5 ways to finance your private rehab

- Private health insurance. The majority of private health plans will cover the cost of drug or alcohol rehabilitation at a private facility.

- Help from family and friends. Maintaining any addiction is costly and many people we speak with are in financial difficulty. ...

- Commercial loans. It may be that you are able to secure a financial loan for your treatment. ...

- Employers. Some employers donate or loan the money to employees.

- Credit cards. As with any major purchase, a credit card can be used. ...

Full Answer

What are the requirements for a rehab loan?

Jan 10, 2022 · Local and State-Funded Rehab. Many rehabs receive funding from the federal government, their state, or their local community. These grants can help them offer lower-cost or even free treatment to qualifying individuals. The government has found that every $1 invested in rehab centers saves $4 in health care costs and $7 in law enforcement costs. 8

How do you get a rehab loan?

Because of the invention of fix-and-flip loans, obtaining financing for a rehab property has become much easier in recent years. This financing option, which is designed expressly for the purpose of purchasing houses that will be rehabilitated and resold, might be highly profitable.

How to get a 203K rehab loan?

Jan 19, 2022 · Personal loans, bank loans, and credit cards are also financing options for addiction rehab. Certain treatment facilities offer specific programs designed for people with an addiction who are struggling financially. Third-party lenders may offer to finance your treatment, while rehab centers allow for payments to be made after discharge.

How to pay for rehab?

Apr 22, 2022 · Personal Loans. If obtaining a personal loan from a friend or family member is not an option, there are other ways to obtain financing for addiction rehab. Two common options include paying for it with a credit card or a bank loan. The payback terms of the credit card might make it easy for you to make payments.

What is a rehabilitation loan?

To put it simply, a rehab loan lets you purchase or refinance a home and put the costs of your renovation into the form of a loan. You then combine those costs with your mortgage to pay both off in the form of 1 monthly payment.

What is the maximum rehab amount of a VA rehab loan?

$50,000VA renovation loan lenders typically have a limit on how much they'll lend for repairs and improvements. This maximum renovation amount is often capped at $50,000, but it depends on the lender.Mar 4, 2022

What is a conventional rehab loan?

A conventional rehab loan allows you to finance the purchase of a new home and the cost of renovations with a single mortgage product. This means you won't have to take out a second mortgage or pay out of pocket for costly home improvement projects.Jan 19, 2022

Will the VA help pay for a new roof?

Common improvements allowed by VA rehabilitation loans include: Roof repairs. Floor repairs. Electrical and plumbing repairs or replacements.Oct 29, 2021

Does USAA offer VA rehab loans?

VA IRRRL program (Streamline Refinancing) USAA offers the VA IRRRL as a refinance option. The VA IRRRL (or “interest rate reduction refinance loan”) is a type of Streamline Refinance that makes it easier for VA loan holders to switch to a lower rate and monthly payment.

Is a rehab loan hard to get?

But rehab loans do come with challenges, Supplee said. Because the repair work that fixer-uppers need is often difficult to estimate, there is more that can go wrong with a rehab loan, she said. "It is frustrating and a lot of work at times," Supplee said. "It is imperative to have good contractors who you trust.

Is it hard to get a conventional rehab loan?

CONVENTIONAL REHAB LOAN QUALIFICATIONS But don't worry. The Wendy Thompson Team makes it easy to get the funding you need. To start, you'll need a down payment of around 5%. Some lenders want a higher down payment, so you may need to put up to 20% down.Mar 25, 2021

How much can you borrow on a 203k loan?

How much can you borrow with a 203(k) loan?Loan TypeMinimum CostMaximum CostLimited 203(k) loan$0$35,000Standard 203(k) loan$5,000Lesser of: Purchase price plus rehab costs, or 110% of the after-repair home value1 more row•Feb 14, 2020

What is rehab financing?

Rehab financing comes in different forms, but one thing most rehab loans have in common is the purpose for which they’re designed. Rehab financing typically covers:

How do rehab loans work?

The total cost of the rehab is divided up over time, to allow the homeowner to pay it back in increments. Rehab loans usually add the cost of the rehab to the home’s mortgage, which means that a homeowner can pay 1 amount every month.

Types of rehab loans

Standard 203 (k) rehab loan: This type of loan is geared towards bigger projects that are going to cost a lot, and you’ll need to hire a consultant that has been approved by the HUD (Department of Home and Urban Development).

How to finance a rehab property

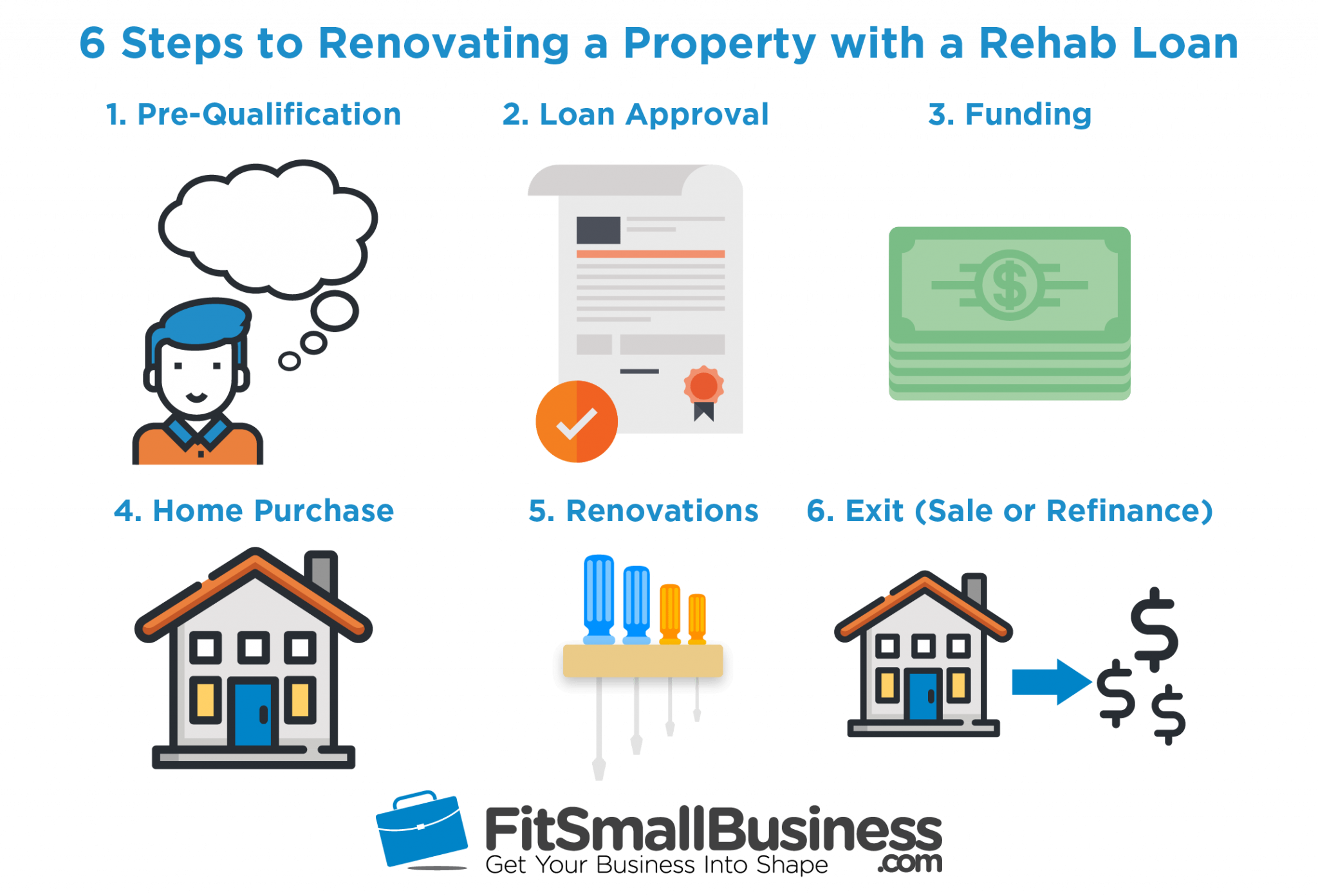

Applying for a loan for a rehab project can be broken down into these steps:

The bottom line on rehab financing

Rehab financing can be a saving grace for many investors and home buyers, however the choice is heavily dependent on each individual situation. For some, a personal loan may be easier, and for others a 203 (k) loan may be the best solution.

Medicare

Medicare is a federal insurance program that covers inpatient and outpatient substance use disorder treatment. However, the patient may be required to pay copayments, a deductible, and coinsurance.

Medicaid

Medicaid is a federal-state assistance program for low-income individuals and families. In many cases, it covers residential and outpatient rehab. However, the benefits depend on the state and the provider. The length of time spent in rehab is not predetermined and is contingent on the length of adequate treatment offered.

Sliding Scale Treatment Centers

Paying for rehab isn’t cheap, but sliding scale treatment centers are an affordable treatment option. These facilities have a flexible fee system, meaning they will charge what a patient can reasonably afford. Many treatment centers in the United States offer a sliding scale fee.

SAMHSA Grants

If you need help paying for rehab, a SAMHSA federal grant might be your best option. SAMHSA grants support substance misuse rehab programs by providing facilities with funding to treat those with a substance use disorder. SAMHSA grants are non-competitive.

Rehab Scholarships

Rehab scholarships are provided by treatment facilities, organizations, and corporations. Corporations and nonprofit organizations often partner with large rehab facilities that have openings and provide rehab scholarships for those in need of addiction treatment.

Crowdfunding

Crowdfunding is another popular way to raise money for addiction treatment. You can do this independently, and online platforms like GoFundMe may be able to assist you. Assistance will cost a percentage of the amount raised, but it may be worth it if you’re inexperienced at fundraising or feeling daunted by it.

Loans and Credit Cards

Personal loans, bank loans, and credit cards are also financing options for addiction rehab. Certain treatment facilities offer specific programs designed for people with an addiction who are struggling financially. Third-party lenders may offer to finance your treatment, while rehab centers allow for payments to be made after discharge.

How to get financing for addiction rehab?

Personal Loans. If obtaining a personal loan from a friend or family member is not an option, there are other ways to obtain financing for addiction rehab. Two common options include paying for it with a credit card or a bank loan. The payback terms of the credit card might make it easy for you to make payments.

What are the programs available for substance abuse?

The available programs included hospital-based, short-term detox, and self-help groups such as 12-step programs.

When was the Mental Health Parity and Addiction Equity Act passed?

In 2008, the Mental Health Parity and Addiction Equity Act was passed. It established legislation that required the insurance industry to provide the same amount of treatment for mental health and substance abuse as they provided for medical and surgical care.

Why is there no longer a barrier to treatment for alcohol?

It may be desperation, incarceration, exhaustion, or intervention that leads a person to realize and accept that treatment is the only way out of the negative and painful cycle of addiction.

Is wrap around treatment well established?

Additionally, wrap-around services that support long-term recovery were not well-established and relapse was common. Tragically, many people suffering from addiction who would’ve otherwise benefited from substance abuse treatment and long-term housing would often be incarcerated.

Do drug treatment centers have financing?

Many drug and alcohol treatment centers offer their own financing to prospective patients. This financing may originate directly from the treatment center, or the center may work with third-party lenders to create affordable lending packages for its clients.

Do jails have rehab centers?

Jails and prisons aren’t equipped as rehabilitation ( rehab) centers. In some cases when addicted people were eventually released from incarceration, they found themselves worse off than before, with even fewer opportunities to adapt to society. This was a setup for relapse and recidivism.

What insurance covers drug rehab?

Private health insurance. The majority of private health plans will cover the cost of drug or alcohol rehabilitation at a private facility. If you have private insurance, make sure you double check the policy or call you insurer to confirm you have cover.

Is private rehab expensive?

Private rehab isn’t as costly as some people imagine and a fear of inadequate funds should not prevent you from exploring private help . Here are five options available to anyone who is serious about recovering from their addiction and securing a place in private rehab. 5. Credit cards.

What are some uses for a rehab loan?

Some of the uses for a rehab loan include: Kitchen and bathroom remodels. Septic system improvements. Major appliance replacement. Heating and air conditioning upgrades. Improvements to make the home more energy efficient. Replacing carpet and flooring. Replacing the roof, new gutters and downspouts. Painting.

What is hard money rehab?

If you’re having trouble finding financing help, consider a hard money rehab loan . Unlike traditional lenders, which look at your credit score and income, hard money lenders base their decision to approve you for a loan based on what collateral you can provide. If you have valuable property to serve as collateral, a hard money lender is more likely to work with you, even if your credit score is less-than-stellar.

What do lenders look for in rehab loans?

Income: Lenders will look for stable income. Real estate experience: Lenders look for borrowers who have completed a few real estate flips before, and turned a profit. Many companies and lenders offer rehab loans, including some big name banks and online lenders that specialize in investor loans.

How long does a FHA renovation loan take?

Although the FHA renovation loan is pretty lenient there are some thing you cannot do with the loan: Any project that will take longer than six months. Minor landscaping projects. Adding luxury amenities like a swimming pool or tennis court. 1. FHA 203 (k) permanent rehab loan.

How long do you have to repay a home investment loan?

And, you can have up to 30 years to repay it. To qualify for an investment property line of credit, you likely need good to excellent credit, a low debt-to-income ratio, and have equity in the property. 2. Hard money rehab loan.

How does investment property line of credit work?

You can borrow a percentage of your property’s equity, and use it again and again as needed. Because investment property lines of credit are secured by the property, they tend to have lower interest rates than other financing options.

What is the minimum credit score required for a 203(k) loan?

There is no income requirement to qualify, but you must have a credit score of at least 500 to be eligible for a 203 (k) loan. Only owner-occupants — not investors — may use the program.

What is owner financing?

Owner financing means that the seller of a property “lends” the money to the buyer of the property, takes a mortgage on the property sold, and gets paid back in installments according to the terms of the agreement between the parties.

How much does a hard money lender lend?

Accordingly, a hard money lender will usually lend you less than a conventional lender (usually 50 – 60%) of the value of the property. If you are unable to get a conventional loan from a bank or mortgage broker, you may benefit from dealing with a hard money lender.

What does hard money mean?

The lender wants to make sure that if the borrower defaults, there will be sufficient equity in the property to repay the debt. Accordingly, a hard money lender will usually lend you less than a conventional lender (usually 50 – 60%) of the value of the property.

What is a conventional loan?

State and federally chartered banks and credit unions are generally referred to as conventional lenders, giving conventional mortgages. According to Webster’s Dictionary, conventional means “used and accepted by most people; usual or traditional.” Investor rehab loans are neither of these things, as they are often unusual and very specific. Conventional loans are very hard to find for rehab properties.

What does "cash" mean at a closing?

The lesson to be learned is that cash means cash, not something else! At a cash closing, the buyer will be advised of the exact amount that they need to bring for the transaction. In most cases, those funds must be wired to the closing agent or transferred by bank or certified check.

Does the FHA offer rehab loans?

The Federal Housing Administration (FHA) offers rehab funding to investors through its 203k loan program. This program lends both purchase price and rehab funds, but it is available only to consumers buying owner occupied properties, not investors.

Is it hard to get a rehab loan?

Conventional loans are very hard to find for rehab properties. While conventional loans are generally the least expensive mortgage loans available, they take a long time to obtain, even from a conventional lender with whom you may have an existing relationship.

What is the minimum down payment for rehab?

Great interest rates for your rehab in one loan. Come with a low down payment. A minimum down payment of 3.5% means you won’t deplete your savings trying to come up with a down payment. Qualifications may be more lenient than for a conventional loan because FHA. insures your mortgage.

How long does it take to repair a home loan after closing?

After closing, the following will occur: A Repair Escrow Account is set up and the repairs must start within 30 days of closing and completed within six months.

What are the benefits of a 203k loan?

203 (k) Rehab Loan Advantages 1 A convenient way to finance your home improvements without the need for perfect credit, huge down payments, or high interest rates 2 Upgrade your home with your style and needs 3 Buy a home that’s usually listed at a lower price due to the older existing condition 4 Great interest rates for your rehab in one loan 5 Come with a low down payment 6 A minimum down payment of 3.5% means you won’t deplete your savings trying to come up with a down payment 7 Qualifications may be more lenient than for a conventional loan because FHA#N#insures your mortgage