- An FHA 203 (k) is a rehab loan that is used to finance or refinance the renovation of a primary residence

- There are two types of FHA 203 (k) loans, streamline and standard

- Rehab must be started with 30 days of closing and total rehab work must be completed within 6 months

- The rehab work must be completed by a licensed contractor

Full Answer

What to expect with a FHA loan?

Dec 21, 2021 · A rehab loan can also be used to refinance and make improvements to your current home. The FHA 203(k) loan is backed by the government and is one of the most commonly used rehab loans available. Instead of applying for multiple loans, homebuyers can use a rehab loan to buy or refinance their primary residence and refurbish it with only one loan. …

How FHA home loans can help you?

May 20, 2021 · An FHA 203K loan is a two-in-one loan used for both the purchase and rehab or upgrades of a property. Often, buyers will first get a construction loan to …

What is the FHA renovation loan process?

Jan 27, 2021 · The FHA 203k rehab loan has become a popular loan choice in today’s market where many homes need a little, or a lot, of TLC. The 203k loan allows a buyer to finance the purchase price of the house and renovation costs – all with one loan. No scrambling around before closing trying to repair the home so the bank will lend on it.

What is a rehab loan and how does it work?

Dec 18, 2020 · How Does An FHA 203k Rehab Loan Work?# Find a home to purchase or refinance your existing property: You find a home that you want to buy, but you want to make... Find an FHA 203k lender: Next, you’ll need to find an approved FHA lender and apply for a 203k loan. Your application... Find a ...

What will a FHA rehab loan cover?

An FHA 203(k) loan allows you to buy or refinance a home that needs work and roll the renovation costs into the mortgage. You'll get a loan that covers both the purchase or refinance price and the cost of upgrades, letting you pay for the renovations over time as you pay down the mortgage.

What is an FHA rehab loan?

An FHA 203(k) rehab loan, also referred to as a renovation loan, enables homebuyers and homeowners to finance both the purchase or refinance along with the renovation of a home through a single mortgage.

Is it hard to get a FHA 203k loan?

The FHA 203k loan requirements are similar to that of a standard FHA loan. All borrowers must meet the FHA credit score requirements. The minimum FICO score allowed is 500. All borrowers must have the minimum down payment of 3.5%, or 10% if the FICO score is below 580.

What is the difference between a FHA 203b and 203k loan?

Rather, the FHA insures or backs a couple of different mortgage products made by approved lenders, including the agency's 203(b) and 203(k) loans. The major difference between an FHA 203(b) and a 203(k) mortgage loan is that one is intended for homes in need of extensive repair while the other one isn't.

How long does it take to close on a FHA 203k loan?

It will likely take 60 days or more to close a 203k loan, whereas a typical FHA loan might take 30-45 days. There is more paperwork involved with a 203k, plus a lot of back and forth with your contractor to get the final bids. Don't expect to close a 203k loan in 30 days or less.

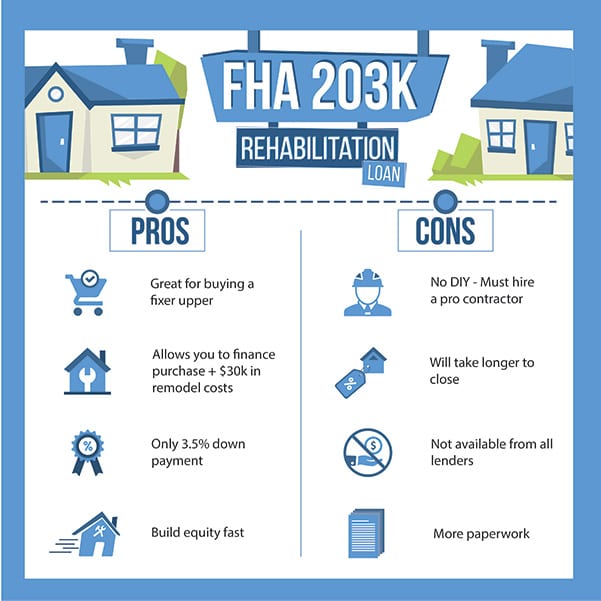

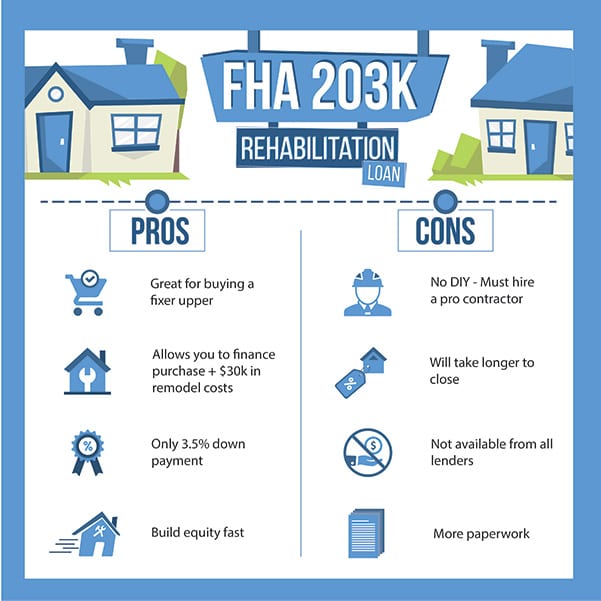

What are the cons of a 203k loan?

ConsOnly eligible for primary residences.Mortgage Insurance Premium (MIP) required (can be rolled into loan)Do it yourself work not allowed*More paperwork involved as compared to other loan options.

What is a rehab loan and how does it work?

To put it simply, a rehab loan lets you purchase or refinance a home and put the costs of your renovation into the form of a loan. You then combine those costs with your mortgage to pay both off in the form of 1 monthly payment.

What is the minimum amount for repair costs under the standard 203 k loan?

$5,000There is no minimum cost requirement, but you can't pay for structural repairs with this type of loan. Standard 203(k): The standard 203(k) loan is for extensive jobs costing more than $35,000. The minimum loan amount for this type is $5,000. Structural changes, like additions or full home renovations, are permitted.Jan 27, 2022

Can you refinance a 203k loan?

In short, yes you can refinance and remodel with the FHA 203k loan. Rolling the mortgage you have now, plus the renovations and improvements you want to do, is possible with the 203k. The new mortgage will include what you owed on the previous loan PLUS the work you're financing.

What is the minimum credit score for maximum financing on a FHA 203b program?

If the credit score is less than 500, then the borrower is not eligible for FHA-insured financing. If the borrower's credit score is at or above 580, then the borrower is eligible for maximum financing with a loan-to-value ratio (LTV) of 96.5 percent.

What is a 203b appraisal?

An FHA-approved appraiser must appraise all homes under the FHA 203(b) to determine if they meet the minimum standards for eligibility. During an appraisal, a property appraiser assesses the home's condition and provides an estimate of the home's value.Feb 25, 2022

What is a conventional rehab loan?

A conventional rehab loan allows you to finance the purchase of a new home and the cost of renovations with a single mortgage product. This means you won't have to take out a second mortgage or pay out of pocket for costly home improvement projects.Jan 19, 2022

Streamline 203K Program Overview

This loan is perfect for someone who already qualifies for an FHA loan, but ends up finding a house that won’t qualify for FHA financing as-is. The...

Why Do A 203K? Is It Worth The Hassle?

The 203k loan can give the buyer an advantage to come out on top as far as equity. Many homes in need of repair are discounted more than those repa...

Streamline 203K List of Allowable and Non-Allowable Repairs

Many buyers are surprised at what the 203k allows them to do. This loan can be used solely for cosmetic purposes, not just when a home is in severe...

Who Can Qualify For A 203K?

Generally, most people who qualify for a standard FHA loan can qualify for a 203k loan, provided the 203k loan amount isn’t significantly higher th...

What If I Exceed The Repair Cost Limit?

If it appears you will exceed about $30,500 in repairs, see if any of your repairs qualify for the Energy Efficient Mortgage (EEM) program. If so,...

The Hud-92700 “203K Worksheet”

As part of the 203k process, you will need to sign the FHA 203k Worksheet, also called the HUD-92700. This form is a breakdown of all loan costs, 2...

What Items Do I Need from The Contractor?

In addition to a correct bid, here are some things your contractor may need to provide. Your lender may require more or less documentation dependin...

Can I Refinance and Repair My Home With A 203K?

Yes. The 203k refinance works just like the purchase program. Instead of the purchase price being on the 203k worksheet, the “purchase price” will...

Can I Do The FHA 203K Work myself?

In some cases, this is allowed. Lenders might require documentation that you are qualified to do the work, and can do it in a timely manner. Usuall...

Streamline 203K Loan: The Right Fit For Many Buyers

Even though the 203k involves a few more leaps and hurdles than the standard FHA loan, it can be a great tool to buy a home that has potential. Don...

What is a 203k loan?

The 203k loan helps the borrower open up one loan to pay for the purchase price of the home, plus the cost of home improvements. Buyers end up with one fixed-rate FHA loan, and a home that’s in much better shape than when they found it. Remodel a bathroom with an FHA 203k loan.

How long does it take to certify a 203k loan?

The contractor must certify work will begin within 30 days of loan closing and must be completed within 6 months. Since the Streamline 203k is for non-structural repairs, the contractor may need to certify that the borrowers will not be displaced for more than 30 days during the repair period.

Can a 203k loan be used for condos?

Typically, 203k loans are for single-family homes, but they are allowed for condominiums as well. For condos, the work is allowed on the interior only, and no more than 4 other units in the condo complex can be undergoing 203k repairs at the same time.

What is the HUD 203k form?

This form is a breakdown of all loan costs, 203k fees, purchase price, repair bid amount, final loan amount, etc. Your lender will provide you with this form.

Do I Qualify for a Rehab Home Loan?

In order to qualify for an FHA 203 (k) home loan, a homeowner must meet certain requirements outlined by the Department of Housing and Urban Development (HUD).

203 (k) Rehab Loan Advantages

Rehab loans are designed to help homeowners improve their existing home or buy a home that can benefit from upgrades, repairs, or renovations. A 203 (k) rehab loan is a great way to help you create your own home equity fast by bringing your home up to date.

What is a cash out refinance?

Cash-out refinance — Like a HELOC or home equity loan, a cash-out refinance can tap into your existing home equity to finance your home improvements. But rather than adding a second mortgage, the new loan would also replace your existing mortgage along with providing cash for renovations.

How long does it take to close a 203k loan?

How long does it take for a 203k loan to close? It will likely take 60 days or more to close a 203k loan, whereas a typical FHA loan might take 30-45 days. There is more paperwork involved with a 203k, plus a lot of back and forth with your contractor to get the final bids.

What is a 203k loan?

A 203k is a subtype of the popular FHA loan, which is meant to help those who might not otherwise qualify for a mortgage. FHA’s flexibility makes 203k qualification drastically easier than for a typical construction loan.

Is a 203k loan worth it?

A 203k loan can be well worth the extra effort, especially if you can buy a home at a discount. For instance, a buyer pays $200,000 for a run-down home, but does $20,000 in repairs. Because the home is now in “turn-key” condition, it would be worth $240,000 on the open market.

Can I refinance my FHA 203k?

Most people use the FHA 203k loan to buy a home, but it can be used for refinancing, too. As long as you have at least $5,000 in improvements, you can use this refi option. The lender will order an appraisal that shows two values: the “as-is” or current property value, and the “improved value” after renovations.

Is 203k higher than FHA?

203k loan rates and mortgage insurance. Mortgage rates are somewhat higher for FHA 203k loans than for standard FHA loans. Expect to receive a rate about 0.75% to 1.0% higher than for a standard FHA mortgage. Still, base FHA rates are some of the lowest on the market, so 203k rates are competitive.

How does FHA work?

Do you know how FHA home loans work? The FHA itself does not lend money, but it does guarantee the mortgage on behalf of the borrower ; if the borrower defaults on the mortgage and the home is foreclosed upon, the FHA reimburses the lender.

What is the minimum down payment for a FHA loan?

FHA home loans require a minimum down payment of 3.5% for the most qualified borrowers. FHA loan program rules require a higher down payment of 10% for those who have marginal credit scores; lender requirements will also apply in addition to the FHA loan program’s rules.

Does FHA require mortgage insurance?

FHA home loans do not require private mortgage insurance (PMI) but does require an up-front mortgage insurance premium (UFMIP) and monthly mortgage insurance premiums (MIP) that are added to the mortgage amount due every month. You can finance the entire amount of the UFMIP or pay the entire amount in cash at closing.

How much down payment is required for a 203k?

Only a 3.5 percent down-payment is required. In addition to other requirements, 203 (k) loan down payments are also significantly lower than conventional loans. With just 3.5 percent of the selling price down at closing, you can achieve your dream home. You’ll also have more available cash for furniture, moving expenses, and other essentials.

Do you have to itemize repairs before approval?

All repairs and improvements must be outlined and itemized prior to approval. A reputable lender can ensure you have the most accurate and correct information. It’s also prudent to check specific coverage items and dollar amounts.

Does the FHA insure 203k loans?

While the FHA doesn’t actually provide buyers with the funds, it does insure the loan through approved lenders, such as Contour Mortgage.