations a fixer-upper property might need.

Can you DIY with a rehab loan?

First of all, HUD 203K loans help you purchase and repair or rehabilitate a home using just one loan, but the renovation period is not open-ended. The repairs must be completed within six months of loan closing.Oct 13, 2017

Why would you need a rehab loan?

Reasons to use a rehab loan may include: Buying a home that needs major improvements and repairs. Buying an outdated home but want to improve it. Your existing home needs renovation.

Is it hard to get approved for a rehab loan?

But rehab loans do come with challenges, Supplee said. Because the repair work that fixer-uppers need is often difficult to estimate, there is more that can go wrong with a rehab loan, she said. "It is frustrating and a lot of work at times," Supplee said. "It is imperative to have good contractors who you trust.

What is a rehabilitation loan?

Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203(k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date.

Can I refinance into a FHA 203k loan?

In short, yes you can refinance and remodel with the FHA 203k loan. Rolling the mortgage you have now, plus the renovations and improvements you want to do, is possible with the 203k. The new mortgage will include what you owed on the previous loan PLUS the work you're financing.

Can I get a 203k loan if I already have an FHA loan?

You could potentially use the 203k loan to refinance your current home, make renovations, then move after one year and rent the house out as an investment property. FHA allows you to rent out a home you still own with an FHA loan, as long as: You fulfilled the one-year occupancy requirement.Feb 23, 2021

What are the cons of a 203k loan?

ConsOnly eligible for primary residences.Mortgage Insurance Premium (MIP) required (can be rolled into loan)Do it yourself work not allowed*More paperwork involved as compared to other loan options.

What is a 203k mortgage?

Section 203(k) insurance enables homebuyers and homeowners to finance both the purchase (or refinancing) of a house and the cost of its rehabilitation through a single mortgage or to finance the rehabilitation of their existing home. Purpose: Section 203(k) fills a unique and important need for homebuyers.

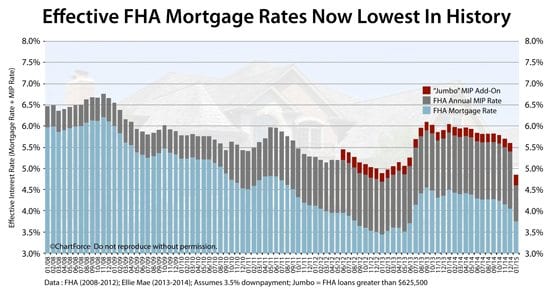

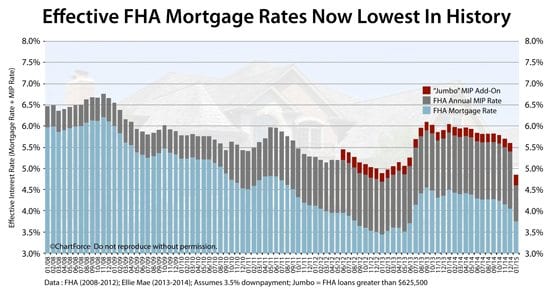

What is the interest rate on 203k FHA loan?

Still, base FHA rates are some of the lowest on the market, so 203k rates are competitive. You'll also pay FHA mortgage insurance. This costs 1.75% of the full loan amount as a lump sum (usually rolled into the loan) and 0.85% yearly (broken into 12 equal monthly payments).

How long is student loan Rehabilitation?

Loan rehabilitation is a program that gives federal student loan borrowers one opportunity to dig out of default by making nine on-time payments in a 10-month period. It restores eligibility for federal student aid, stops wage garnishments after your fifth payment, and may waive collection costs.Mar 1, 2022

Can you settle student loans?

Student loan settlement is possible, but you're at the mercy of your lender to accept less than you owe. Don't expect to negotiate a settlement unless: Your loans are in or near default. Your loan holder would make more money by settling than by pursuing the debt.

How do you qualify for student loan rehabilitation?

To qualify for FFEL or Direct Loan rehabilitation, you have to make 9 monthly payments within 20 days of the due date during a period of 10 consecutive months. The 9 out of 10 rule basically allows you to miss your payment one month, but still be eligible to rehabilitate.

Do I Qualify for a Rehab Home Loan?

In order to qualify for an FHA 203 (k) home loan, a homeowner must meet certain requirements outlined by the Department of Housing and Urban Development (HUD).

203 (k) Rehab Loan Advantages

Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203 (k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date.

How much down payment is required for a 203k?

Only a 3.5 percent down-payment is required. In addition to other requirements, 203 (k) loan down payments are also significantly lower than conventional loans. With just 3.5 percent of the selling price down at closing, you can achieve your dream home. You’ll also have more available cash for furniture, moving expenses, and other essentials.

Do you have to itemize repairs before approval?

All repairs and improvements must be outlined and itemized prior to approval. A reputable lender can ensure you have the most accurate and correct information. It’s also prudent to check specific coverage items and dollar amounts.

Does the FHA insure 203k loans?

While the FHA doesn’t actually provide buyers with the funds, it does insure the loan through approved lenders, such as Contour Mortgage.

What is rehab loan?

A rehab loan could be the perfect solution if you find a property that needs work and you don’t want to exhaust your savings or take out another loan to fix it up. It’s a great way to preserve the cash you have, so you keep your money on-hand for other purposes.

How long does it take to get a mortgage pre-approved?

Lenders can ask for proof of income, asset and credit qualifications. You can get pre-approved, but the loan process can take 60 to 90 days to complete since there are many moving pieces to the puzzle. You may need private mortgage insurance.

What does an appraiser do?

An appraiser will evaluate the home. Lenders base your loan amount on the potential after-repaired value of the property. An appraiser will use the contractor’s plans to determine the potential value. You must provide all qualifying documents. Lenders can ask for proof of income, asset and credit qualifications.

How long does it take to get PMI?

The amount varies based on your down payment, home value and credit score. All work must be complete within six months. If you need longer, you may get up to one year, but you’ll need to get lender approval first.

What is USDA rehab loan?

USDA rehab loans are for low-income families and individuals. To qualify for a Section 504 loan, the homeowners must be unable to obtain affordable credit elsewhere. Homeowners also must have low income, below 50% of the area’s median income. The property must be a home, not a farm or other income-generating property.

What are the benefits of USDA loans?

Among the many benefits to USDA loans are: 1 102% financing/refinancing for first-time and repeat home buyers 2 Low-interest rates 3 No reserve requirements 4 No maximum loan amount 5 Income from self-employment accepted 6 No mortgage insurance required 7 Fixed-rate mortgage loan 8 Ability to finance repairs 9 Financing for low-income individuals 10 Grants for people age 62 and above

What is pre-approval for a loan?

Pre-approval is a more thorough process than prequalification. For this step, your lender will verify information about your income and finances and determine how much you can actually borrow. This is determined by calculating your debt-to-income (DTI) ratio, which shows how much of your monthly income goes towards expenses.

What happens after you find your home?

Once you find your home, you’ll work with your lender and agent to make an offer. This is also time to negotiate on closing costs. Then you sign! After you and the seller sign the purchase agreement, your lender will order a USDA loan appraisal, to ensure the home meets USDA standards . 5.

What is rehab mortgage?

Rehab mortgages are a type of home improvement loans that can be used to purchase a property in need of work -- the most common of which is the FHA 203 (k) loan. These let buyers borrow enough money to not only purchase a home, but to cover the repairs and renovations a fixer-upper property might need. Buyers can use these fixer-upper loans, backed ...

What is a 203k loan?

Standard 203 (k) loans are for homes that do need more intense repairs, including structural repairs and room additions. There is no set limit on the cost of repairs, but the total mortgage must still fall within the FHA's mortgage lending limits for your area. These limits vary, so check the FHA's loan limits for your community.

Who is Denise Supplee?

Denise Supplee, a real estate agent in Doylestown, Pennsylvania, and co-founder of SparkRental, says that rehab loans have helped her clients get into neighborhoods that might otherwise have been out of their reach. She recently worked with a buyer who had a limited budget.

Does Fannie Mae offer rehab loans?

Fannie Mae also offers its own rehab loan, the HomeStyle Renovation Mortgage. This type of rehab loan works much like the FHA's. Fannie Mae must approve your contractor before it loans you any money. You'll also have to submit rehab plans created by your contractor, renovation consultant or architect.

What is VA rehab loan?

A VA renovation loan, sometimes called a VA rehab loan, is a home loan that allows borrowers to include the cost of certain repairs or improvements in their loan amount. This makes it possible for VA loan borrowers to purchase a home in need of repairs or upgrades without having to get a separate loan; rather, the repair costs ...

What is a home equity loan?

Home Equity Loan Or Home Equity Line Of Credit. These loans, sometimes referred to as second mortgages, allow you to borrow against the equity you have in your home. Home equity loans are installment loans, meaning you’ll receive your funds in one lump sum and pay it back over time.

How long do you have to serve to get a VA loan?

Veterans or active-duty servicemembers are generally eligible for a VA loan if they’ve served a 90 consecutive days of active service during wartime or 181 days during peacetime. The minimum service requirement for National Guard or Reserve members is 6 years. Qualifying surviving spouses may also be eligible for a COE.

Can VA loans be used for renovations?

VA renovation loans can only be used for repairs and upgrades that improve the safety and livability of the home. They can’t be used for luxury improvements. Additionally, these loans can’t be used for major structural changes.

Does the VA have a minimum credit score?

Lender Credit Standards. In addition to meeting basic service requirements, you’ll also need to meet your lender’s credit standards. The VA doesn’t set a minimum credit score for the loans it guarantees. However, lenders can and usually do have their own requirements.

Limited 203 (k) Mortgage

FHA's Limited 203 (k) program permits homebuyers and homeowners to finance up to $35,000 into their mortgage to repair, improve, or upgrade their home. Homebuyers and homeowners can quickly and easily tap into cash to pay for property repairs or improvements, such as those identified by a home inspector or an FHA appraiser.

203 (k) Mortgage

The Section 203 (k) program is FHA's primary program for the rehabilitation and repair of single family properties. As such, it is an important tool for community and neighborhood revitalization, as well as to expand homeownership opportunities.

What is a mortgage loan?

Mortgage loans provide potential home buyers the funds to purchase a single- or multi-family home, condominium or townhouse. There are other types of loans, however, which additionally assist qualified applicants with upgrades and repairs.

What is a 203k loan?

Department of Housing and Urban Development (HUD), the FHA states that a 203 (k) loan “helps both borrowers and lenders, insuring a single, long term, fixed or adjustable rate loan that covers both the acquisition and rehabilitation of a property.”.

What is a limited 203k loan?

The first is the Limited 203 (k) loan, for non-structural work. Specifically, home buyers can potentially finance “up to $35,000 into their mortgage to repair, improve, or upgrade their home,” according to the FHA's website.

How much does a 203k loan cover?

The full FHA 203k rehabilitation mortgage loan covers repair budgets in excess of $35,000, repair items that are ineligible under the streamline 203k program, or require the use of a approved FHA Consultant.

What is minor remodeling?

Minor remodeling, such as kitchens and bathrooms, which does not involve structural repairs. Weatherization, including storm windows and doors, insulation, weather stripping, etc. Purchase and installation of appliances, including free-standing ranges, refrigerators, washers/dryers, dishwashers and microwave ovens.