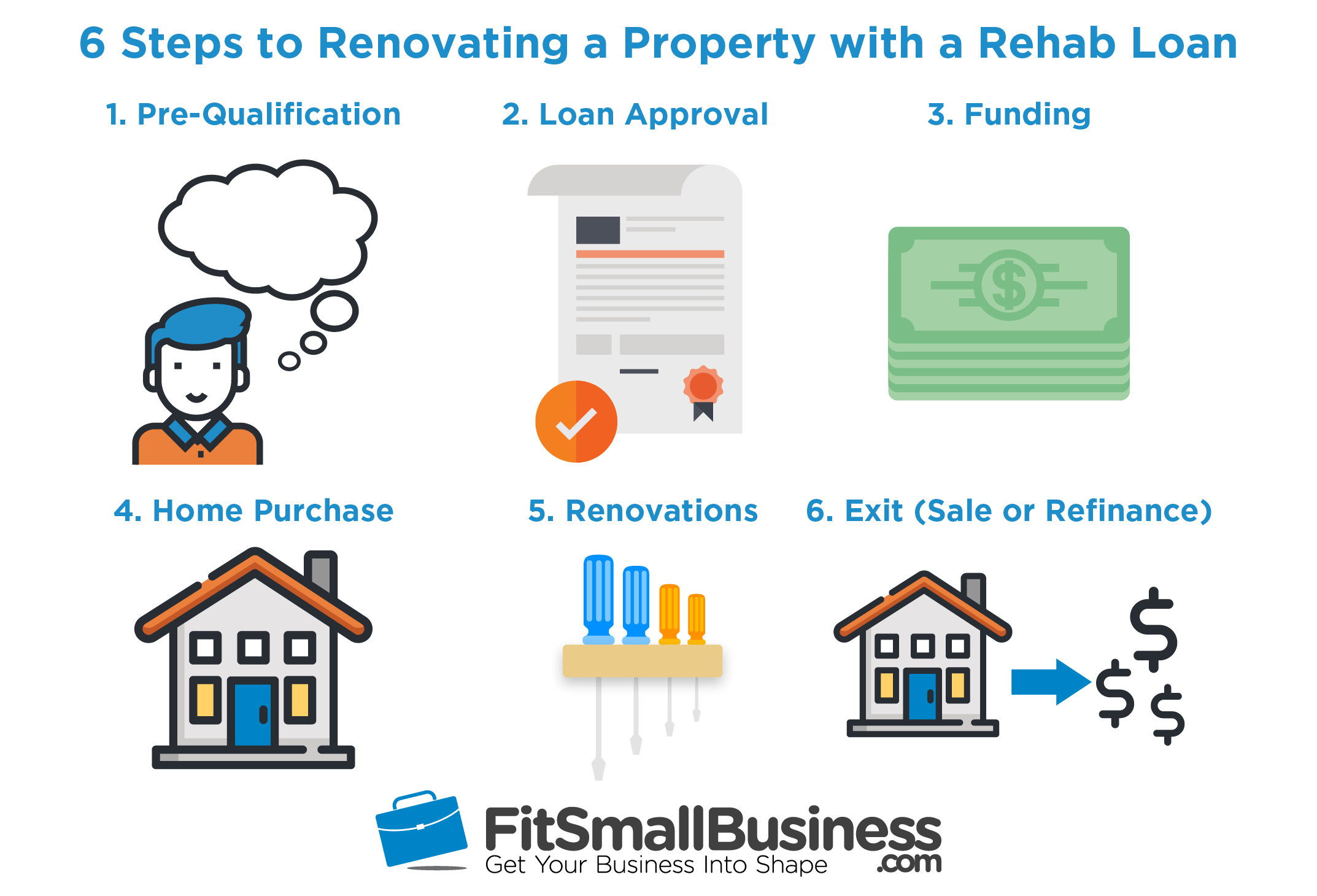

- Apply for a rehab loan with a participating lender.

- Get approved for the loan.

- Request bids from experienced contractors.

- Select your contractor.

- Close on the loan.

- Have the repairs and renovations completed.

- Have the rehabbed home inspected, if required.

Full Answer

What are the requirements for a rehab loan?

Dec 21, 2021 · According to Solomon, here are the likely steps for getting and using a rehab loan : Apply for a rehab loan with a participating lender. Get approved for the loan. Request bids from experienced contractors. Select your contractor. Close on the loan. Have the repairs and renovations completed. Have ...

Can you get a home loan with a 550 credit score?

Jul 26, 2019 · These requirements will determine if you are a good fit to take out a rehab loan for a property you wish to purchase and improve. This loan works like any other type of home loan - you’re approved and set to close on a specific date. After closing, a repair escrow account is created and the repairs are required to start within 30 days.

What is a rehab loan and how does it work?

Jan 24, 2022 · To be eligible for a 203 (k) loan, the home needs to be at least one year old and renovation costs need to be a minimum of $5,000. In addition, the amount borrowed can’t be more than the area’s FHA...

How to help get someone into rehab?

Feb 16, 2022 · Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203(k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date. How difficult is it to get a rehab loan? But rehab loans do come with challenges, Supplee ...

What is a rehab loan and how does it work?

To put it simply, a rehab loan lets you purchase or refinance a home and put the costs of your renovation into the form of a loan. You then combine those costs with your mortgage to pay both off in the form of 1 monthly payment.

Is it hard to get a 203k loan?

Credit score: You'll need a credit score of at least 500 to qualify for an FHA 203(k) loan, though some lenders may have a higher minimum. Down payment: The minimum down payment for a 203(k) loan is 3.5% if your credit score is 580 or higher. You'll have to put down 10% if your credit score is between 500 and 579.

How long does it take to close on a rehab loan?

If you're buying a home it's important to let the seller know of your plans because the FHA 203(k) could take 60 days to close and it's important that everyone is on the same page with respect to the timeline. You'll also need to find a contractor and do a bit more work to get the loan closed.

What is a FHA rehab loan?

An FHA 203(k) rehab loan, also referred to as a renovation loan, enables homebuyers and homeowners to finance both the purchase or refinance along with the renovation of a home through a single mortgage.

What are the cons of a 203k loan?

ConsOnly eligible for primary residences.Mortgage Insurance Premium (MIP) required (can be rolled into loan)Do it yourself work not allowed*More paperwork involved as compared to other loan options.

What is the difference between a 203b and a 203k loan?

Rather, the FHA insures or backs a couple of different mortgage products made by approved lenders, including the agency's 203(b) and 203(k) loans. The major difference between an FHA 203(b) and a 203(k) mortgage loan is that one is intended for homes in need of extensive repair while the other one isn't.

What is a 203k loan?

An FHA 203(k) loan is a type of government-insured mortgage that allows the borrower to take out one loan for two purposes: home purchase and home renovation. An FHA 203(k) loan is wrapped around rehabilitation or repairs to a home that will become the mortgagor's primary residence.

What is a conventional rehab loan?

A conventional rehab loan allows you to finance the purchase of a new home and the cost of renovations with a single mortgage product. This means you won't have to take out a second mortgage or pay out of pocket for costly home improvement projects.Jan 19, 2022

Can I get a 203k loan if I already have an FHA loan?

You could potentially use the 203k loan to refinance your current home, make renovations, then move after one year and rent the house out as an investment property. FHA allows you to rent out a home you still own with an FHA loan, as long as: You fulfilled the one-year occupancy requirement.Feb 23, 2021

Is 203k a conventional loan?

FHA 203(k) Loan Offered by the U.S. Department of Housing and Urban Development (HUD), this loan is backed and insured by the FHA. While only approved lenders, such as Contour Mortgage, can offer these, they also have slightly more lenient terms than conventional mortgages.Aug 23, 2021

How long does it take to close on a FHA 203k loan?

It will likely take 60 days or more to close a 203k loan, whereas a typical FHA loan might take 30-45 days. There is more paperwork involved with a 203k, plus a lot of back and forth with your contractor to get the final bids.

Who can assume an FHA loan?

As of the current year, an FHA loan allows the borrower up to 96.5% of a home's value. These loans are assumable only by applicants with a FICO score of at least 600. In this case, the buyer must go through the same approval process he or she would for a new FHA mortgage.

What is an FHA 203 (k) rehab loan?

The FHA 203 (k) loan is a type of mortgage backed by the Federal Housing Administration for homebuyers looking to renovate the home they’re purchasing. 203 (k) loans tend to come with more competitive rates, and require a smaller down payment and lower credit score compared to other kinds of loans.

How does a 203 (k) loan work?

A 203 (k) loan bundles your mortgage and renovation funds into one loan. Once you close on the loan, a portion of the loan proceeds is paid to the seller of the home, and the remaining balance goes toward the renovations.

Who qualifies for a 203 (k) loan?

If you’re interested in a 203 (k) loan, you’ll need to meet the same requirements for a standard FHA loan:

Summary: Best FHA 203 (k) rehab mortgage lenders

Sarah Li Cain is an experienced content marketing writer specializing in FinTech, credit, loans, personal finance,and banking. Her work has appeared in Fortune 500 companies, publications and startups such as Transferwise, Discover, Bankrate, Quicken Loans and KeyBank.

How much down payment is required for a 203k?

Only a 3.5 percent down-payment is required. In addition to other requirements, 203 (k) loan down payments are also significantly lower than conventional loans. With just 3.5 percent of the selling price down at closing, you can achieve your dream home. You’ll also have more available cash for furniture, moving expenses, and other essentials.

How do fixer uppers make money?

You could make money in the long run. Fixer-uppers garner a significant return on investment (ROI) through value increases from upgrades and repairs. Depending on your location, you could land an even lower purchase price if the property requires an extreme makeover .

How many units can you buy in a 203k?

203 (k) mortgages permit buyers to purchase multi-family homes with the stipulation the property doesn’t exceed more than four units.

Can you personalize a 203(k) loan?

You can personalize your new home as your own. A limited 203 (k) loan funds value-added, non-structural changes to customize the home as your own. These include paint colors, flooring, cabinetry, countertops, and other cosmetic improvements.

Do you have to itemize repairs before approval?

All repairs and improvements must be outlined and itemized prior to approval. A reputable lender can ensure you have the most accurate and correct information. It’s also prudent to check specific coverage items and dollar amounts.

Does the FHA insure 203k loans?

While the FHA doesn’t actually provide buyers with the funds, it does insure the loan through approved lenders, such as Contour Mortgage.