Full Answer

What do you need to qualify for a rehab loan?

Feb 16, 2022 · Credit score: You’ll need a credit score of at least 500 to qualify for an FHA 203(k) loan, though some lenders may have a higher minimum. Down payment: The minimum down payment for a 203(k) loan is 3.5% if your credit score is 580 or higher.

Are you eligible for a MassHousing mortgage?

How do I get an FHA rehab loan?

How do I apply for a MassHousing mortgage?

What credit score is needed for a rehab loan?

Credit score: You'll need a credit score of at least 500 to qualify for an FHA 203(k) loan, though some lenders may have a higher minimum. Down payment: The minimum down payment for a 203(k) loan is 3.5% if your credit score is 580 or higher. You'll have to put down 10% if your credit score is between 500 and 579.

What is a rehab loan in MA?

Regardless of the market, a rehab loan in MA is available to most borrowers to access money to do necessary repairs or renovations to a home you just purchased or to refinance and fund renovations of a home you already own. FHA 203k Rehab loans have been around since the 90's.

What is a rehab loan and how does it work?

To put it simply, a rehab loan lets you purchase or refinance a home and put the costs of your renovation into the form of a loan. You then combine those costs with your mortgage to pay both off in the form of 1 monthly payment.

What is a 203k loan Massachusetts?

FHA 203k Loans in Massachusetts FHA 203k loans are a great program which will allow you to borrow the money needed to purchase the home plus additional funds needed to rehabilitate or remodel the home.

What are the cons of a 203k loan?

ConsOnly eligible for primary residences.Mortgage Insurance Premium (MIP) required (can be rolled into loan)Do it yourself work not allowed*More paperwork involved as compared to other loan options.

Can I get a 203k loan if I already have an FHA loan?

You could potentially use the 203k loan to refinance your current home, make renovations, then move after one year and rent the house out as an investment property. FHA allows you to rent out a home you still own with an FHA loan, as long as: You fulfilled the one-year occupancy requirement.Feb 23, 2021

Can you refinance a 203k loan?

In short, yes you can refinance and remodel with the FHA 203k loan. Rolling the mortgage you have now, plus the renovations and improvements you want to do, is possible with the 203k. The new mortgage will include what you owed on the previous loan PLUS the work you're financing.

What is the difference between a FHA 203b and 203k loan?

Rather, the FHA insures or backs a couple of different mortgage products made by approved lenders, including the agency's 203(b) and 203(k) loans. The major difference between an FHA 203(b) and a 203(k) mortgage loan is that one is intended for homes in need of extensive repair while the other one isn't.

What is the minimum amount for repair costs under the standard 203 k loan?

FHA 203(k) loan types Limited 203(k): The limited 203(k) loan has an easier application process because it's for projects valued at less than $35,000. There is no minimum cost requirement, but you can't pay for structural repairs with this type of loan.Jan 27, 2022

What credit score is needed to buy a house in Massachusetts?

A borrower's credit score must be at least 640 to buy a single-family or condo and at least 660 to buy a two- or three-family home. MHP also will work with consumers who don't have any credit history. 7. The homebuyer must agree to use the home purchased as a primary residence through the term of the loan.

What is a FHA 203k rehab loan?

An FHA 203(k) rehab loan, also referred to as a renovation loan, enables homebuyers and homeowners to finance both the purchase or refinance along with the renovation of a home through a single mortgage.

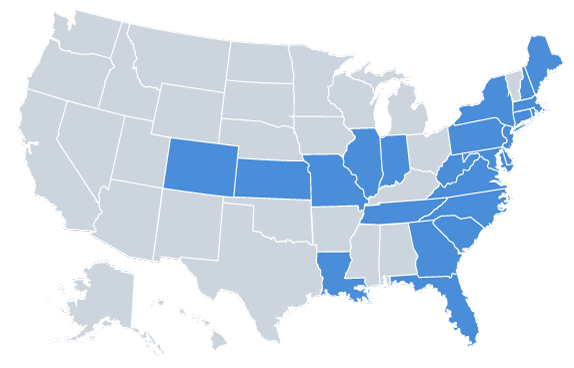

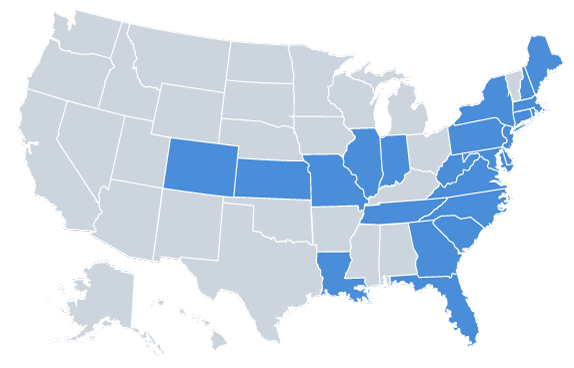

What are the requirements for an FHA loan in Massachusetts?

Other key FHA loan requirements in Massachusetts include:Minimum credit score: 500.Minimum down payment: 3.5%Minimum DTI: 50% or less.Income requirements: Must have at least 2 established credit accounts and must not have delinquent payments associated with past FHA mortgages.More items...

What to Know About 203k Rehabilitation Loans

Guest writer Michael Dunsky from Guaranteed Rate Mortgage is back to take to help review a popular mortgage program known as the 203k rehabilitation loan.

About the Author Bill Gassett

Bill Gassett is a thirty-three year veteran to the real estate industry. He enjoys providing helpful information to buyers, sellers and fellow real estate agents to make sound decisions. His work has been featured on RIS Media, National Association of Realtors, Inman News, Placester, RESAAS, Credit Sesame, and others.

Do I Qualify for a Rehab Home Loan?

In order to qualify for an FHA 203 (k) home loan, a homeowner must meet certain requirements outlined by the Department of Housing and Urban Development (HUD).

203 (k) Rehab Loan Advantages

Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203 (k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date.

What is hard money rehab?

If you’re having trouble finding financing help, consider a hard money rehab loan . Unlike traditional lenders, which look at your credit score and income, hard money lenders base their decision to approve you for a loan based on what collateral you can provide. If you have valuable property to serve as collateral, a hard money lender is more likely to work with you, even if your credit score is less-than-stellar.

Do hard money lenders look at your credit score?

When determining your loan, hard money lenders will look at the property’s after repair value (ARV).

Is a 203k loan FHA?

By contrast, 203 (k) loans are insured by the FHA, and usually offer lower rates and longer repayment terms. The process for leveraging an FHA rehab loan is pretty straightforward: Apply with an approved lender. Meet the credit requirements and get approved. Choose a contractor.

Do you need a rehab loan to flip a house?

If you’re planning on flipping houses for profit, you’ll likely have to make significant repairs and renovations to the home you intend to flip. To do so, you’ll probably need a rehab loan to pay for the property and its repairs so you can sell it. There are three main types of rehab loans for investors you should know about.