What is a rehab loan and how does it work?

Feb 16, 2022 · A rehab loan, also known as a renovation loan, is a type of mortgage that allows homeowners to finance both the purchase and the refinancing of a house with a single mortgage. Interest rates are among the lowest they’ve been in recent years, owing to a surplus of demand relative to supply.

What is a relationship rehab lender?

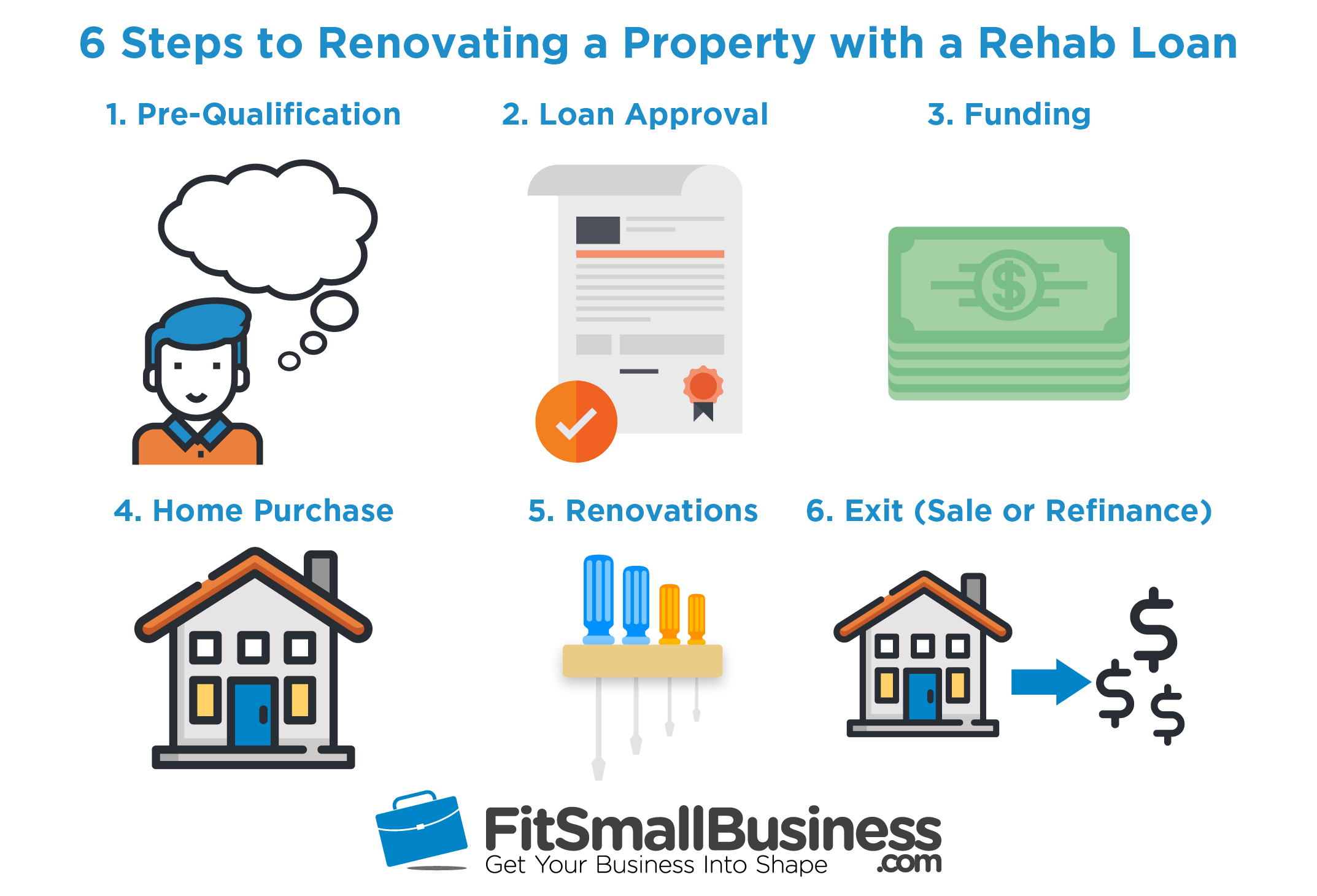

How Rehab Loans Work. As a relationship rehab lender, it is our goal to be reliable and responsive to your needs. During our initial conversation, we will explain the process of a rehab loan and send you an application, if requested. Your first step would be to complete and send back our application along with the rehab loan application fee.

Are hard money rehab loans a good idea?

Jan 23, 2013 · Hard money rehab loans are by far the easiest loans to get for real estate investors who are buying and selling investment properties. They can usually fund in less than 14 days, but the interest rates are typically a lot higher than bank interest rates. Expect to pay 11% to 12% interest only on a hard money rehab loan. The loan term is usually 6 months to 1 year, and you …

What do Lenders look for in a rehab loan application?

Oct 22, 2021 · A loan through the USDA Escrow Holdback Rehab Program will allow you to borrow 100% of the purchase price for the home and add on 2% of the home’s value for repairs. If you bid lower than the value of the home, you’ll have even more money for repairs — the USDA will still allow you to borrow 102% of the home’s value.

What is a rehab loan and how does it work?

To put it simply, a rehab loan lets you purchase or refinance a home and put the costs of your renovation into the form of a loan. You then combine those costs with your mortgage to pay both off in the form of 1 monthly payment.

What is a FHA rehab loan?

An FHA 203(k) rehab loan, also referred to as a renovation loan, enables homebuyers and homeowners to finance both the purchase or refinance along with the renovation of a home through a single mortgage.

What are the cons of a 203k loan?

ConsOnly eligible for primary residences.Mortgage Insurance Premium (MIP) required (can be rolled into loan)Do it yourself work not allowed*More paperwork involved as compared to other loan options.

What does a rehab loan mean?

Rehab mortgages are a type of home improvement loans that can be used to purchase a property in need of work -- the most common of which is the FHA 203(k) loan. These let buyers borrow enough money to not only purchase a home, but to cover the repairs and. renovations a fixer-upper property might need.

How long does it take to close on a FHA 203k loan?

It will likely take 60 days or more to close a 203k loan, whereas a typical FHA loan might take 30-45 days. There is more paperwork involved with a 203k, plus a lot of back and forth with your contractor to get the final bids.

Is it hard to get a 203k loan?

Credit score: You'll need a credit score of at least 500 to qualify for an FHA 203(k) loan, though some lenders may have a higher minimum. Down payment: The minimum down payment for a 203(k) loan is 3.5% if your credit score is 580 or higher. You'll have to put down 10% if your credit score is between 500 and 579.

What is the difference between FHA and 203k?

Rather, the FHA insures or backs a couple of different mortgage products made by approved lenders, including the agency's 203(b) and 203(k) loans. The major difference between an FHA 203(b) and a 203(k) mortgage loan is that one is intended for homes in need of extensive repair while the other one isn't.

What is a 201k loan?

Section 203(k) insurance enables homebuyers and homeowners to finance both the purchase (or refinancing) of a house and the cost of its rehabilitation through a single mortgage or to finance the rehabilitation of their existing home. Purpose: Section 203(k) fills a unique and important need for homebuyers.

What is the difference between a HomeStyle loan and a 203k loan?

FHA 203(k) loans are more lenient about the borrower's credit and more strict about the renovation work that can be done. Fannie Mae HomeStyle mortgages are more strict about the borrower's credit and more lenient about the renovation work that can be done.Dec 14, 2018

Can I get a 203k loan if I already have an FHA loan?

You could potentially use the 203k loan to refinance your current home, make renovations, then move after one year and rent the house out as an investment property. FHA allows you to rent out a home you still own with an FHA loan, as long as: You fulfilled the one-year occupancy requirement.Feb 23, 2021

Can you refinance into a 203k loan?

Current homeowners can refinance the house into the 203k, pay for the home improvements they want, and have a new mortgage that includes the work. This way it's one loan, one payment and the interest is tax deductible. It's a better option than credit cards and second mortgages.

What is a 203k loan?

An FHA 203(k) loan is a type of government-insured mortgage that allows the borrower to take out one loan for two purposes: home purchase and home renovation. An FHA 203(k) loan is wrapped around rehabilitation or repairs to a home that will become the mortgagor's primary residence.

Why do you get a hard money rehab loan?

Because a property is always more valuable after it’s been fixed up, a hard money rehab loan is usually given based on the value of a property after the fix up. For example, if you buy a property for $150,000 but it will eventually be worth $215,000 once it’s all fixed up.

Who is Corey Dutton?

Corey Curwick Dutton, MBA Park City, Utah - 2005 MBA Graduate with 10 years experience in Business Management including International Management. Corey is a Private Money Lender and Loan Officer. In her spare time Corey enjoys writing on topics in the private money lending industry. She also enjoys hobbies such as mountain biking and skiing in the great outdoors of Utah.

What are the requirements for a USDA rehab loan?

What are the Requirements to Get a USDA Rehab Loan? USDA rehab loans are for low-income families and individuals. To qualify for a Section 504 loan, the homeowners must be unable to obtain affordable credit elsewhere. Homeowners also must have low income, below 50% of the area’s median income.

What is pre-approval for a loan?

Pre-approval is a more thorough process than prequalification. For this step, your lender will verify information about your income and finances and determine how much you can actually borrow. This is determined by calculating your debt-to-income (DTI) ratio, which shows how much of your monthly income goes towards expenses.

Why does USDA take longer to process?

Underwriting and processing for USDA loans can take longer than traditional mortgages because the USDA program uses a two-party approval system. First, lenders underwrite the loan to make sure it meets USDA requirements. Then the USDA underwrites the file. 6.

What happens after you find your home?

Once you find your home, you’ll work with your lender and agent to make an offer. This is also time to negotiate on closing costs. Then you sign! After you and the seller sign the purchase agreement, your lender will order a USDA loan appraisal, to ensure the home meets USDA standards . 5.

Does the USDA own land?

The USDA owns a lot of land and a lot of homes. Many of the homes they own are older and in need of repair. The USDA Rural Housing Renovation Loan Program comes from Section 504 of the USDA Escrow Holdback loan program. This program helps low-income buyers buy their homes through the USDA housing program. Many USDA properties must be repaired as ...

How do fixer uppers make money?

You could make money in the long run. Fixer-uppers garner a significant return on investment (ROI) through value increases from upgrades and repairs. Depending on your location, you could land an even lower purchase price if the property requires an extreme makeover .

How much down payment is required for a 203k?

Only a 3.5 percent down-payment is required. In addition to other requirements, 203 (k) loan down payments are also significantly lower than conventional loans. With just 3.5 percent of the selling price down at closing, you can achieve your dream home. You’ll also have more available cash for furniture, moving expenses, and other essentials.

How many units can you buy in a 203k?

203 (k) mortgages permit buyers to purchase multi-family homes with the stipulation the property doesn’t exceed more than four units.

Can you personalize a 203(k) loan?

You can personalize your new home as your own. A limited 203 (k) loan funds value-added, non-structural changes to customize the home as your own. These include paint colors, flooring, cabinetry, countertops, and other cosmetic improvements.

Do you have to itemize repairs before approval?

All repairs and improvements must be outlined and itemized prior to approval. A reputable lender can ensure you have the most accurate and correct information. It’s also prudent to check specific coverage items and dollar amounts.

Does the FHA insure 203k loans?

While the FHA doesn’t actually provide buyers with the funds, it does insure the loan through approved lenders, such as Contour Mortgage.

What are some uses for a rehab loan?

Some of the uses for a rehab loan include: Kitchen and bathroom remodels. Septic system improvements. Major appliance replacement. Heating and air conditioning upgrades. Improvements to make the home more energy efficient. Replacing carpet and flooring. Replacing the roof, new gutters and downspouts. Painting.

What do lenders look for in rehab loans?

Income: Lenders will look for stable income. Real estate experience: Lenders look for borrowers who have completed a few real estate flips before, and turned a profit. Many companies and lenders offer rehab loans, including some big name banks and online lenders that specialize in investor loans.

What is hard money rehab?

If you’re having trouble finding financing help, consider a hard money rehab loan . Unlike traditional lenders, which look at your credit score and income, hard money lenders base their decision to approve you for a loan based on what collateral you can provide. If you have valuable property to serve as collateral, a hard money lender is more likely to work with you, even if your credit score is less-than-stellar.

How long does a FHA renovation loan take?

Although the FHA renovation loan is pretty lenient there are some thing you cannot do with the loan: Any project that will take longer than six months. Minor landscaping projects. Adding luxury amenities like a swimming pool or tennis court. 1. FHA 203 (k) permanent rehab loan.

How long do you have to repay a home investment loan?

And, you can have up to 30 years to repay it. To qualify for an investment property line of credit, you likely need good to excellent credit, a low debt-to-income ratio, and have equity in the property. 2. Hard money rehab loan.

How does investment property line of credit work?

You can borrow a percentage of your property’s equity, and use it again and again as needed. Because investment property lines of credit are secured by the property, they tend to have lower interest rates than other financing options.

What is the minimum credit score required for a 203(k) loan?

There is no income requirement to qualify, but you must have a credit score of at least 500 to be eligible for a 203 (k) loan. Only owner-occupants — not investors — may use the program.

What is a rehab loan?

A Rehab Loan benefits borrowers, as well as lenders, since it insures a single, long term loan--whether its a fixed-rate or ARM-- that covers the purchase/refinance and renovation of a home. The FHA's 203 (k) program is also a good option in cases of federally declared natural disasters that cause property damage or destruction. ...

What are the types of rehabilitation that borrowers may make using Section 203 (k) financing?

According to the US Department of Housing and Urban Development, the types of rehabilitation that borrowers may make using Section 203 (k) financing include: Structural alterations and reconstruction. Modernization and improvements to the home's function. Elimination of health and safety hazards.

Does FHA make home loans?

FHA.com is a privately-owned website that is not affiliated with the U.S. government. Remember, the FHA does not make home loans. They insure the FHA loans that we can assist you in getting. FHA.com is a private corporation and does not make loans. FHA Loan Guidelines.

Does 203(k) insurance save time?

While section 203 (k) insured loans save borrowers time and money, they also benefit the lender by allowing them to have the loan insured, even though the property has not yet been renovated, and the condition and value of the house may not yet offer adequate security.